Thailand’s top startups forced to look overseas for IPOs

Negative market sentiment may push Line Man, Bitkub and others to Hong Kong

Consumer-facing giants such as Facebook and Google have a natural advantage in public listings because investors understand their products. But in Thailand, Line Man, a delivery app rivaling Grab that’s used by more than 10 million people, is looking overseas for its IPO to escape torrid domestic market conditions.

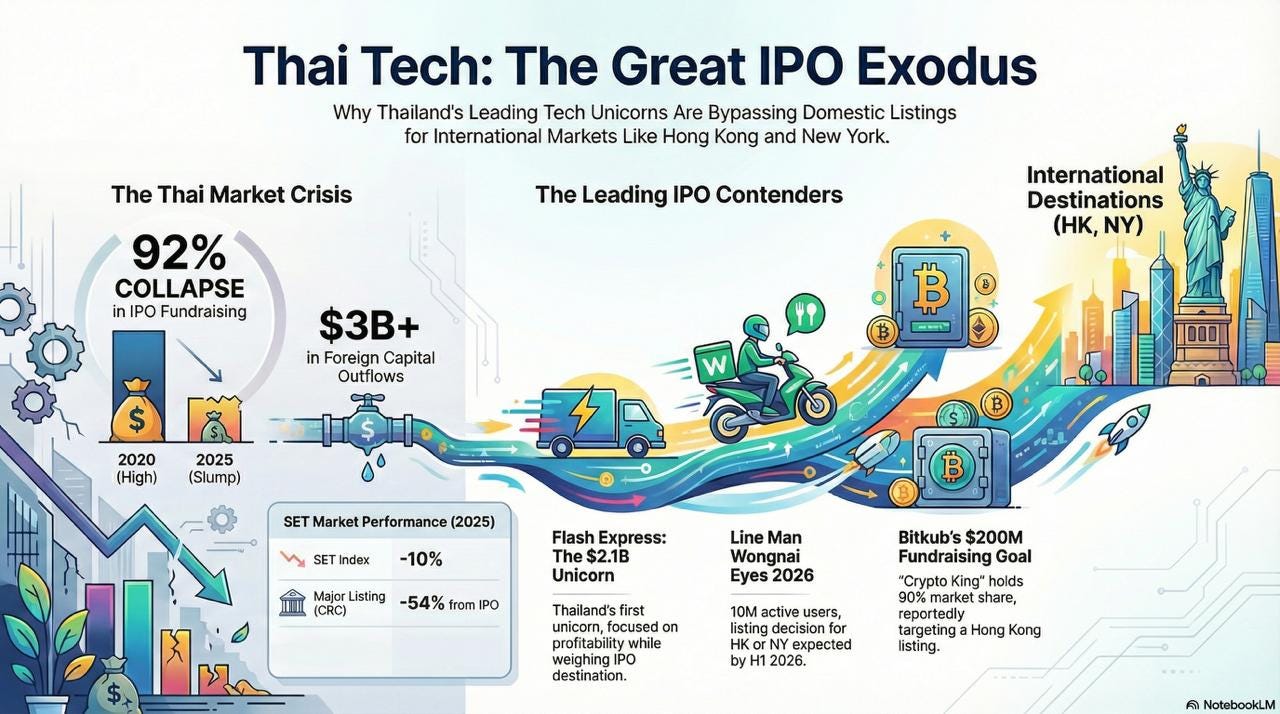

Line Man is considering listing in Hong Kong or New York, according to CEO Yod Chinsupakul. A decision will come during the first half of 2026. The company has made no secret of its desire to go public. Chinsupakul previously targeted 2025 for its IPO, but last year passed by and the company remains a private business.

Line Man, which is valued at over $1 billion with backing from Singapore’s GIC and Line Corp, isn’t alone in exploring foreign destinations for its exit opportunity. Bitkub, Thailand’s top crypto exchange, has been linked with a $200 million Hong Kong IPO and others are assessing alternatives to the Stock Exchange of Thailand (SET).

Bitkub has been spinning its wheels for an exit after a deal to sell a majority stake to Siam Commercial Bank for around $500 million was dissolved in August 2022.

