Southeast Asia regresses to pre-unicorn era of VC funding

New report shows Southeast Asia lags other emerging markets as exits continue to be elusive

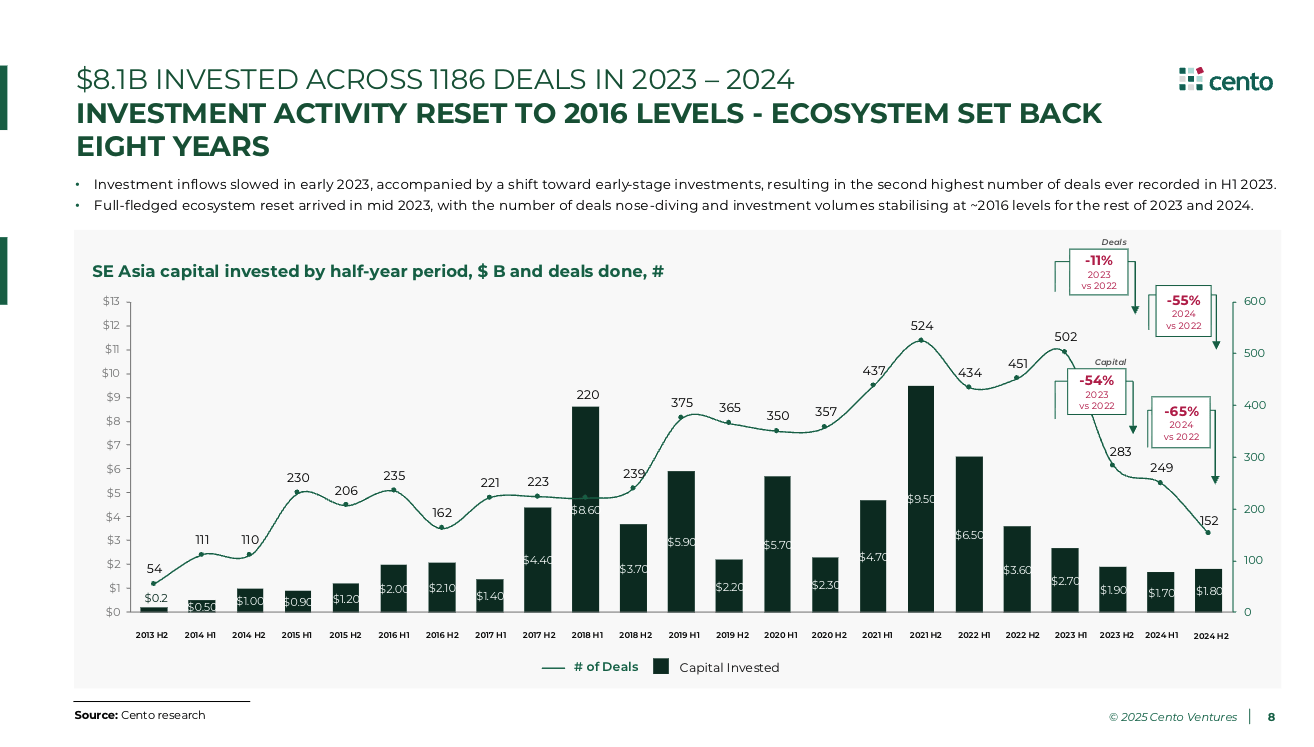

Southeast Asia’s venture capital funding industry has reset to levels of nearly a decade ago, according to a new report from Singapore’s Cento Ventures.

The amount of capital deployed by investors in the region dropped to levels seen in 2016, a time when Grab had just become a billion-dollar valued business and the region had little-to-no other unicorns. Worryingly, that’s for both the amount of dollars spent and the number of deals completed.

We know that the Covid pandemic stimulated a deal-making frenzy, as funds found themselves forced into remote deal-making over Zoom. But there was also a sense that quality startups could exist in every corner of the world. Southeast Asia, in particular, seemed primed with Grab and Gojek anticipating IPOs, Sea’s stock price flying and all manner of business from digital stock trading, to neobanks, quick commerce and more emerging.

