Grab turns a profit—with billions in the bank to fuel its next move

Forget ‘adjusted positive EBITDA,’ the ride-hailing firm has strung together four quarters of net profit

Welcome back,

This week we can finally say Grab is a profitable business for the last four quarters. That feels like a fairly major milestone that flew under the radar.

The quarter was pretty positive: with decent growth from its core businesses, and promising numbers from its newer units such as advertising. Grab’s business isn’t sexy but it is wearing the competition down and its spending isn’t so outlandish.

Let’s see what happens if other players enter, such as Meituan—a relative destroyer of worlds which is just about to enter Brazil having upended the Hong Kong market and found strong and rapid traction in the Middle East.

Elsewhere we look at a government-enforced detente among China’s food delivery war, why India now supplies more smartphones sold in the US than China, and why Nvidia is backing a backlash against its China AI chip.

Have a great week,

Jon

Note: An earlier version of this newsletter incorrectly stated this was Grab’s first quarterly profit. It is in fact the fourth. Apologies for the confusion.

Follow the Asia Tech Review LinkedIn page for updates on posts published here and interesting things that come our way. If you’re a news junkie, the ATR Telegram news feed has you covered with news as-it-happens or join the community chat here.

News in Focus

Grab passes a year of profitability with nearly $6 billion in cash to spend

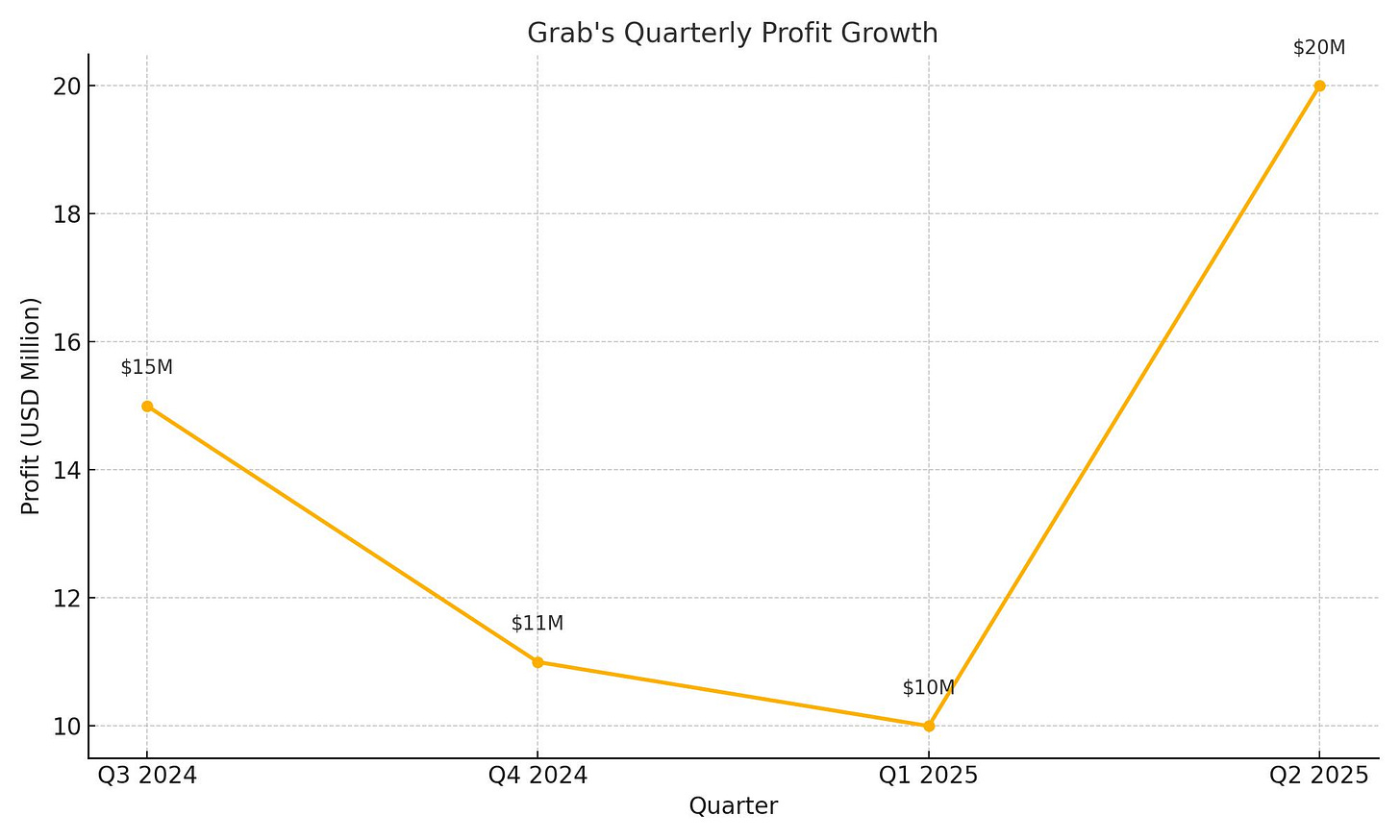

Grab reached an important milestone after it announced its fourth consecutive profitable quarter with its Q2 2025 results.

The company previously touted ‘adjusted positive EBITDA’—a buzzy term for tracking the road to profitability for unprofitable businesses—but now it posted its highest quarterly profit. It came in at just $20 million (for scale: Grab’s quarterly revenue was $819 million) but it’s a positive metric that the company will need to continue.

Grab maintained profitability through a mix of more prudent spending and solid growth within its core business. New units are also showing promise, including advertising (which is approaching $250 million in ARR) and its loan book, up 78% annually to reach $708 million.

There’s plenty of cash. With net liquidity of $5.9 billion—including a recent injection of $1.5 billion from the sale of notes—Grab has money to spend on expansion and, potentially, acquisitions.