As recently as 2020, SET was Asia’s second top destination for IPOs. It has since regressed. Its overall performance was down 10% last year, with more than $3 billion in foreign capital outflows as political uncertainty weighed heavily.

In 2020, when I was Southeast Asia editor at The Ken, I wrote that Thailand needed a run of tech IPOs to kickstart its flagging startup ecosystem. That didn’t happen. Local market confidence is so low that aspiring public tech companies may need to head overseas to get the cash they need to grow, the exits their investors want and the story that can rejuvenate Thailand’s tech startup story.

A changing of the guard

New York has always been synonymous with IPOs through both the New York Stock Exchange (NYSE) and Nasdaq, but something remarkable happened in January. It was overtaken by Hong Kong.

A flurry of activity led by tech listings helped Hong Kong become the world’s top IPO destination in January, reaping the rewards from policy changes made to encourage emerging companies. There’s a strong appetite for frontier technology, too. Recent floats included AI challengers MiniMax and Zhipu, which raised over $500 million each, and chip companies Montage Technology and Biren, which raised $900 million and $700 million, respectively. .

Public Chinese firms are also issuing shares in Hong Kong to capitalise on investor demand, but there’s not been an influx from outside Greater China yet. Neither Line Man nor Bitkub would raise as much as those four Chinese firms nor are they at the cutting edge, but Hong Kong could exploit a huge opportunity if it can land overseas listings like these.

Things were different for Thailand’s market not long ago.

Central Retail Corporation (CRC), a division of the Central conglomerate, raised nearly $2.5 billion when it went public in February 2020. That level of raise is more typical in the US, and it helped Thailand dominate public listings in Southeast Asia.

Thai companies raised nearly $5 billion in 2020, a figure that placed it behind only China. But the impact of the Covid-19 pandemic and Thailand’s volatile political landscape has seen the numbers dwindle to just $408 million last year.

