Lalamove could become China's newest decacorn and Grab reportedly lines up US IPO

Asia Tech Review: 26 January 2021

Welcome back,

It’s been a busy past week and there's a lot to catch up on. Including:

China will soon have a new decacorn: low-profile logistics on demand service Lalamove; India’s government stepped into WhatsApp’s privacy backlash in India; and, in Southeast Asia, Grab may have been spurned by Gojek—which is tipped to merge with Tokopedia—but now it is said to be preparing for a US-based IPO that could raise over $2 billion.

See you next week,

Jon

China

Lalamove is set to become China’s latest decacorn. The logistics firm is reportedly in talks to raise $1.5B at a valuation of over $10B, according to local Chinese media reports. The raise comes after the company expanded to the US market during the Covid-19 outbreak. Most of its business is in China, but Lalamove has been active in Southeast Asia for many years while it has forayed into India and Latin America, too

Ant Group’s valuation is set to drop to $108B following its botched IPO, according to reports. It had previously been valued as high as $313B before regulator concern ended its proposed China-Hong Kong public listing last year

Speaking of IPOs and valuations, TikTok rival Kuaishou could be valued at $61B when it IPOs in Hong Kong this week. The company is looking to raise around $6B

Tsinghua Unigroup, a Chinese conglomerate that is aiming to break into the semiconductor business, is struggling with some $31B in debt. It is struggling to convince banks to give it financial support and insiders say its business units are not yet mature enough to go public and raise funds

Uisee, an autonomous driving startup founded by veterans of Intel Labs China and other places, raised $150M. Investors include the National Manufacturing Transformation and Upgrade Fund, a $21 billion state-backed fund set up in 2019 to promote and upgrade the manufacturing value chain in China, with the Ministry of Finance as the biggest shareholder

WeChat’s mini-program did $250B in annual transactions in 2020, that’s huge and double its 2019 figure

That goes some way to explaining why Douyin (TikTok in China) has added an e-wallet. Parent ByteDance has long held an ambition to get into fintech. Meanwhile, the firm has suspended its internal project to develop a phone

Huawei has already sold its Honor smartphone brand and now it looks like it could exit the high-end smartphone market altogether. The firm is reportedly in “early-stage talks” to sell its P and Mate phone brands

Tencent Music Entertainment Group snapped up audiobook platform Lazy Audio for $417M

Twitter locked the account of China’s US embassy for a tweet that defended the country’s policy towards Muslim Uighurs in Xinjiang. It’s a start but Twitter isn’t likely to be as proactive finding contentious political tweets outside of the US as it is at home in America

Chinese logistics firm Best, which is backed by Alibaba, is considering a sale as part of a strategic review. Best hasn’t lived up to its name and its shares are down to one-fifth of the price of its 2018 IPO—its market cap is currently under $800M

A look at Gitee, the Github alternative that’s been backed by the Chinese government

A Chinese hacking group is stealing airline passenger details

Chinese robotics still lags the US and Japan

India

WhatsApp’s new policy provoked a major backlash from consumers in India, but the government also stepped in and told Facebook to withdraw the change

That opened a window for Signal and Telegram downloads to spike as people sought alternatives, but it didn’t save one other rival. Hike—backed by Tencent and SoftBank—shut down last week. The company retired what was once its messaging app, with CEO Kavin Bharti Mittel saying: “India will not have its own messenger.”

Tell that to Reliance, the ambitious firm wants to embed its JioMart service into WhatsApp in India to break the e-commerce dominance of Flipkart and Amazon

Those e-commerce giants have their own problems brewing when it emerged that the Indian government may also revise its e-commerce foreign investment rules which could require Amazon and Flipkart to rejig their relationships with major sellers

The $3.4B deal between Reliance Retail and Future Group has won the approval of India’s stock exchanges. Amazon has contested the transaction which will see Future, which runs India’s largest retail chain, sell its retail, wholesale, logistics and warehousing businesses

Amazon is opening an interesting new chapter for its streaming service: an ad-supported tier that will help it compete in the tricky and price-sensitive market

In other policy news, the government is cracking down on more than two dozen China-backed fintech lenders, such as SnapIt Loan, Bubble loan, Go Cash and Flip Cash, after troubling details of their operations and harassment of customers came to light.