So far it has doubled down on existing areas:

Physical retail: it bought Malaysian supermarket Everrise in March

Licensed taxis: it launched licensed cabs in Singapore with GrabCab, joining the very market it originally disrupted

Indonesia: Grab said it will expand its driver base to meet ‘rising demand’ in the country

An acquisition of GoTo is the obvious question on the list. It appears that won’t happen, but Grab did call itself at three times larger than its “next largest competitor.” It also reiterated the above growth targets for Indonesia, GoTo’s home market.

A good take comes from Momentum Works, which raised the potential of Meituan (finally) moving into Southeast Asia after years of expectation.

China delivery giants agree to cool off pricing war

China’s delivery war is cooling down with Meituan, Alibaba and JD all pledging to end the cutthroat pricing war that got severe enough for the government to step in and apply pressure.

The “disorderly competition” will be shelved, according to statements from the three companies just weeks after each was summoned by the State Administration for Market Regulation. Subsidies, hugely discounted food and drinks and other subsidies had been unleashed by all, as they aim to take a chunk of a market estimated at $80 billion.

Meituan and JD are now developing thousands of delivery-only kitchens to speed up their orders. ByteDance, meanwhile, is playing catch-up. It is reportedly planning to merge its shopping platform and delivery team to get more competitive.

Things look different overseas. The New York Times reports on Hong Kong, where Meituan’s Keeta brand drove DeliveryHero out of the market. Keeta changed the dynamic with initially generous subsidies and salaries which diminished as its success grew.

Keeta’s rapid ascension in Saudi Arabia—where it cracked the top four in just four months—has validated the concept of international expansion. Brazil is next, and Meituan has a $1 billion budget for that move. (One major investor, Prosus, is selling shares on account of investment conflicts there.) That expansion raises the possibility of a Southeast Asia entry sooner or later.

Nvidia accused of adding security flaw to H20 AI chips for China

You’d be forgiven for thinking the Nvidia-in-China story has stabilised. Right after the US government gave the company the green light to sell its China-focused H20, the Chinese government has claimed the AI chip has a backdoor.