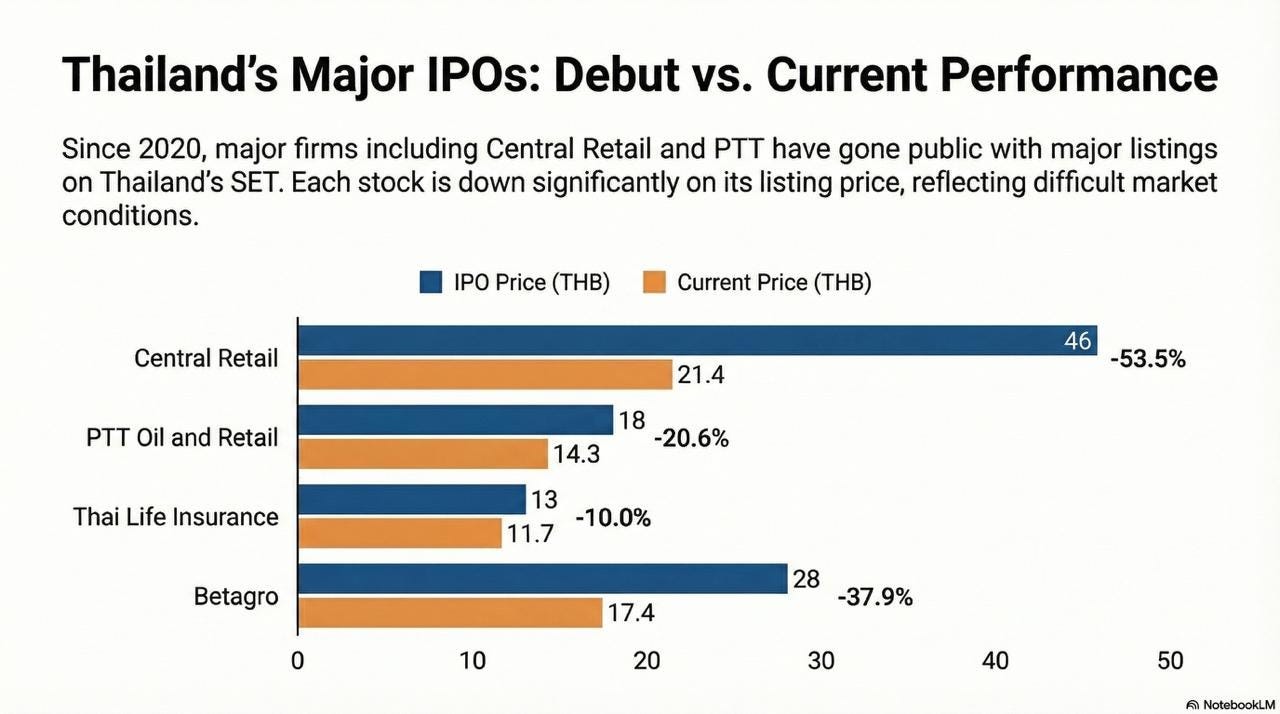

More than that, the major listings that put Thailand on the map have massively underperformed.

The CRC share price is down 54% on its listing price. It isn’t an isolated case. Significant floats from food producer Betagro, oil major PTT and Thai Life Insurance all remain underwater, reflecting the overall struggles of Thailand’s public markets.

SET hit a five-year low in June 2025 after the contents of a phone call between then Prime Minister Paetongtarn Shinawatra and Cambodian leader Hun Sen became public. The narrative made Shinawatra, daughter of former Thai leader Thaksin, look weak and unpatriotic, and she left the role on July 1.

It’s no wonder that tech companies, a rare commodity on SET, are skittish at the prospect of a domestic IPO.

Negative vibes cascading

Southeast Asia’s tech community regularly bemoans a lack of exits in the region. It’s simple. Exits are the lifeblood that makes everything tick. Without them, there is no money. Founders don’t start companies. VCs don’t invest. Employees don’t get hired, and later build companies of their own.

The region is severely lacking tech IPOs, but Thailand’s case is particularly pronounced.

“VCs in Thailand have largely given up on Thai tech exits, and honestly, it’s hard to blame them,” wrote Kris Supavatanakul, who leads strategy at Thailand-fintech startup Finnomena, wrote on LinkedIn.

Supavatanakul would know. Not only does Finnomena have aspirations to go public, but he himself spent four years working as a VC for SCB10X, the tech investment fund run by Siam Commercial Bank (SCB), Thailand’s oldest bank.

“You write checks, you believe in founders, and then you wait for exits that never quite happen. It tests your patience like nothing else,” he added.

He’s right. Few regional funds in Singapore maintain a Thai presence, let alone make consistent investments in the country. Local investors, most of which are owned by corporations or banks, focus more attention on investing to bring knowledge or technology from overseas to the domestic market. The once busy landscape of early stage accelerator programmes has fallen from nearly a dozen to a mere handful.

Causes for optimism

It’s tough to call the bottom in any market, but there are reasons for Thailand to be more optimistic for its public markets in 2026. The country recently held a peaceful election. The result maintains the political status quo, which markets tend to prefer.

Hong Kong and also India have shown reform can bring results. Thailand made changes to ease IPOs last year with the goal of attracting new listings and investors. That will need time to play out, and reforms alone won’t solve the confidence problem. But others in the region are hardly firing on all cylinders.

Singapore’s SGX welcomed AI platform Toku’s $12.65 million IPO in January 2026, but its bigger play is a dual-listing partnership with Nasdaq that could go live by the middle of 2026. That framework will allow companies to list simultaneously on both exchanges, potentially offering Southeast Asia-based companies a backdoor to US capital markets through Singapore.

There’s no reason these companies can’t go public.

Line Man built a strong core through its connection to Line, and it has expanded into payments. Bitkub dominates the Thai crypto market with likely more than 90% share in all trading. Finnomena, meanwhile, has over 300,000 accredited investor accounts and more than $2 billion in assets under advisory.

If Line Man or Bitkub ultimately choose Hong Kong, it would mark more than a single listing decision. It would signal that Thailand’s most valuable startups see their future capital formation offshore.

For a market that once dominated Southeast Asia’s IPO league tables, that would be a sobering shift. The next twelve months may determine whether Thailand rebuilds its tech listing pipeline, or it is quietly exported.