India and Indonesia save the best for last with major tech IPOs in December

Strong performing Meesho and Superbank stocks can inspire 2026 listings

Welcome back and hello from the UK—I’m back ‘home’ for the festive period, which is why there was no ATR last week. But there’s plenty to look forward to in this issue.

In a year of new tech IPO opportunities in India, the best has been saved for last as Meesho’s listing became the best performing listing of the year in India.

The social commerce company saw gains of 95% last week as its valuation rose to nearly $11 billion. Despite a small decline since, Meesho is valued at over $10 billion, meaning its CEO Vidit Aatrey is a billionaire on paper.

It’s been a long climb to IPO for Meesho, which raised capital from investors including Facebook, SoftBank, Y Combinator and Peak XV and has pivoted multiple times during its decade of existence. With Flipkart tipped to make its long-awaited entry into public markets next year and quick commerce favourite Zepto closer still, Meesho may have benefited from bringing early e-commerce exposure to investors.

We’ll have more analysis on Meesho in the New Year here at Asia Tech Review.

Meanwhile, there’s positive news in Indonesia, where Super Bank raised $168 million in the country’s second-largest IPO of the year.

The development will be much welcomed as we close out a challenging year that’s seen the country rocked by startup scandals including eFishery and the poor performance of leading tech firm GoTo’s stock.

Super Bank includes Grab and Kakao among its backers, and it claims to have reached a base of 5 million customers with over 1 million daily transactions since it launched its digital app in June 2024. Its share price gives the business a valuation of over $1.5 billion, and its backers will see this moment as an opportunity to push hard in the new year. More importantly, Indonesian startups may find inspiration to take themselves to public markets for that exclusive exit opportunity.

Have a great Christmas if you celebrate it, and see you next Monday,

Jon

Follow the Asia Tech Review LinkedIn page for updates on posts published here and interesting things that come our way. If you’re a news junkie, the ATR Telegram news feed has you covered with news as-it-happens or join the community chat here.

