Grab races after autonomous vehicle tech after making its largest investment bet ever

The Singapore-based ride-hailing company has backed five self-driving car startups since September

Welcome back to this week’s ATR Original. Grab is on a spending spree with one thing in mind. Since September, the Singapore-based ride-hailing firm has backed five major self-driving technology startups through significant investments.

Its shopping list has included public companies WeRide and Hesai, US-based May Mobility and a fast-rising Chinese startup.

Asia Tech Review can reveal exclusively that Grab quietly invested in Momenta, which reportedly raised funding at a $5–6 billion valuation in a previously unannounced deal.

Those deals were all undisclosed, but we can quantify the size of Grab’s ambition after it announced a $60 million investment in Vay last week.

Vay is a German startup that develops ‘remote driving’ technology for vehicles and it could become the most significant investment in Grab’s 13-year history. If milestones agreed between the two companies are hit in the next year, then their deal will rise to $410 million.

But that’s not all. Grab could take a majority stake in the business after three years if further undisclosed conditions of the deal are met.

The Vay investment mostly fell under the radar as word of a dramatic shareholder revolt at GoTo, which could see the Indonesian company’s CEO ousted, came to light. It is reported that a change of leadership at GoTo, which major backers including Peak XV and the Indonesian sovereign fund are keen on, would make a Grab acquisition of the company more likely.

A pioneer that fell behind

The Vay deal is a major investment on paper. But a glimpse under the bonnet shows the deal isn’t as blockbuster as it may seem.

For one thing, Vay appears to be in the midst of a cash crunch. It is well backed having raised $125 million previous to Grab’s cash, including a significant $90 million Series B which made it the highest-funded self-driving car startup in Europe.

But that last round was back in December 2021. Four years is an eternity in venture-backed startups.

Vay’s investors include European backers Kinnevik, Eurazeo, Creandum, Coatue, Atomico and Project A

Vay’s business model hasn’t gained traction, either, and is in danger of looking outdated.

Autonomous vehicle startups in Europe are red hot with investors right now. UK-based Wayve recently raised over $1 billion from SoftBank, Microsoft and other top names. Nvidia alone put $500 million into the deal.

