TikTok’s US future goes boom

Biden signs bill to ban TikTok—could parent of fast-growing shopping app Temu and drone maker DJI be next?

Welcome back,

TikTok’s US future is the big story of this week after a bill to ban the app was signed by the President. Years in the making, it could take years for any ban to happen but that doesn’t mean that the future of TikTok—ByteDance’s other apps and other Chinese firms—isn’t up in the air.

Elsewhere, there’s a deep look at the incredible growth of Pinduoduo, the parent firm of social commerce app Temu, which could come under the US regulatory radar in the future. And, to complete the US-China circle, there’s colour on the struggle of the efforts of Taiwan’s TSMC to develop a US plan to offset America’s reliance on China’s supply chain.

That’s all for this week—see you in your inbox next Monday,

Best,

Jon

PS: Follow the Asia Tech Review LinkedIn page for updates on posts published here and interesting things that come our way. If you’re a news junkie, the ATR Telegram news feed has you covered with news as-it-happens.

News in focus

Tiktok’s US future goes boom

President Biden signed off on the TikTok ban bill, which begins the 9-12 month countdown for ByteDance to divest its social networking app or face a ban in the US. TikTok’s CEO expects to win a legal challenge, and the reality is that an actual ban isn’t likely to happen for as many as a few years, such is the US legal system.

A bigger ‘win’ for the US would be a sale, and ByteDance was reported to have explored scenarios for a majority sale of the TikTok US business, albeit without the secret source algorithm that serves up recommendations to users. Although the firm has publicly ruled that out.

More sources—and there are many coming out of the woodwork—have claimed TikTok would rather shut its US business down than sell it. The Chinese government has remained quiet and there’s speculation that it, too, would prioritise allowing TikTok US to be banned rather than sold. (Perhaps because (1) a ban could be overturned later and (2) it would be better without the tech in US hands?) A penny for the thoughts of US investors, like SIG, which has a 15% stake worth over $40B and is run by a major Republican donor.

Just to put the cherry on top, President Trump—who tried to ban TikTok back in 2020—has claimed Biden’s proposed ban is designed to enrich Facebook… no further comment needed.

The most interesting questions to ask right now are:

Q: How much would TikTok’s US business be worth?

A: $20B-$100B according to experts who spoke to the Wall Street Journal

Q: Will other countries follow suit and ban TikTok following the US lead?

A: India banned TikTok nearly 4 years ago, so it isn’t unprecedented

One final note, WSJ has a long read on how TikTok lost the lobbying/reputational battle in Washington.

More on this topic next week, and beyond, I am sure.

