Smartphone slowdown hits industry king Samsung

Asia Tech Review: 1 May 2023

Welcome back,

Happy Labour Day/May 1 for those who are off today. ATR is still busy slaving away today, but this week’s newsletter is a little lighter than usual with just one story in focus.

Enjoy the long weekend (if you have one) and we’ll catch you again next week.

See you,

Jon

Smartphone woes hit Samsung, telecom’s teflon beast

Patent infringement against Apple; exploding smartphones; bribery convictions… Korea’s Samsung is a teflon beast that can rebound after even the most serious dramatic episodes, as we’ve see over the last decade but the tech giant is shaking right now.

A constant theme in recent weeks has been slipping demand for electronics, and in particular smartphones, and we are reminded of that this week as Samsung—the 800-pound gorilla with arms in every part of the smartphone pie—was hit hard by the lacklustre market.

Samsung Electronics (the parent firm) saw its lowest quarterly profit for 14 years. On the face of it, a $480M positive for a three-month period of business is something most businesses would cherish but it’s well below the Korean giant’s lofty standards.

Indeed, its chip division—which is invariably the top performer for its focus on components and materials that are crucial to building smartphones and more—carded a $3.4B loss down from a more than $6B profit one year earlier due to a fall in demand for electronics.

Equally notable, China saw its smartphone shipments in the January-to-March period sink to the lowest levels in a Q1 period for a decade with numbers dropping 11% year-on-year, according to analysts.

China

SMIC-linked chip foundry Semiconductor Manufacturing Electronics Shaoxing is set to raise $1.4B in what will be Asia’s biggest IPO so far this year link

ASML, Europe's most valuable tech firm, is at the heart of the US-China chip war link

Consulting firm Bain is the latest target of China’s corporate crackdown after authorities ‘visited’ its Shanghai office to question employees link

A report has estimated that China’s search engines have more than 66,000 rules controlling content—now you wonder how Beijijng will try to exert control over AI models/services link (Full report: Missing Links: A comparison of search censorship in China)

Tencent is ramping up overseas investment in gaming assets, as it looks to diversify away from China even as Beijing lifts hard restrictions on the industry link

Politico looks at how a little-known piece of Huawei technology that controls power consumption triggered a massive probe into Chinese telecom equipment vendors (in short: the potential for state control of a national telecom network) link

Meanwhile, Republican senators are pressuring President Biden to sanction Huawei Cloud and other Chinese firms over national security concerns link

And Germany is also in talks to limit the export of chemicals to China that are used to manufacture semiconductors—this is part of a broader strategy to cut off materials and services used to produce semiconductors link

The Chinese government passed an expansion of its counterespionage law on Wednesday that would allow suspects to be charged as spies if they target critical infrastructure or government bodies with cyberattacks link

Alibaba is going after opportunities in AI after it announced a co-development programme to allow partners to tap its Alibaba Cloud businesses’ AI capabilities to build services for industrial clients link

Binance is facing mounting pressure as the US intensifies its crackdown on crypto link

Overseas growth helped Didi cut its annual losses in half (-$3.4B) despite China’s cybersecurity fine and the impact of Covid link

Pinduoduo’s refund policies are causing seller lawsuits link

Sequoia Capital has been working with national security advisory firm Beacon as it faces potential US government restrictions on American technology investment in China link

Hong Kong

TinyTap, an education tech startup owned by Animoca Brands, raised $8.5M to build out a programme that will "disrupt education with web3"—Sequoia China, Polygon and Shim Capital were part of the deal that came with a valuation of $100M and, as yet, no plans for a token link

India

Edtech giant Byju’s founder is on India’s financial crime agency radar link

India will use the “full force of the government” to promote the adoption of ONDC, its open e-commerce network—it warned that it may revoke invitations for e-commerce players that don’t sign up quick enough link

Reliance JV struck a content streaming deal with Warner Bros to add more steam to India’s online streaming battle link