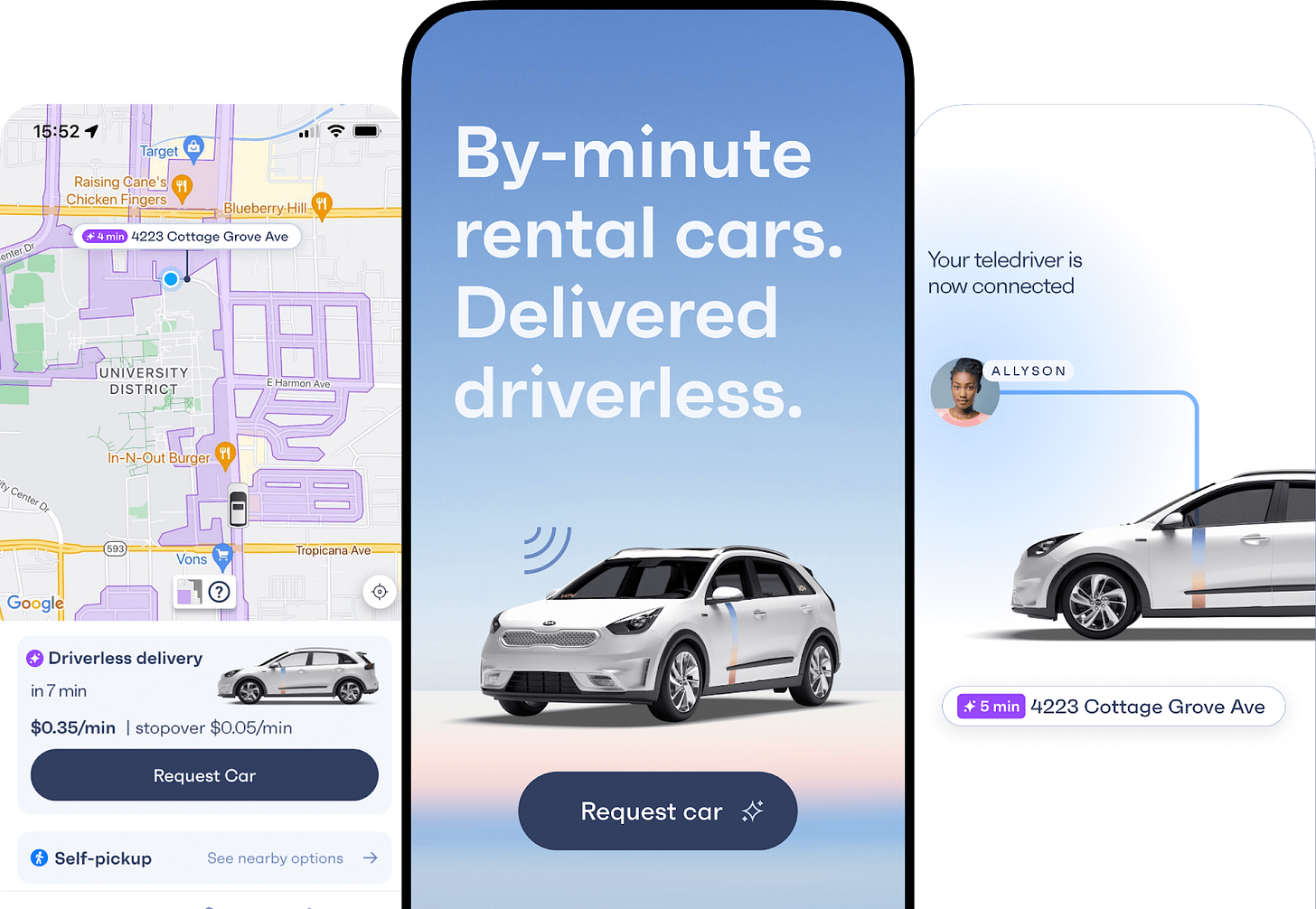

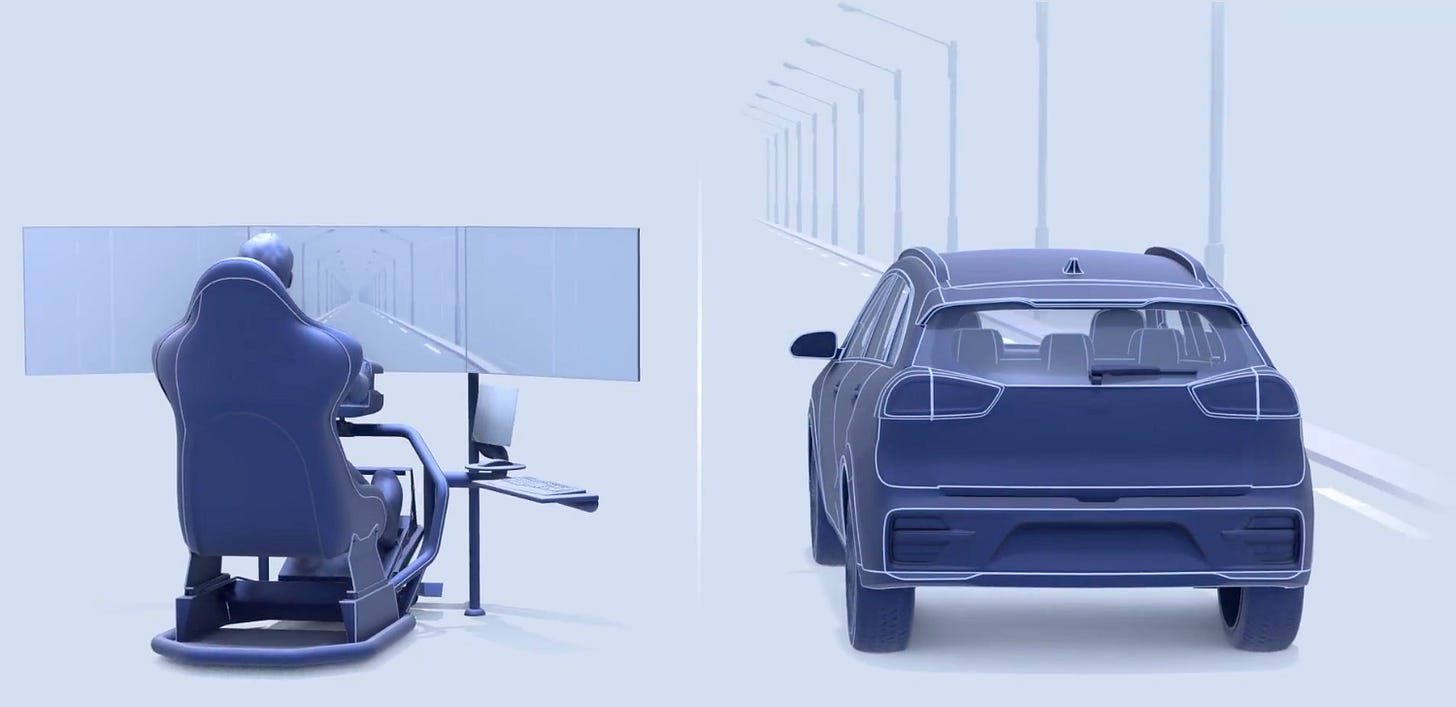

But Vay has taken a different approach to Waymo, Wayve and others. It enables remotely located drivers to take control of a vehicle rather than relying fully on artificial intelligence (AI). The idea being you can get a rental vehicle to a customer more efficiently and cheaply by using a dedicated remote driver.

