India scores a hattrick of own goals with three cyber policy fails

Cybersecurity is a critical topic, but India has shown the world how not to do it

Welcome back—the Indian government was in the spotlight for almost the entirety of last week as three efforts to reduce cybersecurity risk and crime resulted in major backlashes.

The debacle began when the nation’s telecom department ordered messaging apps such as WhatsApp and Telegram to enforce SIM binding within 90 days. While this is an attempt to improve security and reduce fraud, the potential impact could be significant for users and will cause massive inconveniences.

That wasn’t all.

The government also quietly ordered smartphone makers including Apple to pre-load a state-run cybersecurity app on all new devices, Reuters reported, and it was impossible to remove.

The goal was, again, ostensibly to curb cybercrime and increase security but the news drew a similarly critical response with free speech advocates and almost everyone else pointing out that a non-removable app run by the state would effectively become a government tracking app. Comparisons to a similar scheme in Russia were apt.

Apple rejected the demands, as you’d expect, and it wasn’t long before the order was dropped following the backlash. Just over one day later. The app is now not mandatory, which effectively ends the initiative.

Finally, because this type of news comes in threes it seems, Reuters broke another story that provoked a fierce reaction.

“India’s government is reviewing a telecom industry proposal to force smartphone firms to enable satellite location tracking that is always activated for better surveillance, a move opposed by Apple, Google and Samsung due to privacy concerns, according to documents, emails and five sources,” it wrote.

The key driver for these policies and others like them is the reaction to the growing trend of cyber scams, a number of which are covered in this timely Bloomberg feature story.

It seems unlikely that these policies were introduced with the malicious intent that many critics have held up. Yes, they were poorly thought-out, with clumsy implications and poor communication. The express goal was not surveillance.

Clearly the government has much work to do to find effective solutions to a very serious problem. Engaging with key companies and other stakeholders for answers is always better than kneejerk reactions. But this is politics. And unfortunately, when mixed with technology the results are rarely smooth.

Have a great week—let’s hope for no further privacy scandals anywhere in the world.

Best,

Jon

Follow the Asia Tech Review LinkedIn page for updates on posts published here and interesting things that come our way. If you’re a news junkie, the ATR Telegram news feed has you covered with news as-it-happens or join the community chat here.

Airwallex under fire for alleged China data access

Airwallex came under fire from veteran Silicon Valley investor Keith Rabois who accused the $8 billion-valued company of becoming a “Chinese backdoor into sensitive American data like from AI labs and defense contractors.”