The Chinese internet regulator summoned Nvidia to address the apparent security risks. The source of information is said to be US experts, who have claimed that the chip could enable remote shutdowns or user tracking.

Nvidia has rejected the claim, but there’s already enough smoke to pull the fire alarm. State-run media outlet People’s Daily demanded to be shown “convincing security proofs” in an editorial titled "Nvidia, how can I trust you?”

Still. Nvidia has seen strong demand for the chip from China. The company is said to have ordered 300,000 H20 units from its manufacturing partner TSMC. That’s in addition to the 700,000 chips it has stockpiled before a sale ban was introduced in April.

The demand for Nvidia’s tech has never been greater. Will these accusations simply blow over because every tech company needs its AI chips?

Related: Thousands of US export license applications, including for AI chips to China from Nvidia, are stalled due to dysfunction at the agency overseeing approvals, according to reports.

India overtakes China as top source for US smartphone sales

More proof of trade tariff power: India leapfrogged China to become the top source of smartphones sold in the US, between April and June.

India accounted for 44% of devices in Q2 ahead of China, which dropped from 60% to 25% year-on-year, according to data from Canalys reported by Bloomberg.

Yes, India is increasingly a destination for manufacturing with Apple leading the charge as it looks to offset its reliance on China. India is not making more devices than China, but it is serving the US market because—crucially—US tariffs that apply to China don’t apply to India.

That’s a big caveat but it is a sign of the future.

China

The Trump administration is softening its stance on tech export controls to gain leverage in trade talks and boost US AI dominance—the latest move may see it drop a Biden-era rule restricting AI tech exports to China and Russia link

Cadence Design agreed to plead guilty and pay over $140M to settle US charges of illegally selling chip design tools to front companies tied to China’s National University of Defense Technology link

Bitmain, the world’s top crypto mining hardware maker, plans to open its first US facility by Q3, with a new HQ and assembly line in Texas or Florida link

China-specific national-security concerns were a big reason the Justice Department decided last month to allow Hewlett Packard Enterprise to take over rival Juniper Networks, Trump administration officials told Axios link

Z.ai, formerly Zhipu, has launched its GLM-4.5 AI model, offering a cheaper, open-source alternative to DeepSeek—it runs on just eight Nvidia H20 chips and reflects a broader push by Chinese firms to develop smarter, more efficient AI systems ink

Meanwhile, the company saw revenue increase by as much as 4x in H1 2025, according to CEO Zhang Peng—revenue in 2024 was just $42M but that was before the Deepseek moment for Chinese AI companies link

Unlike the West, Chinese universities want students to use more AI, not less link

As China ramps up its AI push, students and tech workers are flocking to online courses in hopes of landing high-paying jobs, though many programs fail to provide the skills they promise. link

Manus is launching Wide Research, a major update that lets multiple AI agents work together to process large data sets—it is available with a $199 monthly premium subscription link

Arkham Intelligence says it uncovered a previously unknown 2020 theft of 127,426 BTC—then worth $3.5B now worth over $14.5B—from Chinese mining pool LuBian, that would make it the biggest hack of all time link

