TikTok Shop’s suspension was supposed to help small shop owners in Indonesia—its Tokopedia takeover won’t change a thing

Indonesia’s government was inspired to help small businesses but instead it matchmade a billion-dollar deal

Welcome back,

This week we are digging into the TikTok-Tokopedia deal (TikTokopedia?!). Billion-dollar deals don’t happen every day in Southeast Asia, especially in a ‘winter’ year like 2023, and there’s plenty that hasn’t been scrutinised by the media to date.

Thanks to long-time ATR friend and former journalist Aulia Masna for the heavy-lifting and co-writing this piece with me.

We will be back on Monday with another weekly recap—have a great weekend,

Jon

PS: Follow the Asia Tech Review LinkedIn page for updates on posts published here and interesting things that come our way. If you’re a news junkie, the ATR Telegram news feed has you covered with news as-it-happens.

TikTok Shop’s suspension was supposed to help small shop owners in Indonesia—its Tokopedia takeover won’t change a thing

Indonesia’s government was inspired to help small businesses but instead it matchmade a billion-dollar deal

Months after TikTok was ordered to shut TikTok Shop in Indonesia, we have the answer on how it will come back in the market—which represents a crucial one-third of TikTok’s 325 million Southeast Asian users.

The deal sees Tokopedia, the 14-year-old Indonesian e-commerce veteran, acquire exclusive rights to operate TikTok Shop in Indonesia for $340 million, with TikTok buying 75.01% of Tokopedia through the purchase of new shares for $840 million. Finally, it has allocated a cool $1 billion for Tokopedia’s future capital expenditure under its watch.

This is an e-commerce transaction in the truest sense. It’s a deal that involves a significant discount, cash back, and a gift voucher since the effective $2 billion valuation for Tokopedia is below its stock market value as 40% of the GoTo group, the rest being Gojek.

There was no stock market buzz from the deal. At close of business on Monday, hours after the deal was announced, GoTo’s stock price plummeted from opening above Rp100 to closing at Rp85. Shares jumped as much as 9% on Thursday as GoTo’s CEO spoke to press, but the price remains down 3% this week at the time of writing.

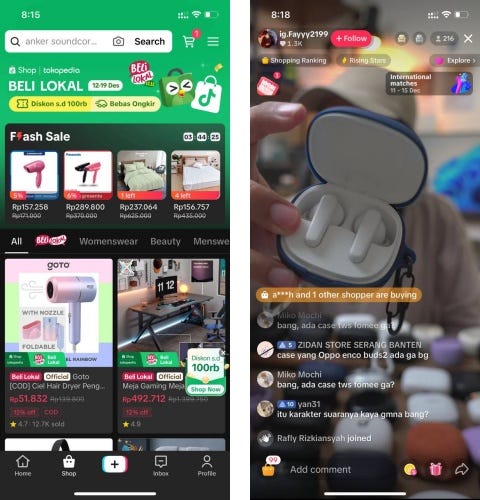

With what is effectively a full operational take over, since GoTo will no longer contribute to Tokopedia, TikTok relaunched the shopping tab on its social media app the next day in full Tokopedia green livery with both companies’s logos adorning the top of the tab. They even got off to a quick start with a week-long promotion focused on Beli Lokal, or Buy Local, which coincided with the 12.12 (12 December) online shopping festival.

The two giants couldn’t have orchestrated it better.

It’s not all roses, however. Despite the deal and plenty of congratulatory exclamations, there is uncertainty around whether TikTok can continue to sell items through its social media app at all. With or without Tokopedia. Plus, the offline shop owners who were supposed to benefit from TikTok Shop’s suspension aren’t likely to see any boost, despite the carefully worded announcement highlighting “support” for MSMEs.

How did this all start?

Back in the middle of this year, a number of offline store owners across Indonesia and particularly Jakarta’s once-bustling Tanah Abang commercial district got together to complain that TikTok Shop’s mainstream popularity was stealing their customers and threatening their livelihood as sellers.

Videos from the Tanah Abang district went viral showing empty store fronts, shop cabinets and fittings covered in drapes, with darkened hallways devoid of customers, despondent looking individuals sitting around, etc. Shop owners in the videos called for government help, blaming TikTok Shop for taking away their customers.

It’s not just the presence of TikTok Shop that they were protesting because online shops and ecommerce giants have been part of the country’s internet revolution for the past decade. They raised concern with the proliferation of cheap imports that come primarily from China, which allegedly are key to TikTok Shop’s ultra-low pricing. They simply couldn’t compete with these cheap, online goods, they argued.

