China’s top AI startups aren’t making much money at all

IPO disclosures show Zhipu and MiniMax lag OpenAI, Anthropic and other US rivals

Welcome back—this year may almost be finished but we’re about to discover the inner workings and what makes AI companies tick. Albeit through Chinese lenses.

Already, we know that China may be winning the open source battle for AI, but its top startups are minnows when it comes to making money.

That’s according to disclosures from two startups that are preparing for IPOs in Hong Kong, MiniMax and Zhipu AI, both of which are backed by Alibaba and Tencent.

Zhipu disclosed that it grossed $44.4 million in revenue in 2024, while MiniMax reached $30.5 million.

OpenAI is said to have reached sales of $3.7 billion last year, with revenue this year estimated to be between $10 billion and $13 billion, according to reports.

Anthropic, meanwhile, is said to have made $1 billion in 2024 and as much as $9 billion this year.

Both Chinese firms are valued at $4 billion. That’s a price that feels rich, but actually comes in at better multiples.

OpenAI is said to be raising $130 billion at a $800 billion valuation, while Anthropic successfully raised $18 billion at a $183 billion valuation in September.

So, yes, those numbers give the Chinese companies a better earnings to valuation ratio, but the figures are dated and the US firms have a more mature sales strategy, particularly among corporates, including customers in China.

Still, these IPOs will give a fascinating look under the bonnet of a modern AI business. The US firms may be orders of magnitude larger, but there may be commonalities in how their business works and their financials tick.

They will also need to weather China’s regulatory landscape, which is particularly challenging when it comes to AI given the level of media and internet control that Beijing typically exerts. Indeed, the government is issuing new rules on chatbot and AI-generated content, which must pass an “ideological test” and be clearly and transparently labeled. There may also be requirements around disclosures and ethics.

To show just how close they are, Zhipu AI and MiniMax unveiled new flagship AI models within hours of each other.

But before the two rivals duke it out in the public markets, AI chipmaker Biren will raise $620 million from a Hong Kong IPO listing on January 2.

Happy New Year, have a great week and see you in 2026!

Jon

Follow the Asia Tech Review LinkedIn page for updates on posts published here and interesting things that come our way. If you’re a news junkie, the ATR Telegram news feed has you covered with news as-it-happens or join the community chat here.

China launches $7 billion ‘seed stage’ investment programme for emerging tech

China already backs its tech companies with significant state funding, but it is preparing to invest even more cash this time into early stage ventures after three new state-backed funds were unveiled.

China Central Television reported that the funds will collectively put more than $7 billion into “hard technology” startups valued below $71 million across areas including chips, quantum tech, biomedicine, brain-computer interfaces and aerospace. The mandate is described as “seed stage” funding with investments capped at around $7 million. That’s plenty of spending power over the coming decades.

The funds are divided between the Beijing-Tianjin-Hebei region, the Yangtze River Delta region and the Guangdong-Hong Kong-Macao Greater Bay Area, but they will be expanded to cover up to 600 ‘sub-funds’ across the regions. They will be managed by selected professional investment companies.

If they roll out as expected, the funds will boost founders who can contribute to China’s domestic technology push, enhance the self-sufficiency push and give the government significant skin in the game for emerging technologies. Of course, investing at such an early stage will carry risk.

China’s IPO market is heating up. Chip firm Moore Threads raised $1.1 billion this month, a number of AI firms are poised to go public and autonomous driving companies have also hit public markets. Shrewd early-stage deals could repay the government’s commitment here. But money is neither the sole nor most important goal here.

Another fintech-crypto acquisition on the cards in Korea

Following on from Naver’s $10 billion-valued acquisition of top domestic crypto exchange Upbit earlier this month, Korean financial conglomerate Mirae Asset is reportedly in negotiations to acquire Korbit for as much as $100 million.

Upbit dominates the South Korean market with more than double the market share of rival Bithumb, but Korbit lags behind with an estimated 1% of all trading despite being founded way back in 2013. These days, it is majority owned by NXC, the holding firm behind gaming giant Nexon, with a subsidiary of SK Telecom owning a minority share. Nexon was previously linked with a sale to Tencent back in the summer, indicating that there may be some turbulence or change behind the scenes.

There’s a growing convergence between fintech and crypto and this deal underscores how mature the latter market is in Korea.

China

Nexperia China, the estranged unit of the Dutch chipmaker, is intensifying efforts to secure new wafer suppliers in six months link

The Trump administration branded Chinese-made drones a security risk which means a block on new sales from DJI but US users can keep existing models link

Nvidia told Chinese customers it plans to begin shipping its second-most powerful AI chips to China before the Lunar New Year in mid-February link

However US lawmakers want disclosure of license reviews for Nvidia H200 chip sales to China link

Baidu partnered with Uber and Lyft to launch robotaxi trials in London next year link

China has only just begun to allow local self-driving car firms to mass produce and sell vehicles after fatal crashes slow down regulators and development link

ByteDance’s private market valuation hits $500B after deals that followed the TikTok US agreement link

Meanwhile, leading EV battery firm CATL is pushing its low-cost batteries abroad after saturating its home market link

CATL is part of a consortium of companies that formed an automotive chip firm link

Chinese suppliers are emerging as unlikely winners of the global AI boom, as a scramble to build data centres exposes acute shortages of transformers and other power equipment in the West link