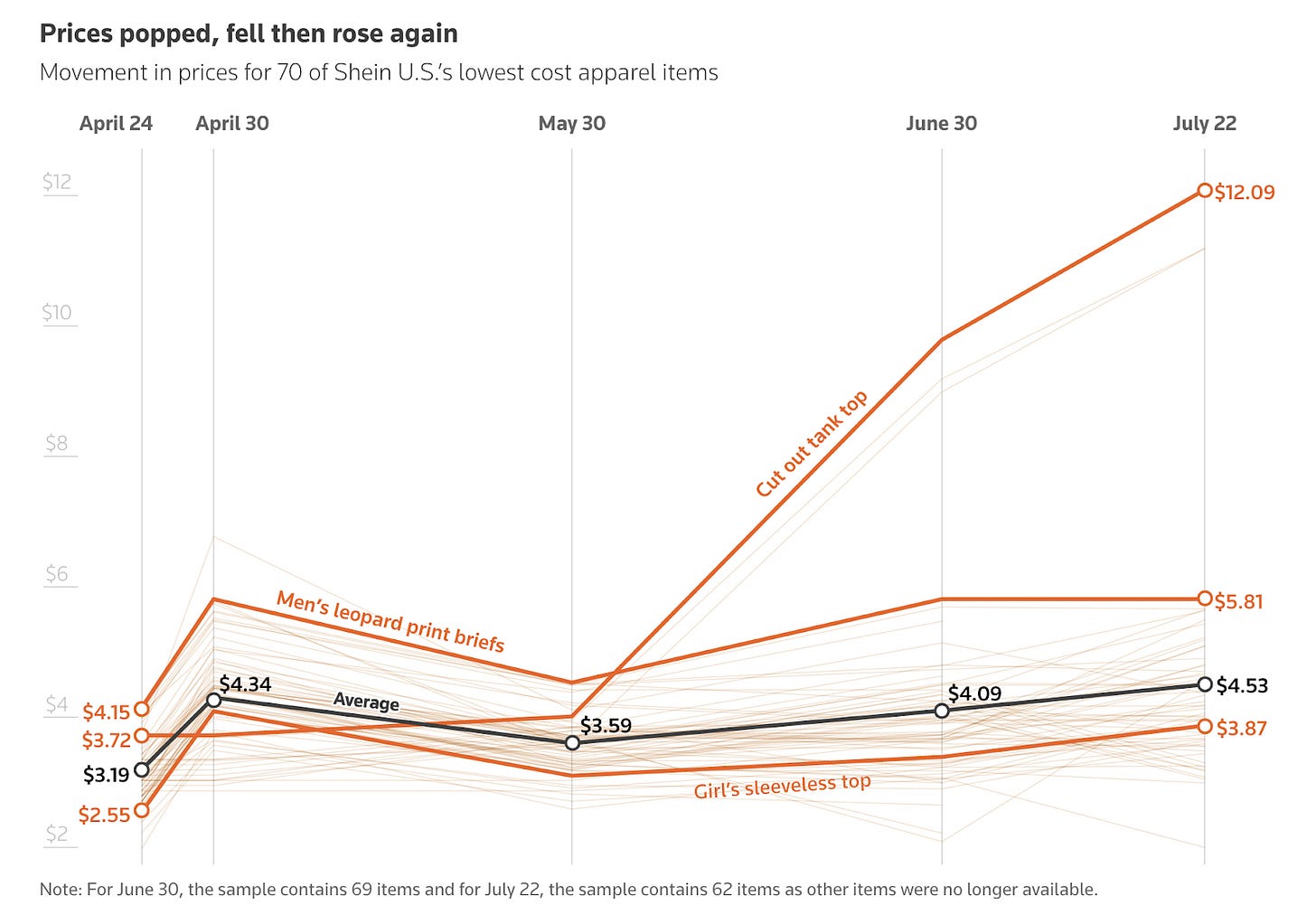

Shein reportedly posted over $400M in net income and nearly $10B in revenue in Q1—profit margin rose by 5% as shoppers rushed to buy before US tariffs, according to sources link

Reuters analysed how Shein prices changed before and after US tariffs were applied link

The EU is investigating Temu for failing to accurately assess illegal product sales on its platform—it is said to have violated online content rules which could bring a fine of up to 6% of global revenue link

Pony.ai is the only company approved to operate robotaxis in China’s top four cities, and now it plans to mass produce driverless cabs to make robotaxis more affordable and widely available link

Researchers have uncovered over 10 patents for offensive cybersecurity tools filed by Shanghai Firetech, a company linked to China's Silk Typhoon hacking campaign link

Last month we wrote about reports of China-backed hackers taking advantage of a security hole in Microsoft’s Exchange service—now China is accusing the US of exploiting the flaw to hack its national defense sector and steal military data link

India

Coinbase is reportedly in advanced talks to acquire India’s CoinDCX in a cut price deal of less than $1B—Coinbase is already an investor in the startup, which was previously valued at $2.2B but has been in a tough spot after hackers hit the exchange last month link