Their pleas reached all the way to President Joko Widodo who then held cabinet meetings to find ways to save these traditional small business owners.

Just weeks prior, a number of celebrities and influencers shared videos of their success selling items through TikTok Shop—earning billions of rupiahs or hundreds of thousands of dollars. Ironically for TikTok, this contrasting visage ultimately helped the case of the traditional shop owners. Instead of creating an influx of sellers setting up shop on TikTok, it backfired as public sentiment sided with the shop owners being seen as victims.

When the government demanded TikTok shut down its shop front, it also released regulations forbidding social media apps from facilitating any ecommerce transactions. The Trade Ministry regulation number 31/2023, published at the end of September was meant for this very purpose in addition to addressing several other e-commerce aspects.

The regulation allows advertisements and promotions for social commerce providers or merchants but no actual payment may be made within a social media app to purchase those goods or services. It also introduces an anti-dumping clause limiting the value of imported products permitted to be sold online to a minimum of $100 per item as a way to appease the protesting business owners.

Just how popular was TikTok Shop? Reuters noted that prior to the shutdown, TikTok Shop generated $6 billion in transactions until September, a figure that Tokopedia took 10 years to reach.

So what will happen next?

Right now, nothing has changed. From a consumer's perspective, they can return to buying things through TikTok.

The difference, however, is that TikTok Shop has been replaced by Tokopedia so the shopping tab is all Tokopedia—that includes any shopping ad and live shopping experience within TikTok’s FYP (For You Page) or Following feeds.

That’s hardly the revolution that small shops called for, but it will remain the case for three to four months as the Trade Ministry and the Cooperative and Small and Medium Businesses Ministry are allowing a trial to see the impact. TikTok and Tokopedia’s arrangement is actually in violation of the Trade Ministry’s September regulation but they are allowing this as a short term experiment.

In a weird way, if the Tokopedia-TikTok integration is a success during this trial period, there could be a strong argument to decouple social commerce altogether as the regulation requires because it specifically forbids the conflation of social media user data and the consumer data for transactions or ecommerce. It could prove to be too tempting for TikTok to avoid.

There’s also a red tape issue to contend with.

The Trade Ministry pointed out that despite acquiring Tokopedia, TikTok does not have a license to operate an ecommerce platform. Director General of Domestic Trade Isy Karim said it must apply for an ecommerce license to meet trade regulations even though it is currently allowed to sell through Tokopedia.

That said, Trade Minister Zulkifli Hasan seems happy to acknowledge that Tokopedia is the ecommerce provider while TikTok is the social media platform. Confused? Join the club.

Indonesia Inc is the real winner

That brings us to the crux of this drama, the government’s involvement.

Indonesia has never been shy to flex its muscles to protect domestic interests. From the standard anti-dumping laws to requiring a significant fee paid for foreign-issued phones to connect to local phone networks, and even fighting the EU at the World Trade Organization, domestic trade interests have always been a sticking point of the Indonesian government. It’s no surprise, then, that all this manoeuvring by the government ends up with an offending foreign entity picking up the tab of over $1 billion.

Even though Tokopedia may be undervalued, it’s undeniable that this deal allows GoTo, which has been struggling to get close to profitability, to offload much of the weight to one of the world’s most-funded corporate giants that’s eager to conquer the global online commerce market. The terms mean GoTo will reap a chunk of the rewards should TikTok’s efforts bear fruit. GoTo CEO Patrick Walujo confirmed it will receive revenue every quarter which will contribute directly to earnings.

“We were going to lose even more market share if we didn’t do anything,” Walujo told Bloomberg. “Once we combine, we have a very high chance to become the number one player in a much bigger market.”

GoTo had struggled as a public company. Combining two homegrown tech winners—Gojek and Tokopedia—was the narrative that helped it go public but, with the share price down more than 75% from its initial listing, a new narrative is needed: and TikTok is the hottest tech company in the world right now.

The result is also far from the panacea that those struggling shop owners in Tanah Abang seek, but the new import restrictions should allow some room to move. You can argue they were pawns in a larger game.

As to their complaints that TikTok Shop caused them to lose customers, nothing in this deal changed how consumers discover and purchase products from within the app. It doesn’t encourage shoppers to visit the trade district. Whichever way it goes after the trial ends, it’s unlikely people will return to the shops. The world has changed beyond anything that even the Indonesian government can force-matchmake.

You just finished reading Asia Tech Review, the weekly newsletter for keeping up with the tech industry across Asia.

If someone sent this to you, you can sign up for free at Asiatechreview.com