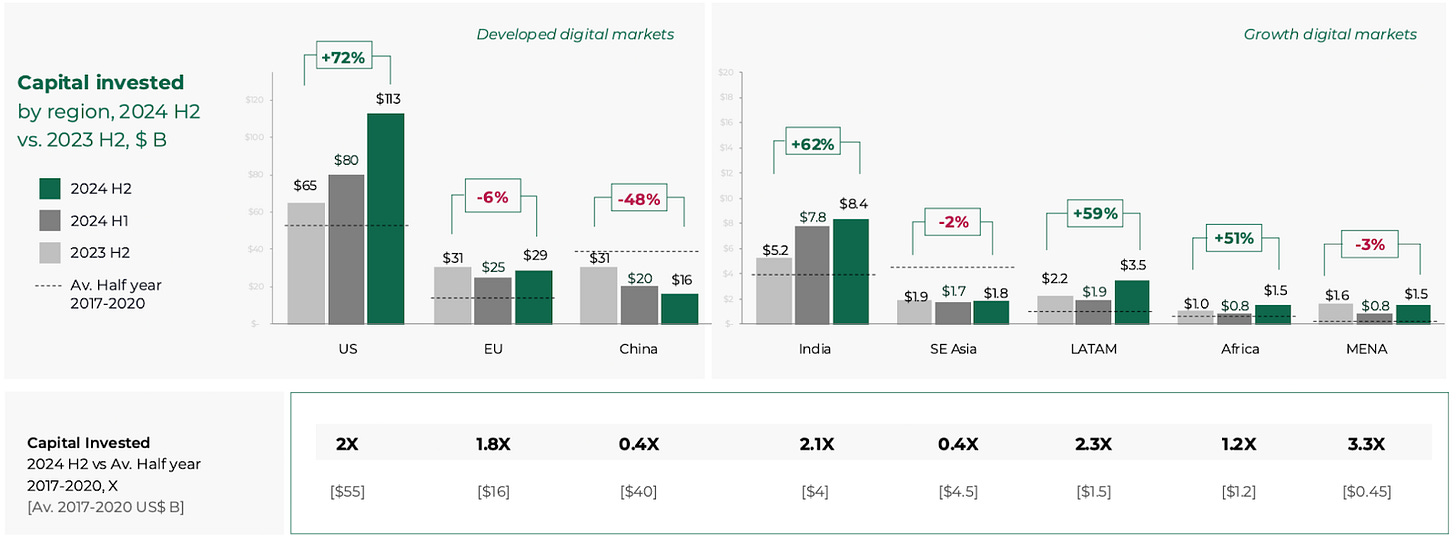

That sentiment fell after the pandemic, but what is concerning is that figures show that other emerging regions have rebounded, but Southeast Asia has not. The region now lags markets like Latin America and the Middle East.

Cento points out that some narratives, such as Vietnam being the next China and the Philippines being a key growth market, haven’t panned out as expected, or were perhaps overhyped.

One silver lining is that fintech, or digital financial services (DFS) as Cento calls it, accounted for nearly three-quarters of all VC money in the second half of last year.

The challenge, as always, is exits.

Cento sees progress in M&A, and particularly smaller deals, but the solution isn’t quite so simple as just more acquisitions.

Grab and Gojek haven’t enjoyed success as public companies—Grab shares are around half of their debut while Gojek is valued at one-quarter of its previous high. This has dented investor confidence in Southeast Asia, but, crucially, the region still lacks a robust pathway to IPO which makes it harder for investors to deliver the exits they need.

The situation feels particularly pronounced given the busyness of Hong Kong’s tech IPO pipeline, and the progress that’s happening in India, where a number of major tech firms are lining up for significant listings.

You can dig into the Cento report for free—and without even needing to give your email address—right here.

Follow the Asia Tech Review LinkedIn page for updates on posts published here and interesting things that come our way. If you’re a news junkie, the ATR Telegram news feed has you covered with news as-it-happens or join the community chat here.

TikTok US: ByteDance to retain significant role and profit-sharing

The deal to secure the future of TikTok in the US is nearing its conclusion and we’ve learned a few unlikely details.