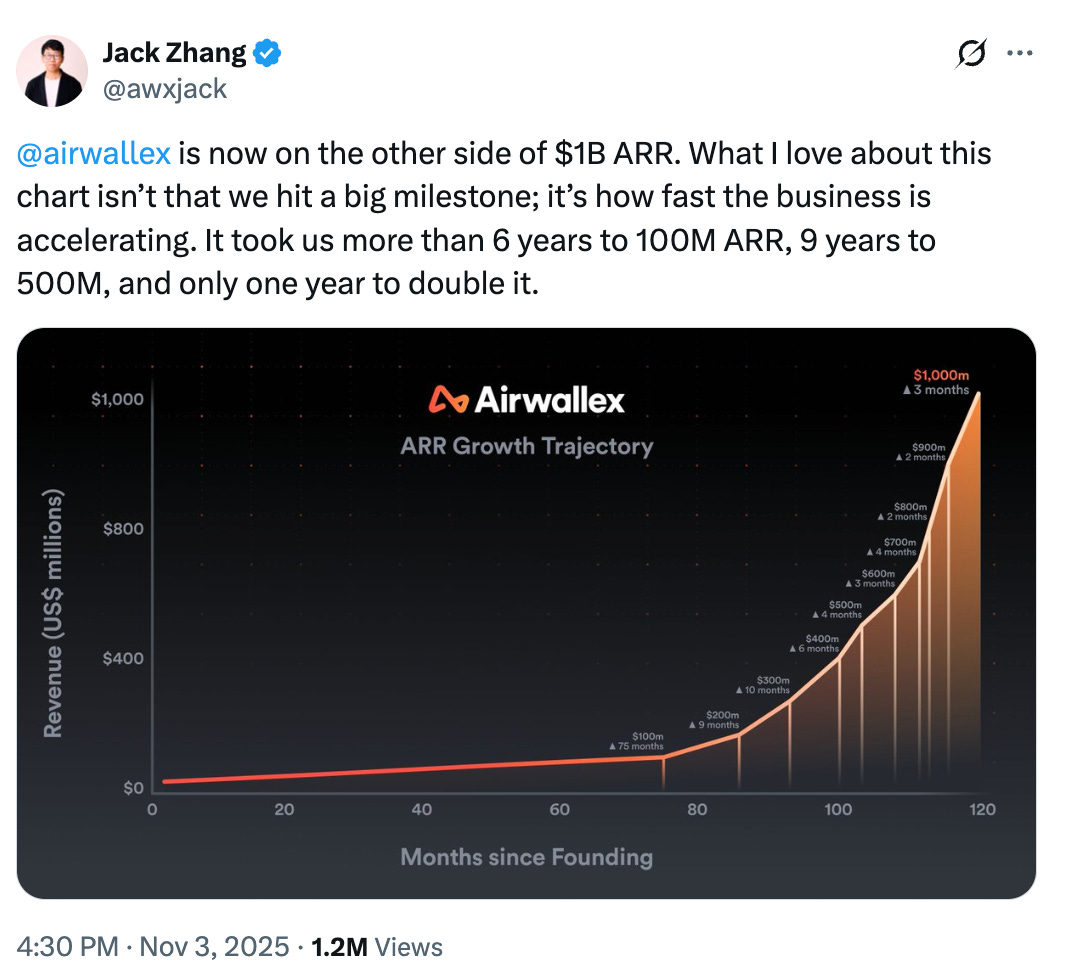

Rabois fired off at Airwallex CEO Jack Zhang after he shared a growth chart that showed the Australia-headquartered startup crossing $1 billion in annual recurring revenue.

“It took us more than 6 years to 100M ARR, 9 years to 500M, and only one year to double it,” Zhang wrote on Twitter.

“Have you disclosed to US customers that you’re quietly sending their customers’ data to China?” replied Rabois.

“Through Airwallex, Beijing can access: supplier payments for AI labs, payroll data for defense contractors, personal data for employees abroad. Obviously many companies do business in China, and that’s not inherently a bad thing. But your company has become a guaranteed vector for data transfer to the Chinese government, and that’s a different thing entirely,” he added.

Zhang hit back by claiming that customer data is stored in local jurisdictions. Airwallex’s head of product added it gives its customer choices on the location of their data.

“Airwallex will continue to build data centers that isolate customer data into their respective region, going beyond regulatory requirements and customer expectations. Many of our customers are multi-national themselves, so creating customer choice will also be key,” he wrote.

The timing is interesting as media reported on Monday morning that Airwallex raised a new $330 million funding round that values the business at $8 billion and was led by US VC firm Addition with Robinhood Ventures among the other participants. The 10-year-old startup has now taken around $1.5 billion from investors that include DST Global, HongShan, Visa Ventures, Salesforce Ventures and Mastercard, as well as Chinese firms Tencent and Alibaba.

China does have strict rules around the potential access to data, so this looks like a straight up he said/she said. But it is worth remembering the US CLOUD Act, which enables law enforcement to demand access to data held by a US company regardless of where it is located in the world.

Still, these claims could trigger the US government to take a closer look at the company.

Moore Threads, often dubbed China’s Nvidia, lands $1.1 billion in monster chipmaker IPO

It was a big week for China’s domestic tech ecosystem as Moore Threads, a chipmaker often referred to as China’s Nvidia, went public in an IPO on the Shanghai Stock Exchange’s STAR Market that raised $1.13 billion.

Demand was strong. The retail portion of the raise was oversubscribed 2,750 times, while the stock itself soared by more than 400% on the opening day to reach a $40 billion market cap.

That vaulted Moore Threads to the fourth highest valued company on the STAR, minted at least four billionaires in the process:

CEO Zhang Jianzhong: $4.3 billion

Vice president Zhang Yubo: $1.7 billion

Director Zhou Yuan: $1.4 billion

Vice president Wang Dong: $1.4 billion

The company’s rapid rise to the public markets is remarkable.

Moore Threads was founded as recently as 2020 by Zhang, who spent 15 years as Nvidia’s China general manager. Now, his company is on a mission to fill the gap vacated by his former employer in China. It plans to use the proceeds of this blockbuster listing to develop next-generation AI and graphics chips as part of China’s push for tech sovereignty.

Perhaps in response to the market validation, Baidu is considering listing its Kunlunxin AI chip unit, which was valued at $3 billion, in Hong Kong.

Another IPO candidate is Zhipu, which is also valued at $3 billion and likely to head a Hong Kong listing, too. The company revealed last week it is on course to double the $42 million it made last year, with revenue from access to AI and software tools now clocking in at a $14 million annual run rate.

It hopes those numbers can lay the groundwork for what would be China’s first AI IPO.

Elsewhere:

DeepSeek released upgraded versions of its experimental AI model which claims parity with OpenAI GPT-5 on key reasoning tests and offers autonomous use of tools like search, calculators and code executors.

Kuaishou unveiled a new AI video-generation model designed to rival Sora and Runway in the global content-creation market.

ByteDance launched an AI voice assistant powered by its Doubao LLM, initially on ZTE’s Nubia M153 phone.

