Upbit’s up-and-down week: $10 billion acquisition and $30 million hack

What could be worse than being hacked one day after your deal, and by North Korea too?

Welcome back—an IPO is the dream of all company founders. This week was a rollercoaster for Upbit, the Korea-based crypto exchange, which took a big step towards going public but also suffered a major hack.

Dunamu, the company which owns Upbit, announced that it will be acquired by Naver, the Korean internet giant, for $10.3 billion. That’s a deal widely seen as key to enabling Upbit to go public through a US IPO.

Naver, which is famous for the Line messaging app, fintech services and much more, gives Upbit considerable clout. Not only is it a publicly traded company itself, but it plans to double down and invest more than $6.8 billion to build out the go-to financial platform for Koreans.

Korea remains one of the most active markets for crypto trading, the country is a major target for crypto projects, and Upbit is the top place to trade. Under Naver’s strategy, Upbit will sit firmly in the center as a key platform that offers crypto trading, DeFi and much more alongside traditional financing and AI services.

That could get potential investors excited, but the next part will not.

Just one day after the Naver announcement, Upbit was forced to halt trading after $30 million was drained from its accounts. The company said an ‘internal wallet flaw’ enabled the hackers to drain the funds, which were taken in Solana.

The kicker is that North Korea’s Lazarus Group appears to have been responsible for the heist.

Welcome to the big leagues, neighbour.

Hacks aren’t uncommon in the crypto industry, but this incident could not have been timed worse for Naver or Upbit. There will obviously be a lot of pressure to maintain normal service and rebuild trust.

A related piece of news that caught my eye was a report that Thailand-based Bitkub is eyeing a Hong Kong IPO. It makes sense that the crypto exchange, which dominates its home market but hasn’t always had it easy, wants an exit but there’s precious few options. We’ve not really seen non-Chinese tech IPOs in Hong Kong yet, this could be something to watch.

Have a great week,

Jon

Follow the Asia Tech Review LinkedIn page for updates on posts published here and interesting things that come our way. If you’re a news junkie, the ATR Telegram news feed has you covered with news as-it-happens or join the community chat here.

Alibaba’s AI and data strategy bears fruit

Alibaba had a strong week as the company’s rebirth continues to gain momentum.

The e-commerce giant beat earnings as revenue rose 5%, as its domestic e-commerce sales increased by 16% and its cloud computing revenue rose by 34%. On top of that, its Qwen chatbot crossed 10 million downloads in its first week and the company just began to sell smart glasses powered by its AI model.

We’ve been writing for some time that Alibaba’s new strategy blends its core e-commerce business with newer growth engines like cloud computing, AI and related services. The company has always played down its ‘cloud intelligence’ business, which includes cloud and AI services, but now that unit represents 15% of all Alibaba revenue, crossing $22 billion in ARR in its own right.

Ant Group, its sister fintech business, is also diving into new technologies as it ramped up investments in AI models, humanoid robots, and health care technology. Its business already contributed $384 million so this push into AI and other areas will enrich Alibaba in other ways, too.

China’s Southeast Asia AI chip tourism

China has made no secret of its ambition to close the innovation gap with the US, especially in high-performance AI chips dominated by Nvidia. But with Beijing pushing domestic alternatives and Washington restricting exports, China’s biggest tech firms are increasingly finding workarounds to keep their AI roadmaps on track.

One major strategy is overseas AI training. Chinese companies are turning to data centres in locations like Southeast Asia where they can access Nvidia’s most advanced chips. Alibaba and ByteDance are among those training their models offshore using Nvidia hardware housed in non-Chinese data centres, the FT reported.

This allows them to bypass US export controls that limit which Nvidia chips can be sold into China, and Chinese regulation that bars the use of Nvidia processors in new domestic data centres as part of a push to boost local chipmakers. Waiting for homegrown alternatives to catch up risks slowing core products today. That’s a chance its top tech firms must hedge against, especially as their users are worldwide, not just in China.

ByteDance is the most striking example. It bought more Nvidia chips than any other Chinese company this year, according to The Information, which claims it is now unable to deploy much of that stock. That leaves a stockpile of expensive and sought-after GPUs sitting idle.

Training models abroad allows Alibaba, ByteDance and others to access state-of-the-art compute despite the political headwinds. You’d imagine this will be allowed to continue as it benefits everyone, for now.