Firstly, the deal will happen at a valuation of just $14 billion. That seems very low, as MG Siegler writes:

But just how small is $14B? ByteDance itself is worth north of $300B – with secondaries currently trading in the $400B range. Yes, there’s more to ByteDance than TikTok, but it’s a huge part of the value. And yes, this is just the US portion of the service being sold, but it’s also undoubtedly the most lucrative part given the importance and usage in the American market.

Secondly, ByteDance is expected to very much remain a part of the business despite a mere 20% ownership stake post-deal. The joint venture will control data, content and the algorithm. It will also receive around half of the profits of the US business, according to reports.

That profit-sharing arrangement could be a key factor in allowing the deal to happen at such a low valuation. A figure of $40 billion had previously been mooted. But the takeaway is that strikingly low figure. As a remainder, Oracle, Silver Lake and Abu Dhabi-based MGX fund will hold 45% of the business, with other investors taking 35% and ByteDance retaining 20%.

President Xi is said to have informally approved the arrangement, but it is still awaiting China’s official sign-off. Beijing has been oddly quiet about the whole transaction so far. Will that change this week?

Alibaba and Jack Ma reemerge as AI pioneers

We’ve written fairly extensively about Alibaba’s resurgence through AI, and last week prompted further reminders of that journey. Alibaba’s rebirth continued as Jack Ma, once forced out of public view for challenging regulators, featured in government content as a figure who is key to the future of AI and domestic chipmaking in China.

It’s quite a comeback for Ma, who was persona non grata after regulators forced the last-minute cancellation of Ant Group’s IPO in October 2020, just before it was about to raise $34.5 billion at a monster $313 billion valuation. Ma had strayed too far, ruffled too many feathers and been too disruptive.

Ant is still to go public, but the once-prominent Alibaba co-founder is finding his way into the public domain again as a figurehead tied to a new-look Alibaba—one that stands for China-made artificial intelligence, and with the desire to build cutting-edge chips and other core technology on Chinese soil.

Indeed, Alibaba’s new Qwen AI models include a multimodal system that processes text, audio, image and video inputs, with results said to rival OpenAI’s GPT-4o and Google’s “Nano Banana” image editor. DeepSeek gets most of the attention, but Alibaba is diligently shipping major updates to Qwen to grow its appeal not only in China but across international audiences, too.

The company’s shares are flying after it increased its budget for AI past $50 billion.

Elsewhere, Ant is also quietly innovating using those foundations.

It has developed an advanced treasury system that helps global businesses move money using a trove of data signals and AI. The inputs range from shipping rates to weather forecasts, and they come together to predict currency needs. That’s paired with a blockchain-based platform to instruct banks on where to send funds.

Bloomberg reports that this technology is handling up to $10 billion for about 20 external clients. Alibaba claims the system can cut companies’ daily cash requirements by as much as 60%.

China

China has launched its own take on America’s “Stargate” $500B plan to dominate AI—Beijing aims to turn agricultural land into a ‘data island’ that services China’s four top telcos and others through a $37B project link

House China committee leaders urged Commerce Secretary Howard Lutnick to probe Chinese electronics maker Anker for unfair pricing and alleged tariff evasion link

China’s cyberspace regulator issued warnings to ByteDance’s news aggregator Jinri Toutiao and Alibaba’s browser unit UCWeb for inadequate content moderation link

TikTok will tighten safeguards to keep children off its platform after a Canadian probe found its protections inadequate link

China’s market regulator is drafting rules to rein in food delivery competition, capping restaurant fees, curbing forced subsidies and tackling ghost kitchens link

China’s push to lure back talent is gaining traction amid its intensifying tech rivalry with the US—a Stanford study found nearly 20,000 Chinese-origin scientists left the US between 2010 and 2021, many returning home, with departures in engineering and computer science surging in 2021 link

Mech-Mind Robotics, which includes Meituan among its backers, is reportedly lining up a Hong Kong IPO that could raise $200M link

China’s central bank has set up a digital yuan operations center in Shanghai to develop cross-border payment systems, blockchain infrastructure, and digital asset platforms link

Autonomous driving startup Momenta is looking to raise several hundred million dollars at a valuation of more than $5B link