Pinduoduo’s rebirth

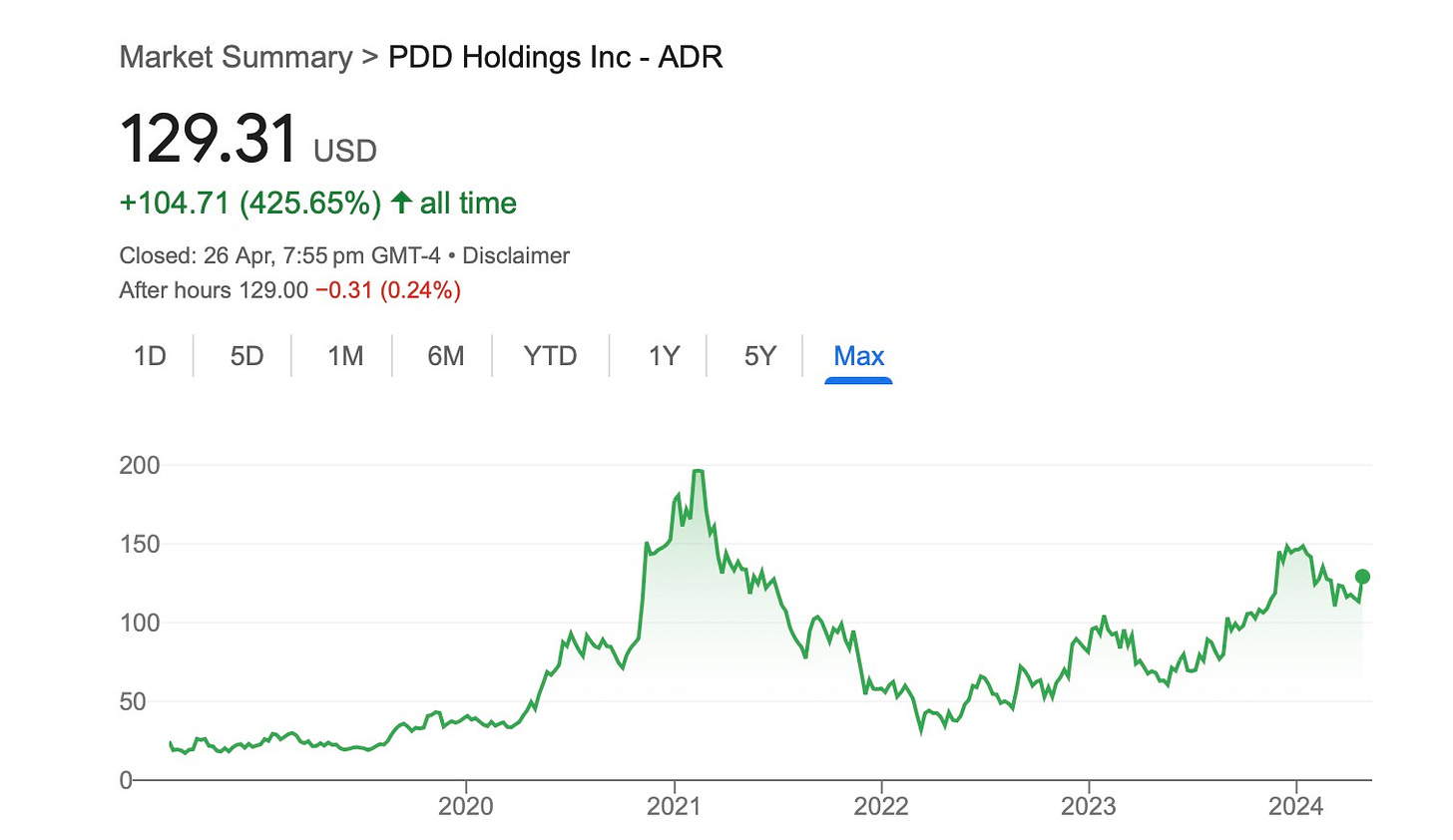

TikTok may be caught in the US political crosshairs but a different US firm, Pinduoduo (PDD)—the parent company of Temu—is very much on the top in the US. The New York Times looks at how the company, which went public in 2018 at $19 per share, has grown from an e-commerce “gimmick” into an innovator with its discount shopping service.

PDD began on the premise of group-buying and targeting the lower-spending and less-coveted customers in rural China. Today, though, it is a social commerce leader that has changed the way online sales work in China as bigger rivals Alibaba and JD are stuck to their middle class focus:.

Around that time, Alibaba opened a chain of supermarkets, selling king crab legs, 30-year-old single malt Scotch whisky and other luxury items. JD started an e-commerce portal called Toplife for premium brands.

“The biggest mistake at the time was this belief that China had become filled with middle-class consumers, and that it would just go up and up into the future,” said Robert Wu, editor of the Baiguan newsletter, which is focused on investment and business in China.

In a 2018 interview, Pinduoduo’s founder, Colin Huang, who is now China’s second-richest person, said it was trying to satisfy not just China’s nouveau riche but also people outside of “Beijing’s fifth ring,” a colloquialism for financially struggling people who live far from China’s main cities.

Still, noise is growing in the US with politicians concerned around labour practices and failure to enforce intellectual property laws. This is one to keep an eye on.