Kuaishou shares fell to a near five-week low after a livestreaming cyberattack link

Beijing-based humanoid robot maker Galbot raised more than $300M at a valuation of over $3B link

Huawei increased the share of domestic components in its latest smartphones to nearly 60% by value, according to a teardown link

Shanghai aims to foster more than 200 open-source projects over the next two years as part of an ambitious road map to build a world-class ecosystem link

India

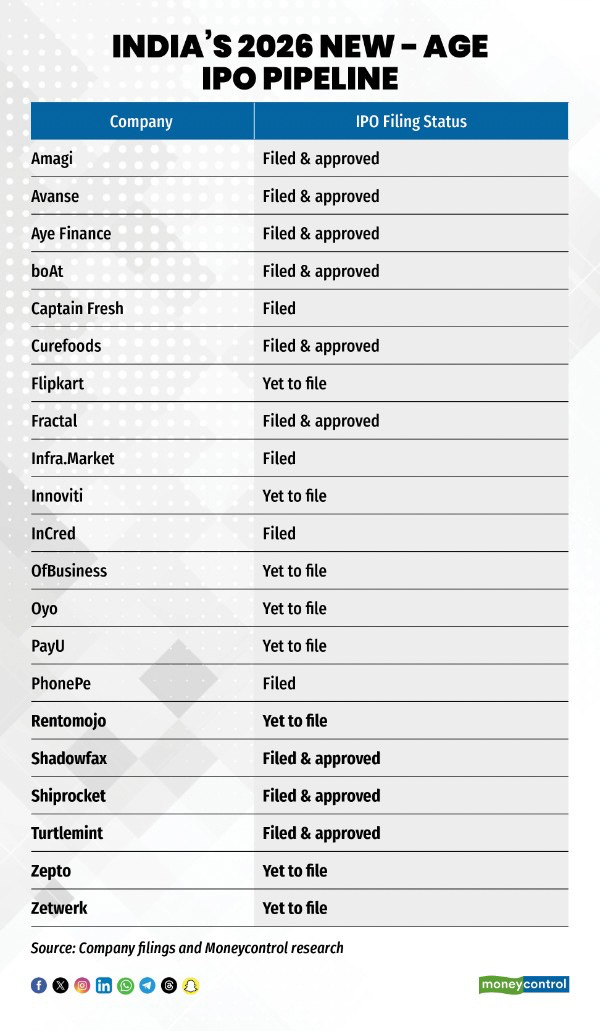

MoneyControl looks at more than 21 upcoming tech startup IPOs in India link

YC is keen to invest in more Indian founders after major windfalls from Groww and Meesho’s IPOs link

A former Coinbase customer service agent was arrested in India months after hackers bribed support staff to access customer data link

A look at how the major names in India’s IT services industry, which is worth more than $250B annually, have adapted to AI by taking on work including AI prep, data cleanup and system integration link

Case in point: IT services provider Coforge is buying AI firm Encora at an enterprise value of $2.35B to boost its in-house AI capabilities and expand its presence in the US and Latin America link

India’s startups raised about $10.5 billion in 2025, but investors wrote far fewer checks and tightened risk—the total number of funding rounds fell 39% year-on-year but total capital dropped by 17%, according to data from Tracxn link

Paytm set up units in Indonesia and Luxembourg for expansion, and it sold a 49% stake in its UAE arm link

Tata Electronics will test and assemble chips with Japan’s ROHM link

Wealthtech startup PowerUp Money secured $12M from Peak XV Partners and others link

AST SpaceMobile launched its largest satellite yet from India, kicking off a rollout to rival SpaceX in direct-to-phone connectivity link

HCLSoftware, a subsidiary of HCLTech, is buying Jaspersoft from Cloud Software Group in an all-cash deal valued at $240M link

India is in talks with the US to join the Pax Silica supply chain partnership for critical minerals and may enter the US-led multilateral initiative alongside other countries in the first half of 2026, US undersecretary of state for economic affairs said link

Southeast Asia

Singapore-based AI firm Megaspeed has become Southeast Asia’s largest buyer of Nvidia chips in under three years, drawing scrutiny from Washington link

Trafficked foreign workers in Cambodia were forced to keep running online scams even as fighting intensified along the Thai border this month, according to witnesses and video evidence reviewed by The Wall Street Journal link

Vietnam’s tech boom is fueled by investors like Apple and Samsung but it is not enriching local firms, according to reports link

South Korea

South Korea will begin requiring facial recognition for new mobile phone numbers in a bid to fight scams link

Samsung-owned Harman is buying a driver-assistance unit from Germany’s ZF Group for $1.8B to further Samsung’s push into automotive electronics and smart driving link

South Korean prosecutors say China’s ChangXin Memory Technologies illicitly obtained and used state-designated core DRAM technology from Samsung Electronics, enabling mass production link

Japan

SoftBank is rushing to lock in a $22.5B OpenAI investment by year-end, its funding it through asset sales, possible Arm-backed loans and sweeping cutbacks link

Rakuten is scaling up its AI team under a former Google executive link

Japan’s industry ministry will sharply ramp up spending on advanced chips and AI, lifting support nearly fourfold to about $7.8B—that covers state-backed chip venture Rapidus, AI development and securing critical minerals including rare earths link

Hong Kong

Hong Kong is planning new crypto and infrastructure rails for the insurance industry link