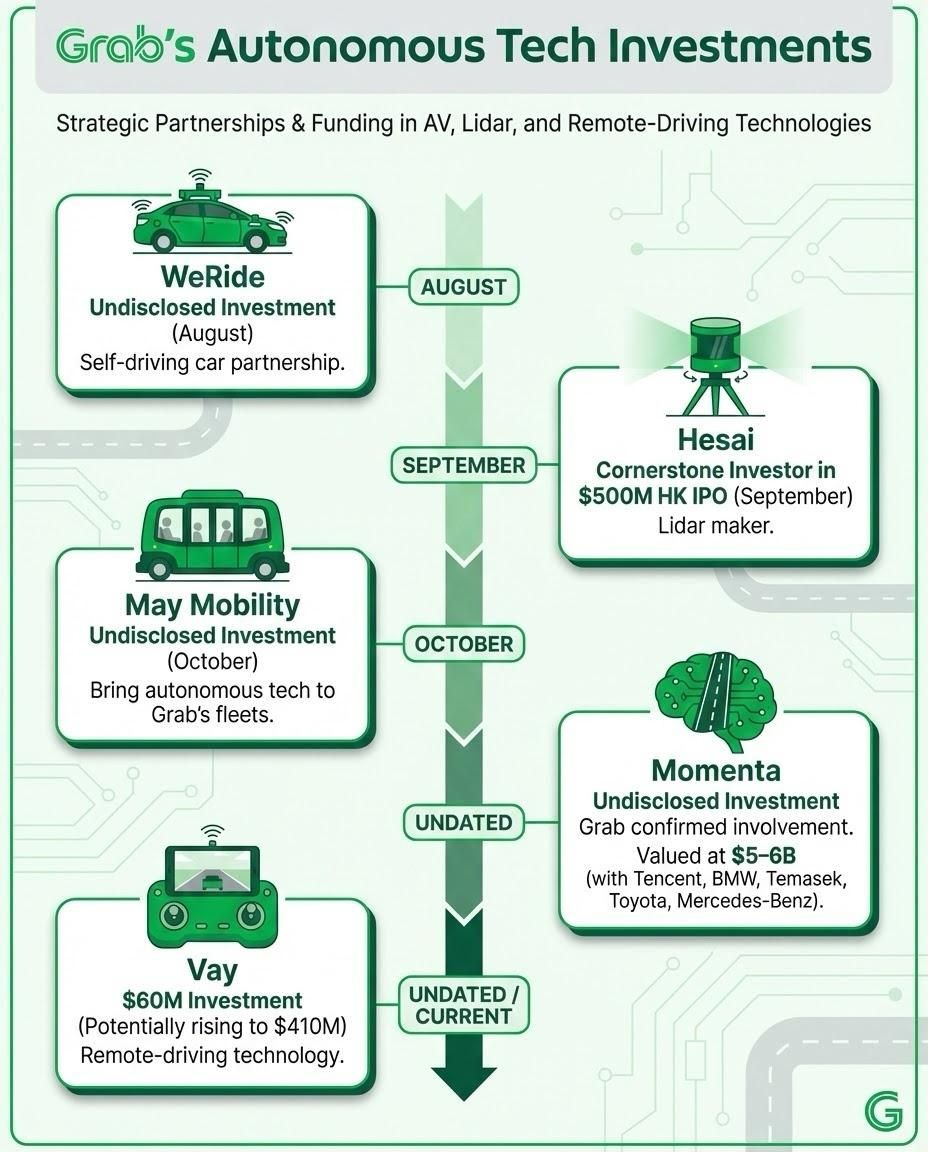

Grab continues investment spree with robotics acquisition

We analyzed Grab’s recent investment spree in an ATR Original article last month, and now the ride-hailing firm has continued the trend with an acquisition after it bought a food delivery robotics company.

Grab bought Chinese startup Infermove which specialises in first and last mile operations through autonomous driving systems and delivery robots. There’s no price on the deal, but we do know Infermove raised $300,000 in angel funding and it had previously been valued at $33 million back in 2024 when it signed an agreement with a subsidiary of Tieda Technology.

With a massive $4 billion war chest of cash, expect Grab to pursue more tech-related investments and acquisitions in 2026.

Tencent is using a Japanese company to access banned Nvidia chips

This newsletter often writes about how Chinese companies have found ways to access Nvidia chips that they are restricted from. Typically that means Southeast Asian countries, but last week it emerged that Tencent is using Japan through a deal that has quickly turned Tokyo-based provider Datasection into one of Asia’s top ‘neocloud’ providers.

Neocloud essentially means a cloud operator that rents out access to its servers, access to restricted technology like Nvidia products is a major selling point.

Datasection owns 15,000 Nvidia’s top Blackwell processors in a data center near Osaka and it is said to have secured more than $1.2 billion in contracts from a single major customer, which has now been identified as Tencent, according to a report from Barrons.

Tencent’s access to the technology is technically legal, but US politics have been looking into methods of circumvention. Datasection is an alarming case since Japan is a close US ally.

China

Time for the TikTok US deal is nigh after reports claimed a sale is agreed to a consortium led by Oracle, Silver Lake and Abu Dhabi’s MGX, each taking a 15% stake—ByteDance will retain 19.9% with other investors holding the remaining 35% link

Meanwhile: ByteDance is on track to earn about $50B in profit in 2025 driven by gains in ecommerce and new markets link

The company is China’s top tech recruiter in 2025, meanwhile AI-related job postings are up 500%, according to a report from China’s largest professional social networking platform link

Meta allowed large-scale ad fraud tied to China to protect revenue, a Reuters investigation found link

Shares in Chinese makers of batteries, transformers and other equipment vital for the global build-out of artificial intelligence have rocketed this year, as power-hungry data centres rush to secure alternatives to overstretched legacy grids.