TSMC struggles for answers with US chip factory expansion

Rest Of World looked at TSMC’s struggle to build a chip factory in Phoenix, where it has brought key Taiwanese workers over but struggled to mixing them with US staff, differing cultures and more:

The American engineers complained of rigid, counterproductive hierarchies at the company; Taiwanese TSMC veterans described their American counterparts as lacking the kind of dedication and obedience they believe to be the foundation of their company’s world-leading success.

Some 2,200 employees now work at TSMC’s Arizona plant, with about half of them deployed from Taiwan. While tension at the plant simmers, TSMC has been ramping up its investments, recently securing billions of dollars in grants and loans from the U.S. government. Whether or not the plant succeeds in making cutting-edge chips with the same speed, efficiency, and profitability as facilities in Asia remains to be seen, with many skeptical about a U.S. workforce under TSMC’s army-like command system. “[The company] tried to make Arizona Taiwanese,” G. Dan Hutcheson, a semiconductor industry analyst at the research firm TechInsights, told Rest of World. “And it’s just not going to work.”

Memory giant SK Hynix sees early AI boom

It’s been a busy week for memory giant SK Hynix, the world’s second-largest maker of memory chips which reported big earnings and major investment plans:

It plans to invest $3.86B in DRAM chip production in South Korea link

The firm is also planning to spend $15B to create a new memory chip complex to meet growing demand around AI development link

Already, demand for AI memory chips has seen SK Hynix enjoy its fastest sales growth since 2010—Q1 sales reached $9B as the company recorded its second-highest first-quarter operating profit on record link

China

China has reportedly greenlit a US listing by autonomous driving startup Pony.ai, raising the potential for an increase in Chinese tech IPO in New York after a more than two-year hiatus link

The US is pushing allies in Europe and Asia to tighten restrictions on exports of chip-related technology and tools to China amid rising concerns about Huawei’s development of advanced semiconductors—that includes stopping engineers from servicing chipmaking tools at advanced semiconductor fabs in China link

Huawei is leading a group of Chinese semiconductor companies seeking memory chip breakthroughs that could help China develop home-grown alternatives to Nvidia’s cutting-edge artificial intelligence chips, which can’t be sold to the country link

The Huawei-led consortium, backed by funding from the Chinese government, aims to produce high-bandwidth memory chips—a crucial component in advanced graphic processing units—by 2026, according to sources

Huawei’s latest smartphones carry a version of the advanced made-in-China processor it revealed last year, independent analysis revealed, underscoring the Chinese company’s ability to sustain production of the controversial chip link [It appears, also, that the chip was made by China’s top foundry, SMIC link]

Congress is weighing legislation to ban DJI drones, prompting a lobbying campaign from the company, which dominates the commercial and consumer drone markets link

A look at rising AI startup G42, which is based in Abu Dhabi and recently took investment from Microsoft in a move that saw it effectively chose the US rather than China having found it ‘could no longer play for both teams’ link

Chinese universities and research institutes recently obtained high-end Nvidia AI chips through resellers, despite the US widening a ban last year on the sale of such technology to China link

TikTok Shop is launching a secondhand luxury category in the UK link

Baidu and Zhipu AI’s large language models top Chinese generative AI rankings, but OpenAI, Anthropic remain ahead in overall performance link [Unsurprisingly, Alibaba and Baidu have rushed to add support for Meta’s Llama 3 on their cloud computing platforms link]

Alibaba’s AliExpress unit is said to have invested $72M for a 5% share of female-focused fashion app operator Ably to tap into South Korea’s booming online fashion market link

Keyboard apps for Chinese users have been found to include major vulnerabilities that could allow attackers to exploit the content of keystrokes for surveillance, exposing passwords, chat message content and more link

Huawei announced a new software brand for intelligent driving (Qiankun) as it bids to crack the EV market—the company expects 500,000 cars on the road will be equipped with Huawei self-driving car systems this year, with more than 10 models adopting Qiankun within a year link