Here’s how Grab explains Vay in its announcement:

Through the Vay mobile app, customers request an electric vehicle to be remotely delivered to their location. When it arrives, the remote driver disconnects from the vehicle and the user takes over, driving it like a regular car. At the end of the trip, they exit the vehicle, and a remote driver resumes control, eliminating the time-consuming search for parking.

Vay has an app to enable car rentals, but it is only live in Las Vegas

Initially, Vay wanted to go up against the likes of Waymo, but it needed to pivot to a business-to-business (B2B) approach. It works more with rental car companies or those with fleets, such as Grab, to help them get vehicles to customers, rather than end users themselves.

Grab told Asia Tech Review this is not intended as a taxi service, but a potential addition to its vehicle rental offering.

“We believe the driverless rental car space is a massive and untapped opportunity that will complement robotaxis offerings,” Thomas von der Ohe, Vay CEO and co-founder, wrote in a LinkedIn post announcing the Grab investment.

Vay plans to use the money from Grab to increase its headcount in the US and grow its business there. Its service operates in Las Vegas as licenses elsewhere have eluded it thus far.

The future terms of Grab’s future investments hinge on the company really nailing the US market. If not, no further investment.

Big bets on AI with a multi-billion dollar warchest

Grab has $5.3 billion in cash, according to its Q3 financial report released earlier this month. It has put that to work with investments that include:

WeRide: undisclosed investment announced in August with a self-driving car partnership

Hesai: cornerstone investor in the lidar maker’s $500 million Hong Kong IPO in September

May Mobility: undisclosed investment in October to bring its autonomous tech to Grab’s fleets

Momenta: undisclosed investment, confirmed by Grab. The Chinese firm was reportedly valued at $5-6 billion when Tencent, BMW, Temasek, Toyota and Mercedes-Benz invested.

Alongside these investments, it has also struck partnership agreements with Korea’s Autonomous A2Z for self-driving buses, US-based Motional (which works with Uber, Lyft and others) and China’s Zelos (self-driving delivery vehicles).

The deals and partnerships are “part of a long-term strategy to lead AV [autonomous vehicle] adoption across Southeast Asia and secure the technology supply chain through strategic partnerships,” Grab said in a statement.

Grab first invested in self-driving companies nearly a decade ago when it backed NuTonomy, which was acquired by automotive firm Aptiv, in 2016 and Drive.ai, which Apple acquired, in 2017

Every ride-hailing company under the sun is deep in self-driving technology, and has been for some time. Uber developed its own vehicle technology at great cost before selling it off four years ago, while China’s Didi recently raised nearly $300 million for its self-driving unit.

There’s no doubt Grab is late to the game, but it looks to have taken a solid approach by backing proven technology players, including publicly listed WeRide and Hesai while Momenta is reportedly planning an imminent IPO, too.

Grab sees Vay as potentially adding a stronger vehicle rental option to its services by using the remote car model, an offering that is fairly forgotten with its current focus on licensed taxis, cars and bikes in some markets.

Remote drivers bringing rental cars to customers might become part of Southeast Asia’s transportation options if Grab and Vay’s partnership bears fruit

More broadly, Vay can potentially bring it a lot more data if it can scale up its operations using Grab’s money. It could also become a revenue generator if it can land deals with other ride-hailing companies or rental firms.

With WeRide, Pony.ai and others announcing partnerships on a seemingly weekly basis. Investor money flowing into upcoming companies, and those with traction going public, Grab would do well to own a service provider that can boost its top line.

Even if the deal doesn’t hit the milestones and unlock the promised capital, Grab’s commitment to fund it with nearly $400 million is a strong statement of its intent and financial muscle. The company is now solidly profitable and has a warchest, as we’ve previously written. That strength will only increase if it is finally able to land that GoTo acquisition.

Vay's remote driving model feels like a transitional aproach rather than the endgame. The real value here might be in the data Grab can colect if Vay scales, not the service itself. Backing multiple autonomous players like WeRide and Momenta shows they're hedging smartly rather than commiting to one tech path.