The Enforcement Directorate (ED) and Criminal Investigation Departments (CID) of various state police forces have instructed payment enabler companies like Razorpay and Paytm to cease working with the firms.

We at The Ken recently published a story explaining how these instant-loan companies are able to quickly spin up new apps and disburse loans with eye-gouging terms baked in

There’s a spate of major funding stories, kicking off with Zomato raising what looks to be a pre-IPO round of $500M at a valuation of $5.5B—we also recently puts its potential IPO under the microscope

Dunzo raised a $40M Series E from new and existing investors including Google

Ola’s electric vehicle unit plans to raise $300M

Agricultural startup DeHaat raised $30M led by Prosus, formerly known as NaspersTata Group has finalised a $200-250 million investment in BigBasket

Talent investment Antler plans to spend $100M on growing its business in India—I wrote about its presence in Southeast Asia last year

Southeast Asia

Grab may not be getting its merger with Gojek—with Tokopedia instead tipped to tie up a union with Gojek—but now Grab is being inked with a $2B US IPO. As I wrote last month, everyone wants to be like Sea—which was able to raise $2B+ in late 2020 with relative ease thanks to strong public market support

Speaking of Sea, its Shopee service is ramping up operations in Brazil and looking to expand into other markets in Latin America including Mexico, according to Reuters

