South Korean companies are making hay in the AI boom

SK Hynix and Samsung posted huge profits but both warned of a global supply crunch

Welcome back,

They say picks and shovels do best in a gold rush. South Korea might be the best equivalent for the current AI boom.

We got a reminder last week when SK Hynix and Samsung both issued their latest earnings reports which featured record results as their memory businesses surged thanks to demand from AI.

SK Hynix had a record quarter with operating profit up 137% to $13.5 billion in Q4. It also posted record annual financial results which included a $29.6 billion profit in 2025.

A large part of that was down to its high bandwidth memory (HBM) business that’s used in AI chips from Nvidia and others. SK Hynix has a dominant 61% share of that market, and its sales more than doubled in 2025.

Samsung Electronics posted record quarterly consolidated revenue of $64.7 billion and an all-time high operating profit of $13.9 billion.

Like SK Hynix, HBM was a strong driver for the overall Samsung business, which runs from consumer electronics, to semiconductors and more. Samsung’s Device Solutions business, which houses its memory business, grew 33% quarter-on-quarter with a record high for quarterly revenue and operating profit.

Both companies are set to release their newest memory chips soon. Samsung will begin production next month, with Nvidia one confirmed customer, while SK Hynix said development of its next-generation product is progressing as planned.

The results were particularly notable for SK Hynix, which beat Samsung in annual profits for the first time. The change in order is symbolic of the overall shift towards AI. That’s not a reflection of any failure from Samsung, but rather that SK Hynix was better placed to capitalise on the trend. Indeed, their joint success saw Korea overtake Germany in stock market value.

But going forward, both companies warned that a global supply crunch will continue to impact memory chips until at least 2027.

More immediately, SK Hynix is doubling down on the AI boom with the launch of a new US business that will explore new opportunities in the industry.

It’s being backed with up to $10 billion in capital with a fairly vague mandate of “delivering optimized AI systems for its customers in the AI datacenter sector.” That could include investments, partnerships and more when the new company is formally announced later this year.

Have a great rest of the week. Check out our new ATR channel on WhatsApp if you prefer to gather your news there.

Best,

Jon

Follow the Asia Tech Review LinkedIn page for updates on posts published here and interesting things that come our way. If you’re a news junkie, the ATR Telegram news feed has you covered with news as-it-happens.

First consumer AI, now AI chip design firms head for Hong Kong IPOs

Hong Kong saw the first AI startup IPOs when Zhipu and MiniMax went public in January, and now it is the turn of AI chip pioneers.

Axera Semiconductor, a 6-year-old fabless chip designer that develops AI inference system-on-chips, is set to raise $379 million through a Hong Kong IPO. The company is backed by Tencent among other investors, and its products are used for on-device computing, smart vehicles and more to help process visual data in real time.

Added to that there’s Montage Technology, which was founded in 2014 and is raising more than $900 million in a similar Hong Kong IPO. The company is further behind the process than Axera, and it designs integrated circuits that speed data movement in servers and data centres.

These listings show the next dimension of AI IPOs coming to Hong Kong. With AI now on the menu for retail investors, there may be an appetite for infrastructure and chip-level plays, too. Given Beijing’s focus on developing China’s own tech self-sufficiency and the growing importance of AI, you can expect plenty more companies to eye this route.

But not every Chinese AI company is opting for private markets.

StepFun, which builds LLM models and includes Geely and Oppo as partners, just raised $717 million in a Series B round. That gives it more firepower than recently listed rivals Zhipu and MiniMax. As OpenAI and others can testify, raising more private capital makes going public harder but it’s reasonable to expect that Zhipu and MiniMax are very much just the start.

A flurry of deals from China has given Hong Kong its busiest start to the year ever.