Southeast Asia

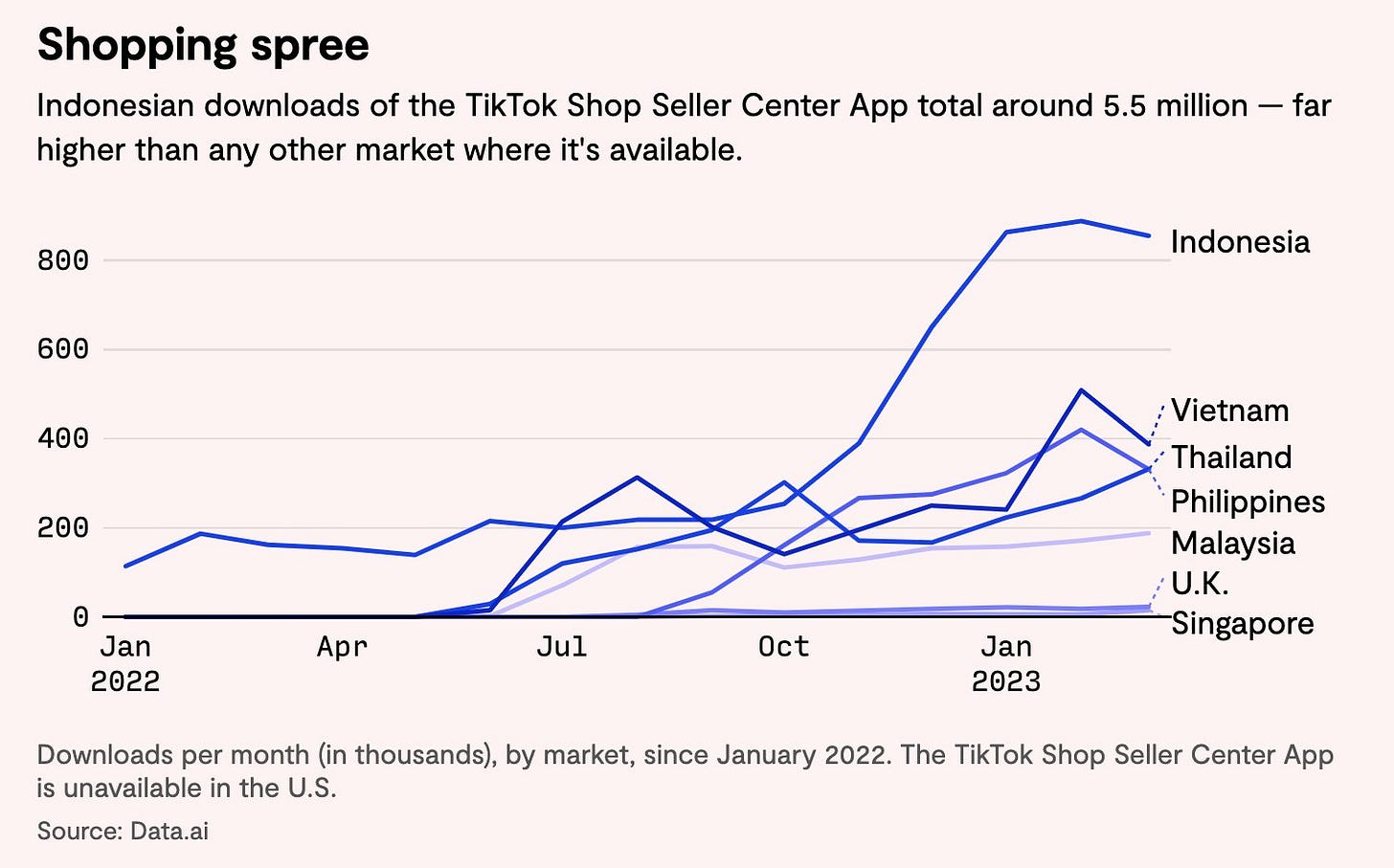

TikTok Shop, the app’s huge plan for e-commerce, is showing promising signs of taking off in Indonesia link

Vietnamese EV automaker VinFast is getting a $2.5B injection of capital from its founder and parent company as it pursues an ambitious plan to woo US consumers and go public in the US link

Singapore’s Mindverse is making customer service agents that are powered by AI link

Zebox, an incubation programme for supply chain startups created shipping conglomerate CMA CGM, launched its Asia hub in Singapore link

Japan

Japan’s banks and government are making moves to support the country’s growing startup ecosystem—including loans, startup-centric staff, and help for IPO planning link

Rapidus, a year-old government-backed chipmaker, is set to net nearly $2B more in aid to strengthen Japan’s domestic chip industry link

More broadly, Japan will provide as much as $1.8B in subsidies for storage battery and chip-related projects as link

Luup, a shared micro mobility startup (aka scooters, see below), raised $30M as Japan prepares to relax its road traffic rules to allow e-scooters to be ridden without a driving licence or helmet at a maximum speed of 20km per hour link

South Korea

Terra co-founder Daniel Shin and nine others have been formally charged by authorities in South Korea link

South Korean dominance of the US EV battery market is under threat from… you guessed it… Chinese rivals after one inked a key deal with Ford link

Fintech Kakao Pay is buying a majority stake in US brokerage firm Siebert—just weeks after it announced a smaller ride-hailing focused acquisition link

Tesla replaced its South Korea chief just as Elon Musk met with the country’s head of state link

Netflix plans to spend $2.5B on original content in South Korea link

SK Hynix saw its operating loss widen in Q1 as the global chip downturn worsened link

North Korea

The US indicted four men who are accused of laundering cryptocurrency and turning it into cash for the North Korean government link

Elsewhere in Asia

London's Sturgeon Capital launched a $35M fund for emerging startups in Central Asia and South Asia (excluding India) link

You just finished reading Asia Tech Review, the weekly newsletter for keeping up with the tech industry across Asia.

If someone sent this to you, you can sign up for free at Asiatechreview.com