AI firm SenseTime suspended trading as shares surged more than 30% following the launch of its updated large language model link

BYD may be leading the push for EVs but its plans also include further and into electric buses, trains, trucks and solar panels link

As domestic growth slows, Meituan plans to launch its food-delivery platform in Saudi Arabia, making its first move outside of greater China having previously launched in Hong Kong link

Elon Musk visits China as Tesla seeks self-driving technology rollout link

Hong Kong

Hong Kong confirmed it will launch Bitcoin ETFs, which come potentially by the end of April—while the launch will draw comparisons with the arrival of Bitcoin ETFs this year, it is likely to be only a small amount of the $56B in assets created over the last three months from US funds link

The Hong Kong IPO of Mobvoi, an AI startup that develops smartwatches, accessories and apps and counts Google among its backers, was deemed a flip by press after shares closed their first day of trading down 3%. Shares went public towards the low end of its pricing range meaning that the listing raised around $41M—that’s some way lower than the original target of $200M-$300M from last year link

Taiwan

Google opened its second hardware engineering hub in Taiwan link

TSMC says its ‘A16’ tech will arrive in 2026, setting up showdown with Intel over who can make the world’s fastest chips link

India

African tech companies are reporting ditching Google workspace services and choosing Indian competitor Zoho for services like email, calendar, storage and more link

WeWork is set to exit its Indian operations by selling its entire 27% stake in the local unit through a secondary transaction link

Office-sharing startup Awfis has received final clearance to proceed with an IPO which could raise $20M link

Glance, which operates a lockscreen platform that serves news and content to Android phones and is backed by Google, is set to launch in the US as it bids to grow beyond 300M active users link

Truck aggregator startup LetsTransport bagged $22M in funding link

Temasek and Fidelity are reportedly in advanced discussions to invest around $200M in Lenskart through a secondary share sale at a valuation of about $5B—that’s just over 10% higher than its previous valuation link

Food delivery firm Swiggy is said to be looking for a valuation of $1.25B for its planned IPO link

Prosus has promoted Ashutosh Sharma to lead its India and Southeast Asia investments, he previously led its venture arm in India link

Southeast Asia

After announcing a major investment in Japan earlier this month, Microsoft CEO Satya Nadella will visit Southeast Asia this week to meet officials in Indonesia, Thailand and Malaysia, with artificial intelligence on the agenda link

Thailand’s SEC says it plans to block unauthorised (read: international) crypto platforms from being used by local customers link

Worldcoin met with Malaysian leaders as the crypto project aims to bolster government ties for its proof of personhood project link

Singapore is pushing its EV charging infrastructure beyond what most countries offer as it prepares to ban the sale of combustion engine vehicle sales from 2030—but EVs remain more expensive, in a market that is already the world’s priciest for cars as public transport is prioritised link

Malaysia is rolling out a 'Golden Pass' scheme to lure unicorns and VC firms with the promise of tax breaks, visa exemptions and more link

South Korea

The SEC is calling for a New York court to impose $5.3B worth of fines on Terraform Labs and its co-founder Do Kwon, citing their roles in the 2022 Terra-Luna collapse link

Crypto.com has postponed its South Korea launch, which looked like a formality following its acquisition of OKBit in 2022, after reports it was visited by local regulators—the Korean market is dominated by local crypto exchanges rather than international ones link

Indeed, one local firm—Upbit—has become a top-five global exchange based on volume thanks to a dominant 80% share in Korea link

Samsung Electronics is also doubling down on memory, albeit for consumer devices, as it began mass production of the world's most advanced, 286-layer NAND flash memory chips with expanded data storage capacity—Google and Apple are said to be among its clients link

South Korea to consult Naver, after report firm faces Japan pressure to divest stake link

Japan

Japan’s Fair Trade Commission says Google used tactics that limited Yahoo Japan’s ability to compete in targeted search ads, and it promised to keep monitoring the US firm link

Japan’s new appetite for risk lures venture investors to Tokyo link