Grab extends food delivery lead as Southeast Asia market surges

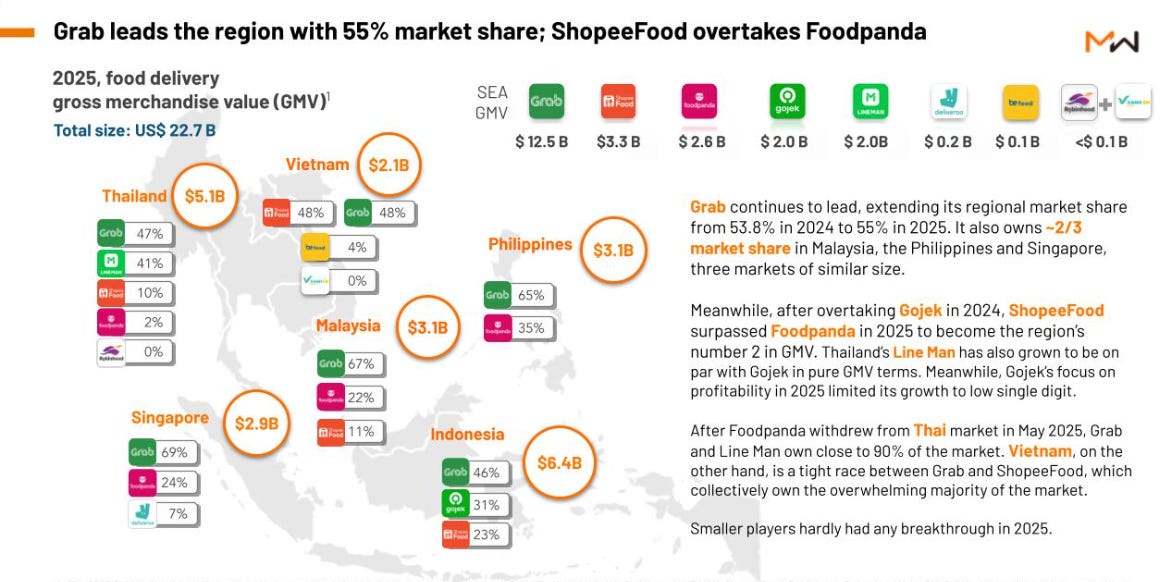

Grab continues to be the food delivery service of choice for Southeast Asia with the Singapore-based company now commanding 55% of the regional market, according to a report from Momentum Works. FoodPanda conceded the most ground, and it could fall further behind after it withdrew from Thailand, which was Southeast Asia’s fastest growing market.

Growth was a key finding from the report, which estimated that total food delivery GMV grew 18% year-on-year to reach $22.7 billion in 2025. That’s the most growth since 2021, a truly standalone year during the pandemic.

Momentum Works also concluded growth is coming from more users, not larger basket sizes and that, relatedly, coupons and vouchers are powerful incentives.

China

Big Tech China has a new showdown area as ByteDance and Alibaba are set to unveil new flagship AI models around the Lunar New Year, spanning text, image and video link

Not to be left out, DeepSeek is expanding its AI lineup with plans to roll out new search features and double down on autonomous agents link

But Alibaba just unveiled Qwen3-Max-Thinking, which it claims includes major gains in factual knowledge, complex reasoning and agent capabilities link

Moonshot AI released Kimi K2.5, a new open-source, natively multimodal model trained on 15 trillion text and visual tokens link

Ant Group open-sourced its first AI models for robotics, as it steps up efforts to build machine intelligence capable of handling complex real-world tasks link

Meanwhile, generative AI is reshaping traditional Chinese medicine in China, with hospitals and labs using the technology for diagnostics, prescriptions and even robot-delivered acupuncture link

China approved ByteDance, Alibaba and Tencent to buy more than 400,000 of Nvidia’s H200 AI chips link

But Nvidia’s CEO claims the Chinese government has not yet approved H200 imports link

Nvidia helped China’s DeepSeek develop AI models that were later used by the Chinese military, the chair of a US House committee alleged link

Three Chinese companies ranked among the world’s top 20 chipmaking equipment makers last year, up from one in 2022 link

DeepWay Technology, a Chinese heavy-duty trucking tech firm, raised $173M in a pre-IPO round ahead of a planned Hong Kong listing link

A Chinese national was sentenced to nearly four years in US federal prison for laundering almost $37M in illicit digital-asset proceeds link

Chinese-language money laundering networks now handle about 20% of all illicit cryptocurrency flows, laundering roughly $16.1B in 2025 alone link