Profits at CATL, the world’s largest battery maker, and Sungrow, the world’s second-largest supplier of energy storage systems, have soared on the back of domestic and foreign demand link

China’s industry regulator approved its first level-3 autonomous vehicles for mass adoption, clearing electric sedans from state-owned Changan Auto and BAIC Motor link

Xiaomi released and open-sourced MiMo-V2-Flash, its foundation language model that it claims excels in reasoning, coding and agentic scenarios link

China completed a major milestone after a Shenzhen team led by former ASML engineers built a full-scale EUV lithography prototype link

Google sued alleged Chinese cybercriminals behind a phishing operation that impersonated Google services to steal nearly 900,000 credit card numbers, including data from Americans link

Tencent named former OpenAI researcher Yao Shunyu as its chief AI scientist, he will lead AI strategy and report to president Martin Lau link

Cisco says Chinese hackers are exploiting its customers with a new zero-day link

Shein’s popularity surged in Argentina following sweeping deregulation link

Chipmaker MetaX saw its stock price jump nearly 700% after a wildly oversubscribed IPO in Shanghai link

That’s the first of many as at least six China-linked AI firms are preparing Hong Kong IPOs in the coming weeks, sources say—including chipmakers Montage Technology and GigaDevice Semiconductor targeting up to $1B while AI chipmaker Biren Technology is seeking $600M link

Alibaba is folding its mapping and navigation platform Amap into its Qwen artificial intelligence app link

PDD Holdings fired a Shanghai-based government relations team after a fistfight reportedly broke out between employees and Chinese regulators during an inspection link

Trump signed into law sweeping new powers to screen and restrict US investment in Chinese technology firms link

Chipmaker Moore Threads unveiled a new processor architecture aimed at cutting reliance on Nvidia. The Huagang architecture will raise computing density by 50% and improve energy efficiency tenfold link

Nexperia’s China unit has secured local silicon wafer supplies to cover all of its 2026 output of IGBT power chips after supplies from the Dutch parent were cut off link

India

Angel investments in Indian startups declined sharply in 2025, marking a year of reset for the country’s early-stage funding ecosystem as regulatory changes altered who participates in such rounds and how first cheques are raised link

South Korea’s Krafton, Naver and Mirae Asset are launching a $720M India-focused fund link

Flipkart received clearance from the National Company Law Tribunal (NCLT) to shift its domicile from Singapore to India, a key move towards its much-anticipated IPO link

Flipkart acquired a majority stake in AI and machine learning startup Minivet AI link

President Trump’s $100,000 price tag for new H-1B workers hired from outside the US will have punishing effects for the IT outsourcing and staffing industries, chiefly Tata and Infosys link