China

China surpassed the US in global downloads of “open” AI models, marking a pivotal shift in the technology landscape—an MIT and Hugging Face study found Chinese-developed models accounted for 17% of new model downloads over the past year, compared with 15.8% from US developers such as Google, Meta and OpenAI link

The Allen Institute for AI (Ai2), a US non-profit, released a set of fully open AI models, complete with training data and pipelines, in a bid to counter China’s lead in open-source AI link

WeRide cut its overall losses to one-third, or a $42M deficit, from one year ago thanks to increasing robotaxi orders link

Rival Pony.ai, meanwhile, plans to triple its robotaxi fleet by the end of next year, signaling faster growth and rising ambitions link

China is reportedly rapidly weaving AI into its factories to protect its status as the world’s manufacturing hub, as rising costs and foreign tariffs threaten its export advantage link

China’s National Development and Reform Commission warned of the risks of a bubble forming in the country’s humanoid robotics industry link

Baidu is cutting jobs across major divisions and reshuffling its AI teams after a loss-making quarter, according to multiple sources link

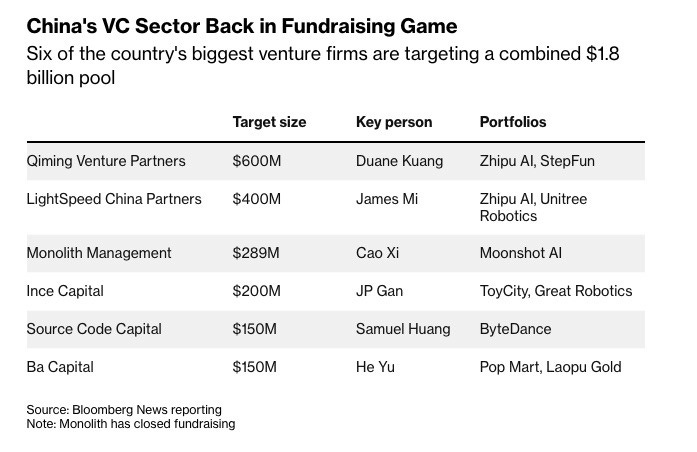

Monolith Management, an investor in MoonShot AI, raised a new fund worth $289M—a number of other funds in China are seeking to follow suit anchored by a track record of successful AI investments to date link

The Pentagon has determined that Alibaba, Baidu and BYD should be added to the list of companies supporting China’s military link

Tencent completed its $1.25B investment into Ubisoft, creating a new subsidiary that will handle franchises including Assassin’s Creed, Rainbow Six, and Far Cry link

Bitcoin mining is quietly resurging in China four years after the ban thanks to cheap power and a data-center boom in energy-rich regions link

TikTok Shop is moving into luxury retail with products like high-end bags, watches and limited-edition sneakers from brands like Hermès, Chanel, Rolex, and Louis Vuitton—although most listings are second-hand sellers link

TikTok appointed veteran government affairs executive Ziad Ojaklias, formerly of Ford, SoftBank and the Bush administration, as its new head of public policy for the Americas link

ByteDance is reportedly in talks to sell gaming studio Shanghai Moonton Technology to Saudi Arabia’s Savvy Games Group—it bought the studio for around $4B in 2021 link

China’s Huawei and ZTE have secured multiple 5G equipment contracts in Vietnam this year, signaling closer Hanoi–Beijing ties and raising Western concerns link

Wingtech, the Chinese owner of Dutch chipmaker Nexperia, accused its subsidiary of trying to build a non-Chinese supply chain and cut it out of control link

Meanwhile, Nexperia says its customers are facing impending production halts despite efforts by Chinese authorities to facilitate the resumption of exports link

China’s draft MIIT rules are sparking concern that stricter standards for portable power banks could eventually limit what passengers can bring on flights link

DeepSeek has unveiled what it says is the first open AI model capable of delivering gold medal–level scores on the International Mathematical Olympiad link

Grindr will not be going private after its two top shareholders scrapped a $3.46B bid link

Didi saw revenue rise by 8.6% in Q3 but it is accelerating spending on overseas expansion link

Meituan slipped into its first loss in nearly three years as an escalating price war with rivals weighed on its finances link

India

Meesho is poised to become India’s first major e-commerce listing with its imminent IPO looking to raise over $600M at a valuation of nearly $6B—notable SoftBank and other lead-name investors aren’t cashing in, indicating that they see long-term growth potential for the business and sector link

Indeed, in conversation with The Economic Times, Meesho CEO Vidit Aatrey said he believes India still has considerable e-commerce growth potential link

India’s e-commerce players are expanding into financial services: Amazon will offer loans to small businesses while Flipkart is exploring BNPL link

Apple is challenging India’s new antitrust penalty rules that could expose it to fines of up to $38 billion, according to a Delhi High Court filing seen by Reuters. This is the first challenge to a law that lets the Competition Commission of India calculate penalties using a company’s global turnover. link