China

The US FTC is investigating whether router maker TP-Link misled consumers by downplaying its China ties after last year’s restructuring link

DJI asked five US national security agencies to conduct a government-mandated security review in a last effort to avoid a sales ban link

China’s central bank has renewed its hard line on cryptocurrencies link

ByteDance is emerging as a powerful cloud-computing player in China, encroaching on Alibaba’s long-held dominance link

TikTok is investing $38B in a massive data center complex in Pecém, Brazil—the site has renewable power, a unified grid and access to major submarine cable routes to Europe and Africa link

The Arizona attorney general sued Temu over data theft claims link

India

Nexus Venture Partners closed a new $700M fund to back early-stage AI, enterprise software, consumer and fintech startups in India and the US link

Activate is a new $75M fund backing early-stage deep-tech startups link

Atomberg Technologies, the Indian consumer electronics company backed by Temasek, Steadview Capital and Jungle Ventures, is weighing a Mumbai IPO that could raise about $200M as soon as next year link

Deepinder Goyal’s wearable company Temple in talks to raise $50M from investors including Steadview, Info Edge and Peak XV link

OpenAI may partner with Tata Consultancy Services to build AI compute infrastructure in India and jointly develop agentic AI tools for enterprises link

SoftBank is offloading most of its InMobi stake for about $250 million, trimming its holding to under 10% from more than 30% as the ad-tech firm rejigs its cap table ahead of a potential IPO link

Flipkart appointed Dan Neary, who previously led Meta across Asia, to its board of directors as it moves towards a planned IPO link

AceVector, parent of Snapdeal, has filed to raise at least $36M in an IPO, although it will also include share sales from existing investors including SoftBank and Nexus Venture Partners link

The perks of being public: Swiggy is preparing to raise up to $1.1B from institutional investors link

Learning platform Yoodli raised $40M led by WestBridge Capital link

Southeast Asia

UltraGreen.ai, a medical imaging company focused on fluorescence-guided surgery, raised $400M in Singapore IPO that was the city-state’s largest non-REIT offering in eight years link

Singapore will ban smartphones and smartwatches in secondary schools from January to promote healthier screen habits link

Temasek and GIC are delivering returns that fall short of many global peers, raising questions about whether the Singaporean funds are losing ground link

Malaysian authorities are deploying drones, handheld sensors and resident tips to hunt illegal Bitcoin miners blamed for widespread power theft link

YouTrip is expanding its multi-currency card business into Australia, its third market behind Singapore and Thailand and first new launch since the pandemic link

Intel will invest an additional $208M to expand its assembly and testing hub in Malaysia link

Foxconn and Luxshare plan to sharply expand gaming device production in Vietnam, according to filings link

Singapore-based DayOne Data Centers is raising over $2B at potentially a $10B valuation for international expansion link

Insuretech startup Bolttech acquired mTek, a digital insurance platform based in Kenya link

Tonik Financial raised $12M led by Diligent Capital Partners. link

South Korea

Coupang, Korea’s largest e-commerce firm, was hit by a major breach that exposed 33.7 million user accounts and may be the country’s largest hack—a former Chinese employee is reportedly suspected of stealing personal data. Police opened a case after Coupang filed a complaint, and the Science and ICT Ministry has set up a joint team to investigate the cause link

Executives at Coupang faced more than seven hours of questioning in parliament over the breach, which is said to have happened in June and affected two-thirds of the population link

South Korean police arrested four people for hacking 120,000 internet-connected security cameras and selling sexually exploitative footage link

Samsung heir Lee Jae-yong is reviving big acquisitions, using its $74B cash pile to regain the company’s technological edge in AI, medical technology and robotics link

AI startup Upstage has hired KB Securities and Mirae Asset to prepare an IPO as early as late 2026 link

Hyundai will begin selling its first mass-produced mobility robot next year, a four-wheeled AI-powered platform called the Mobile Eccentric Droid link

Arm plans to set up chip training facility in South Korea link

US prosecutors pushed for a 12-year prison sentence for Terraform co-founder Do Kwon’s role in the cryptocurrency’s $40B collapse link

Japan

Sony Bank will reportedly launch a US stablecoin for games and anime link

SoftBank founder Masayoshi Son said he would never have sold Nvidia shares if he’d had the cash to keep funding the company’s AI ambitions link

Son is in talks with the Trump administration on a plan to channel large amounts of Japanese funding into Trump-branded industrial parks across the US link

Bottlenecks in data center construction threaten Japan’s AI ambitions link

Defense tech startup Anduril is considering a Japan plant and local manufacturing partnerships to supply the US government link

Mujin, a Tokyo-based automation tech company, raised $233M led by NTT Group and Qatar Investment Authority link

Hong Kong

HashKey Holdings, the operator of Hong Kong’s largest crypto exchange, plans to raise up to $300M from a local IPO, joining rival OSL Group on the public markets link

Klook, a travel-focused technology company based in Hong Kong, plans to list in the US next year and raise up to $500M—it pushed back a 2025 target but wants the cash for acquisition and expansion link

JingDong Industrials, a JD.com unit, is seeking up to $420M in its Hong Kong IPO link

Taiwan

Taiwanese prosecutors charged Tokyo Electron for failing to stop employees from allegedly stealing TSMC trade secrets link

Taiwan will ban China’s Xiaohongshu app for one year on fraud concerns link