India

In a long awaited move. PhonePe—which was spun out of Flipkart—filed for a domestic IPO that could raise $1.5B at a $15B valuation link

Up next could be Flipkart, which is close to securing approvals to shift its headquarters from Singapore to India by late this year, a necessary move as it prepares for an IPO link

Walmart-backed Flipkart is also investing $30M in its fintech arm Supermoney to expand into lending and stock broking link

Smaller players are chipping away at India’s UPI market: Bhim, Navi, and Supermoney grew transactions 50–100% in the past six months—Google Pay and PhonePe’s combined share fell to 80% in August from 85% a year earlier but remains well above the 30% cap due by end-2026 link

Ride-hailing startup Rapido doubled its valuation to $2.3B after Swiggy sold its 12% stake for $270M—Prosus bought about 10% with WestBridge Capital picking up the rest link

Blinkit, owned by Zomato, reportedly now holds over 50% of India’s 10-minute delivery market, up from 40% a year ago, according to BofA Securities—Zepto, Swiggy Instamart, BigBasket, Flipkart Minutes and Amazon Now make up the rest link

India is reportedly drawing up plans to deploy “bodyguard satellites” to protect its spacecraft from potential attacks, a move that follows a near miss with a neighboring country’s satellite link

Tide, an 8-year-old UK banking fintech which counts half of its 1.6M small business clients in India, raised $120M led by TPG at a valuation of $1.5B link

Rocket.new raised $15M in a seed round led by Salesforce Ventures to expand its AI app-building platform link

Apple is deepening its supply chain in India by not only sourcing iPhone components but also manufacturing the machinery needed to make them link

Tata Group is seeking up to $200M for its online pharmacy 1mg—the raise is part of a broader funding effort for Tata Digital units but potentially at a valuation as low as $750M, below its $1.25B valuation from 2022 link

An Indian court rejected X’s bid to overturn the country’s content removal rules link

Phone and electronics maker Nothing will spin off its budget brand CMF into a standalone subsidiary based in India link

LG Electronics is reportedly planning to launch its $1.3B India IPO after an earlier pause in the process link

An unsecured cloud server in India exposed 273,000 bank transfer documents containing account numbers, transaction details, and contact information link

Southeast Asia

Reuters looks at Thailand’s role as a transit hub in enabling multibillion-dollar fraud that sees victims trapped in Myanmar-Thai border compounds and forced by Chinese gangs to run online scams link

Amazon’s Whole Foods is debuting about 300 private-label products in Singapore link

OpenAI expanded its lower priced ChatGPT Go plan to Indonesia, where it costs around $4.50 per month—it debuted in India last month link

Google followed suit by making its cheaper $5 AI Plus plan available in over 40 countries worldwide, including Indonesia, the Philippines, Vietnam and African countries link

Meta made its Llama intelligence platform available to allies of the United States in Europe and Asia link

South Korea

Naver shares jumped as much as 11% on reports its fintech arm may acquire Dunamu, operator of Korea’s largest crypto exchange Upbit link

South Korea’s “Silicon Valley” (Pangyo Techno Valley in Seongnam) is struggling to live up to its global ambitions link

Analysis of Korea’s ambitious sovereign AI initiative, which pledged $390M to five local companies building large-scale foundational models link

A rally that has added more than $100B in market value to South Korea’s two largest chipmakers is seen continuing, according to analysts who see the AI boom spreading globally link

An explainer in the importance of data infrastructure: a major fire at South Korea’s national data center has halted hundreds of online government services including postal and tax facilities link

Japan

Messaging company Line’s Web3 unit is launching a stablecoin superapp alongside blockchain company Kaia, which will include payments, remittances, and on- and off-ramps on one single interface link

AI unicorn Preferred Networks is emerging as a key player in Japan’s push to build homegrown models, even OpenAI and others are prioritising the Japanese market link

Taiwan

Taiwan curbed chip exports to South Africa for two days over security concerns—the move may be a signal that it may target other “unfriendly” nations, including those aligned with China link

TSMC and chip design software firms are using AI to help their chips use less energy link

Rest of Asia

Bangladesh launched its first satellite in 2018, but that $250M project is running into issues including losing money and underused capacity as it faces new competition from rivals like Starlink link