India has formally recognized millions of gig and platform workers under new labor laws, a major step for delivery, ride-hailing, and e-commerce workers but meaningful benefits remain uncertain link

Wealth management startup Wealthy raised $14.5M link

Lendingkart faces escalating turmoil after cofounder Harshvardhan Lunia filed an NCLT case against majority shareholder Fullerton Financial Holdings, alleging breaches of the terms and slashing disbursals link

Google teamed up with Accel to back India’s earliest-stage AI startups: they plan to co-invest up to $2M per company through Accel’s Atoms program link

Reliance Industries and its partners will invest $11B over five years to build 1 gigawatt of AI data capacity in Andhra Pradesh link

Adani plans to invest up to $5B in Google’s new AI infrastructure hub in southern India. link

Contract manufacturer Zetwerk is reportedly preparing a confidential IPO filing that could raise up to $750M link

Deeptech startup LightSpeed Photonics raised $6.5M link

The two founders of online gaming platform WinZO have reportedly been arrested on charges of money laundering link

CarTrade and CarDekho will not be merging after acquisition talks fell apart link

Southeast Asia

A notable win for Alibaba: AI Singapore, a national programme to accelerate adoption of AI in Singapore, picked Qwen as the base for its newest LLM link

Singapore ordered Apple and Google to block or filter messaging account names that resemble government agencies as part of a broader push to curb impersonation scams link

Thai crypto exchange Bitkub is considering a Hong Kong IPO that could raise about $200 million, shifting from an earlier plan to list in Thailand after a bruising year for local offerings. The deal could launch as soon as next year. link

Temasek is in advanced talks to buy about 5% of Singapore-based Quest Global in a pre-IPO deal valuing the engineering services firm at about $4.6B, according to sources—the company plans to redomicile and list in India link

Malaysia plans to ban social media accounts for children under 16 starting next year to protect them from online harm link

Superbank, the digital lender owned by Indonesia’s Emtek Group, plans to raise $186M in a Jakarta IPO link

Johor, Malaysia’s emerging data-center hub, is tightening project approvals to ease pressure on local water supplies. The state will stop approving new Tier 1 and Tier 2 data centers, which can use up to 50 million liters of water a day. link

Myanmar’s junta staged televised demolitions of scam-center buildings, but the networks behind them have already relocated link

Thailand’s data regulator barred Sam Altman’s Tools for Humanity from collecting iris scans—it ordered the company to delete the 1.2M scans it has already gathered link

Sea is revising its Latin America strategy: after exiting Chile and Colombia in October, it plans to re-enter Argentina—the firm’s Brazilian business is reportedly strong and rapidly growing link

South Korea

SK Hynix is in early talks to team up with an Indian partner for a memory chip assembly and testing unit, potentially making it the second major chipmaker after Micron to set up such operations in the country link

Do Kwon requested a US court to cap his prison sentence at 5 years following his guilty plea in a fraud case tied to the $40B collapse of Terra-Luna link

Fresh from hanging out with Nvidia CEO Jensen Huang, Samsung chair Lee Jae-yong hosted Asia’s richest man Mukesh Ambani for talks over deepening the relationship between two of the region’s most powerful conglomerates link

Japan

Rapidus will begin building a second Hokkaido plant in fiscal 2027 as part of its push to restore leading-edge chip production in Japan link

Japan will require chipmakers to meet strict cybersecurity standards to qualify for subsidies starting in fiscal 2026 link

Japan reportedly plans to name six areas, including AI, nuclear fusion and biotech, as “national strategic technologies,” giving them priority for research funding and tax incentives link

The country will also tighten crypto exchange oversight with a new reserve mandate, according to media link

SoftBank has seen its share price slide 40% from peak as markets have panicked about the future of AI, and it is a major OpenAI backer link

Beer giant Asahi says a ransomware attack on its business may have exposed data of 1.5M people link

Micron plans to invest $9.6B in a new plant in western Japan to reduce its reliance on Taiwan link

Hong Kong

JD.com supply-chain tech unit, Jingdong Industrials, is gauging investor interest for a long-delayed Hong Kong IPO that could raise about $500M link

UBTech Robotics, one of China’s top makers of humanoid robots, plans to raise $400M through a share placement in Hong Kong link

Taiwan

TSMC sued former senior vice president Wei-Jen Lo, who recently joined Intel, in Taiwan’s Intellectual Property and Commercial Court link

Intel denied TSMC allegations that the executive leaked trade secrets link