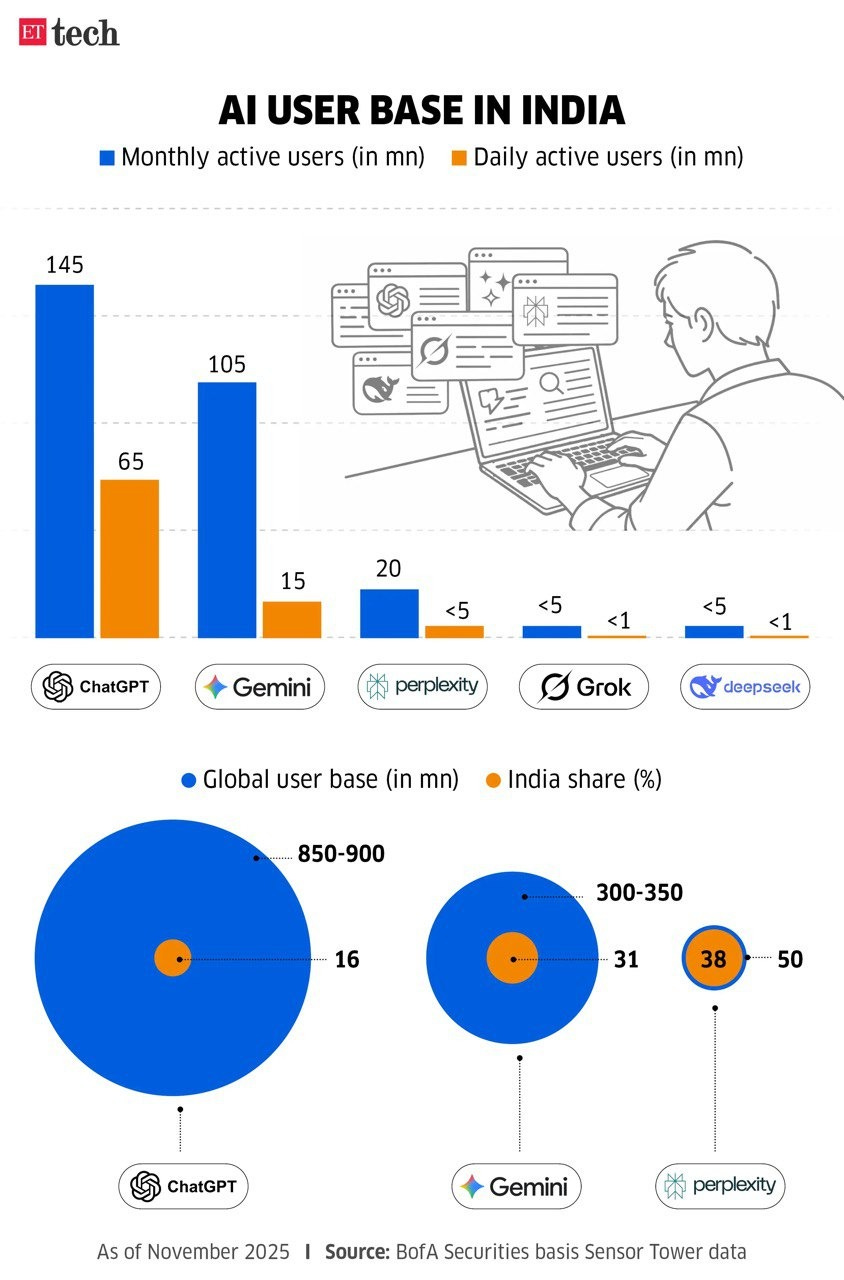

India has become the centre for AI growth worldwide, as we previously wrote, and now the companies going after India-based users are seeing much higher numbers than in markets like the US link

Meesho is India’s best-performing IPO of the year following a surge last week—the stock is up nearly 100% from its list price and is valued at over $10B, having raised $603M from its listing link

MoEngage completed a $180M Series F follow-on round, mostly from secondaries and just weeks after raising $100M link

Apple is in early talks with Indian chipmakers to assemble and package iPhone components, a first for the company link

Indian tutors are using WhatsApp and Facebook groups to teach everyday users basic AI skills link

Prediction markets startup Agara is in talks to raise more than $7M at a post-money valuation of about $25M link

Coinbase’s minority stake acquisition in CoinDCX has been cleared to go through link

Jar is reportedly in talks to raise $100M led by Westbridge at a valuation of over $500M link

Ethereal Exploration Guild, the Indian space tech startup behind reusable launch vehicle EtherealX, is closing $21M in new funding link

Southeast Asia

Malaysia will bring TikTok, Instagram and other major platforms under laws to protect child and tighten accountability from January 1 link

Manus said its annualized revenue run rate topped $125M eight months after launching its AI agents link

Meta partnered with Singapore-based K-ID to roll out its AgeKey age-checking system across Facebook, Instagram and WhatsApp link

South Korea

South Korea’s nominee for the media commission is looking to introduce social media curbs for teens link

Toss added investors including Singapore’s GIC, Baillie Gifford, Wellington and WCM in a secondary transaction link

The administrator winding down what remains of Do Kwon’s Terraform Labs sued Jump Trading, alleging that the high-speed trading giant unlawfully profited from and contributed to the crypto empire’s collapse link

Japan

Apple is updating iOS in Japan to comply with the new Mobile Software Competition Act, which means changes to payments, alternative app marketplaces and browser choices link

Sony reached a settlement with Tencent after suing the Chinese tech giant for copying one of its games link

Hong Kong

RedotPay, a Hong Kong–based stablecoin payments fintech, raised $107M in a Series B round led by Goodwater Capital—the startup raised $47M at a $1B+ valuation just three months earlier link

Crypto exchange HashKey made a flat start to public life after raising $206M in a Hong Kong IPO link

Taiwan

TSMC plans to start installing chipmaking tools at its second Arizona plant by mid-2026, paving the way for 3-nanometer production in 2027 link

Rest of Asia

Bhutan has committed up to 10,000 bitcoin to help fund the long-term development of Gelephu Mindfulness City, building on years of state-backed bitcoin mining powered by surplus hydropower link

North Korean operatives infiltrating remote IT jobs were exposed at Amazon after a subtle keystroke delay revealed an impostor using a corporate laptop from overseas link