Less than two weeks after the hack, police say the breach stemmed from a fake job offer. A software engineer was tricked into installing malware, giving attackers access to company systems. link

Google will invest $6B to build a 1-gigawatt data centre and supporting power infrastructure in Visakhapatnam, Andhra Pradesh, its first such project in India link

Reliance plans to sell a 5% stake in Jio, aiming to raise over $6B in a potential listing link

Reliance is also reported to be in advanced talks to lead $50M raise in spacetech startup Digantara link

Google proposed major changes to its Play Store and ad policies in India to allow more real-money gaming apps—the catalyst is an unresolved antitrust case with local gaming platform WinZO link

Display advertising could be its next issue in India after the Competition Commission of India (CCI) ordered a probe into Google’s practices in that market link

India’s regional satellite navigation system, NavIC (Navigation with Indian Constellation), is facing a severe operational crisis, with only four of its 11 satellites currently operational, according to government data and news reports link

Social gaming startup STAN raised $8.5M from Google, gaming firms Bandai Namco and Square Enix link

US big tech firms are reportedly hiring hard in India, where their total headcount has grown 16% over the past year to more than 208,000 link

Southeast Asia

Philippines-based VC Foxmont announced a first close of $30M for its third fund—this surpasses the combined total of its previous two funds and it includes Grab as a backer. The Philippines has seen its share of regional VC funding jump to 19% from just 2% in 2021—but scaling a fund is not always as simple as it seems link

Bloomberg Businessweek takes a look at the notorious Huione Group: an illicit marketplace that became the ‘Amazon for Criminals’ and is thought to have laundered over $4B for clients that include North Korean hackers link

A US lawmaker asked Elon Musk how SpaceX is preventing misuse of Starlink after reports it was used by scam compounds in Southeast Asia—a Wired report found Starlink active in at least eight Myanmar sites tied to online fraud that caused $3.5B in US losses in 2023 link

Indonesia has raised taxes on cryptocurrency transactions, with a higher rate on trades hosted by overseas exchange link

Singapore’s SixSense has raised $8.5M in Series A funding to scale its AI platform that helps chipmakers detect defects in real time link

Southeast Asia’s premium video-on-demand market added over 1.5M net new subscribers in Q2 2025—nearly double Q1’s growth, according to Media Partners Asia link

GoTo and Indosat Ooredoo Hutchison launched Sahabat-AI, Indonesia’s first locally developed generative AI service link

South Korea

Samsung secured a $16.5B chipmaking deal with Tesla, an expansion of its existing partnership which will boost its foundry unit link

But the company’s chip arm just saw a big miss on forecast profits, fueling concern of a crisis within the Korean electronics giant link

Samsung has snagged Intel’s 2024 Inventor of the Year, Gang Duan, who left the company after 17 years to join Samsung Electro-Mechanics as executive VP link

FuriosaAI raised $125M from Korea Development Bank, Kakao Investment and others to begin developing a next-generation version—the deal values the company around $735M and is said to have surpassed its initial fundraising target of $80M link

SK Hynix overtook Samsung as the top memory chipmaker in Q2, driven by surging AI demand link

Krafton’s profit fell for the first time in two years as a seasonal dip in PUBG: Battlegrounds offset gains from other titles—operating income dropped 26% to 246B won ($177M) in Q2 link

Rest of Asia

Rakuten launched its own AI assistant across services like e-commerce, trading, and music—the beta version of Rakuten AI can shop, translate, code, and more, with plans to add task-specific agents link

Sony sued Tencent in a California court, accusing it of copying its "Horizon" video game series link

Hong Kong has new rules for stablecoins covering the issuance, sales, and marketing of stablecoins tied to the Hong Kong dollar link

Fintech RD Technologies, which specialises in stablecoin infrastructure, raised $40M link

Foxconn has formed a strategic alliance with local peer Teco Electric & Machinery to strengthen its AI hardware push link