US AI companies turn their focus to India and Southeast Asia

Lower-priced products, new offices and carrier deals show the new focus is emerging markets

In this week’s ATR Original we look at how the global artificial intelligence (AI) battle has entered a new era: the emerging market growth period. And the first stop is India.

This isn’t just about offsetting slowing growth in core markets in the West. Asia offers the chance to find an entirely new market of customers to unlock subscription revenue that would otherwise go untapped, and also bring more data in to sharpen AI models and services.

The emerging market focus is well underway already.

All eyes on India

Over the last few months, major AI firms have set their focus on India and Southeast Asia, some of the most prominent markets, and they’ve adopted the traditional Big Tech playbook as their strategy.

That blueprint comes roughly in the form: launch a new localised product, open an office, pledge to invest and hire locally. For bonus points, land a major local player as a partner, ideally a telecom operator, and arrange a meet-and-greet with government officials. In an ideal world, meet the head of state in front of cameras.

Google practically wrote the emerging market entry bible, so it is not surprising that it hit the high notes when it pushed its Gemini AI service in India this month.

It announced a tie-up with Reliance to offer 18 months of free access to its AI Pro platform for customers of Jio, the conglomerate’s telecom arm. It helps that Google has a close relationship with Reliance, it invested $4.5 billion into the Reliance Jio Platforms in 2020.

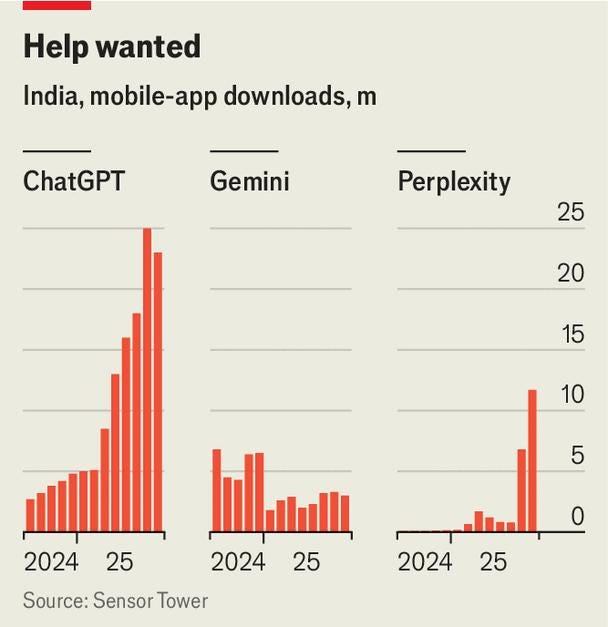

Perplexity, a smaller rival, was first to take the carrier route. It teamed up with Airtel in July to offer its 360 million customers free access to Perplexity’s $200-a-year premium service.

But Google isn’t relying on its carrier relationship, though Jio has just reached a massive 500 million users. It also launched a budget-friendly version of Gemini, which is priced at $5 per month. It launched that product in 40 emerging market countries including India, Indonesia, Vietnam and the Philippines in September.

Western AI companies have used East Asian markets to predominantly sell to corporations given their strong economies and smaller populations

Google may have defined how tech companies localise in emerging markets and work with governments, but its approach here is common.

A month before Google made its move, Anthropic announced it would open an office in Bengaluru, its second location in Asia Pacific, to accelerate its Claude AI service. Its India charm campaign included Anthropic CEO Dario Amodei meeting with Indian Prime Minister Narendra Modi.

There isn’t a lower-priced plan for Claude. That might change next year as Anthropic pushes deeper into India and other emerging markets. Already, it says usage of Claude in India increased five-fold between June and October 2025.

OpenAI accelerates

In the race to plant flags, it appears OpenAI accelerated plans for its first India office. Reports this week suggested it just leased 50 seats in a co-working space in New Delhi. Its original timeframe for its first India office was Q1 2026.

Other activities in India haven’t gone as planned for Sam Altman’s company.

It rivaled Google by launching a promotion to allow anyone in India free access to Go, its $5 per month service that was initially launched exclusively for the country. But following the announcement, users experienced issues providing the payment method required to activate the offer. The problems now appear to have been fixed.

Despite media reports suggesting OpenAI spoke to Reliance and others over potential partnerships, it hasn’t announced a carrier partnership yet.

OpenAI says it doubled its paying subscriber base in India just one month after launching ChatGPT Go in the country

That could mean it will look for alternative distribution channels, or it may be that operators end up offering multiple AI services to their subscribers for free or at a discount.

Offering products for free or at discounted rates is a clear sign that Western AI companies see huge potential for growth in emerging markets.

India has more than 900 million mobile users, data is cheap and adoption is high among young people. That makes it fertile ground to not only convert free users into paying customers, but also gather increased amounts of data to refine their models and generative AI services.

Plus, as the BBC noted in a recent article, Indian law allows AI services to be offered alongside a telecom plan.

India is a key market for user numbers. The country is OpenAI’s second largest market behind only the US. For Perplexity, India is its largest market in the world.

The natural next step after India, is to push into Southeast Asia.

Already, we’ve seen Google launch its cheaper AI subscription to key markets in the region, as well as Latin America and Africa.

OpenAI expanded its $5 per month service to Indonesia in September. Last week, it announced a tie-in with operator Telkomsel to bundle ChatGPT Go and other price tiers to its customers.

More to come, but the same extractive outcome?

You can expect to see other AI companies bringing products to market across the region, and working with mobile operators to help grow their distribution.

Meta, for example, has yet to make a similar play. It has used the popularity of its services to bring AI to where its users are.

A bigger danger may well be Chinese AI startups. They have predominantly focused on US markets, where they are making significant headway with both end users and developers, but Asian markets will likely soon be in focus, too.

India has proven to be a tricky market for Chinese companies given political complications and past examples. TikTok has been banned in India since 2020, for example. Instead, Southeast Asia has been a big focus for Chinese tech companies in general. When it comes to AI startups, plenty of Chinese AI startups have set up shop in Singapore, including Manus which relocated its business entirely.

AI companies placing emphasis on Asia is inevitable.

These regions were significant cash cows for big tech when social networking, messaging and other mobile internet services first became mainstream. India remains the largest global market for WhatsApp, where it has pushed payments and developed monetisation. Southeast Asian nations are among the world’s most active users of Facebook and Instagram.

Markets like Vietnam have become major revenue centres for their advertising business, with rights groups claiming the quest for profits has made them complicit in enabling censorship.

AI may be a different landscape, since it inherently enables creativity, services and efficiency. Education and knowledge are key factors, and already there’s some promise.

In August, OpenAI announced plans to work with educational facilities across India to design and deliver AI training, and a big focus of its hiring is to work with startups and businesses in the country.

The big question is whether this wave of AI investment and low-cost availability will serve to empower and grow local tech and startup ecosystems. Or whether this is simply a repeat of the extractive era that big tech previously brought to this part of the world.

If you’re a freelancer reporter or want to contribute to Asia Tech Review, contact contributors@asiatechreview.com