Chip designer Shanghai Iluvatar CoreX Semiconductor unveiled a multi-year graphics processing unit (GPU) architecture roadmap, aiming to surpass Nvidia’s next-generation Rubin platform within two years link

Alibaba delivered more than 100,000 units of its most advanced in-house AI chip, the Zhenwu 810E, with performance said to rival Nvidia’s H20 link

Tencent is planning to expand its cloud business in the Middle East to capitalize on a tech spending boom in the region link

China executed 11 members of the Ming family, a powerful clan behind scam centres in Myanmar, after a Zhejiang court convicted them of crimes including murder, fraud and running illegal gambling operations link

Alibaba’s logistics arm Cainiao is merging its autonomous-driving unit with Chinese robovan firm Zelos Technology in a deal valuing the combined business at about $2B link

A US jury convicted a former Google engineer of stealing AI trade secrets to help launch a Beijing startup, he faces up to 10 years in prison per trade-secret count and up to 15 years per espionage count link

India

NTT Data and NPCI will trial allowing Indian tourists visiting Japan to make payments using UPI link

Indian tech workers are increasingly burning out due to deadline pressure and concern around layoffs, as highlighted by the death of a young engineer at Ola’s Krutrim AI business link

Google is expanding Gemini’s AI-powered learning tools in India with full-length mock exams for the JEE, allowing millions of engineering aspirants to take practice tests inside the app link

Agrani Labs, an AI semiconductor startup founded by former Intel and AMD executives, emerged from stealth with an $8M seed round led by Peak XV Partners link

Winzo is accused of duping real-money gaming players by pitting them against bot-driven, simulated player profiles with manipulated gameplay conditions link

SpotDraft, an India-US legal tech startup, raised $8M from Qualcomm Ventures at a $380M post-money valuation, it raised $56M last year at $190M link

Paytm reported a third straight profitable quarter thanks to rising sales and cost cuts link

Reliance led a $50M round in spacetech startup Digantara at $200M valuation link

Meesho’s quarterly loss widened sharply in its first earnings report since its blockbuster market debut as consolidated net loss widened 13-fold to $53M link

Southeast Asia

Sony Ventures is doubling down on its Soneium blockchain after it invested $13M in Startale Group, its Singapore-based co-developer which has now raised $20M and is also backed by UOB and Samsung link

US memory chipmaker Micron Technology will invest $24B over the next decade to build a new advanced wafer fabrication facility in Singapore, focused on NAND, in response to AI-driven demand for infrastructure link

Notion added Singapore’s sovereign wealth fund GIC as a new investor through a $270M employee tender at an $11B valuation, the company is also opening a Singapore office as parts of its APAC expansion link

Leaked internal chats from a Southeast Asian “pig butchering” scam compound reveal the daily routines, controls and abuse faced by trafficked workers link

Digital Edge, a Singapore-based digital infrastructure firm, plans to invest $4.5 billion to build one of Indonesia’s largest data centre campuses link

Malaysia’s data centre capacity is set to more than double by the end of the year, according to new industry research link

South Korea

Coinone, Korea’s third-largest crypto exchange, reportedly plans to sell a major stakeholding with major overseas exchanges and local financial institutions said to be interested link

AI startup Upstage is buying Kakao’s Daum internet portal in a stock-swap deal in a move that sees Kakao again shed non-core assets link

Japan

SoftBank shelved talks to buy US data centre operator Switch for around $50B, a deal that looked key to Masa Son’s $500B Stargate AI project link

Crypto infrastructure company Talos raised $45M at a $1.5B valuation as Robinhood Markets and Sony Innovation Fund joined existing backers like A16z and Fidelity and took its total raised to $150M link

Memory chip firm Kioxia will receive more than $1 billion under a five-year extension of its joint manufacturing deal with SanDisk link

Solid analysis! SK Hynix beating Samsung in annual profits for the first time really underscores the shift toward AI infrastructure. The warning about supply crunches through 2027 is fasinating because it suggests the bottleneck isn't demand but manufacturing capacity. I've seen simlar dynamics in my work where the picks-and-shovels players end up with morethan the gold miners themselves.