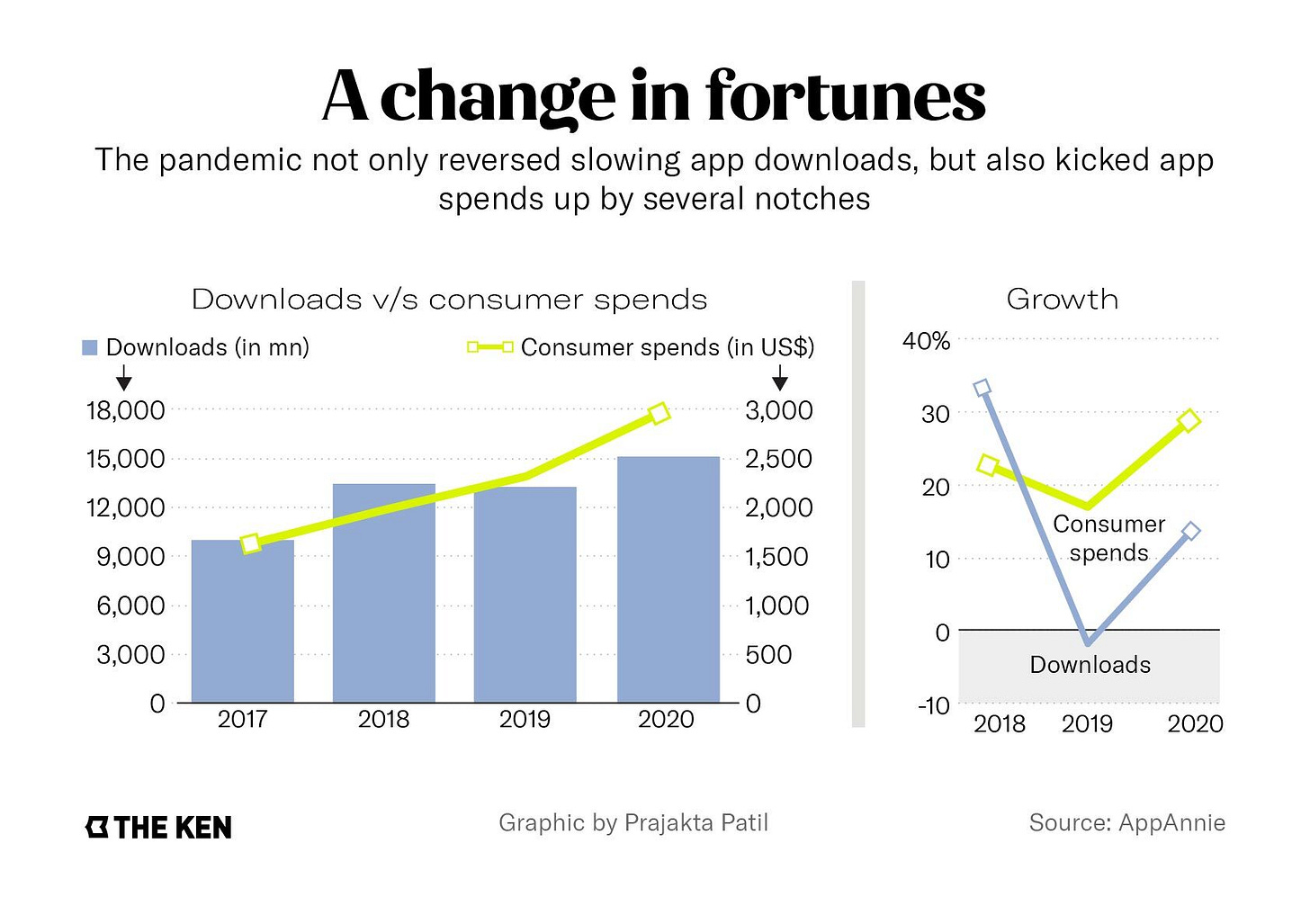

TikTok won Southeast Asia in 2020, that’s according to data we pulled looking at how Southeast Asia’s galaxy of mobile apps performed last year. It’s also worth noting the pandemic boosted app spending after a decline in 2019:

Elsewhere in exits, my colleague Kay wrote about the potential for SPACs in Southeast Asia. Incidentally, Singapore is pushing itself to be the regional hub for SPACs.

$50M Series A deals are apparently now a thing in Southeast Asia after iSTOX closed a massive deal led by two funds owned by the Japanese government and a host of other Japanese investors. iSTOX gives accredited investors access to ‘tokenized’ investment deals, meaning they can buy into assets and income from as little as $75 a pop

In more big money news: Philippines-based Mynt, a fintech business backed by Ant Group, is close to becoming a unicorn after it raised $175M in fresh funding from

Another Ant-backed wallet—TNG Digital—is said to be closing in on $150-$250M in fresh money. The venture is jointly owned by banking giant CIMB, valued at $750M and planning to invest in growing its financial services

Why are Indonesia’s banks being snapped up by tech companies like Sea and Gojek—my colleague Nadine explains

Vietnam continues to suck up manufacturing investment and capitalise of moves to hedge a dependence on China—the Vietnamese government said it has Foxconn approval to develop a $270M to produce laptops and tablets

Indonesia’s latest regulations will ease some rules around startup investing, including lowering the minimum requirements for overseas investors. It’s too early to say what impact that’ll have but the idea is, as ever, to spur the local startup ecosystem

Singapore’s Volopay which helps companies manage their finances raised $2.1M

CapBay, a Malaysia-based fintech start that gives SMEs loans for financing supply chains, raised $20M

Japan

SoftBank’s effort to sell ARM to Nvidia is running into antitrust issues worldwide with national security and monopoly concerns raised in various countries

South Korea

Naver is buying storytelling platform Wattpad for a reported $600M

Samsung is said to be planning to set up a $10B chip plant in Texas

But the company’s heir, and current vice chairman, Jay Y. Lee received a 2.5 year prison sentence for bribery this week. That’s likely to further delay the restructuring of the chaebol’s ownership following the death of Lee’s father last year

Another smartphone maker is on the rocks for different reasons: LG could close its phone business entirely as it reviews the future of the serial loss-making unit

Ebay is considering options for its Korean marketplace

Outside of Asia Tech

Former Bloomberg reporter Eric Newcomer has some big stories to kick off his move to go independent including: The Unauthorized Story of Andreessen Horowitz

You just finished reading Asia Tech Review, the weekly newsletter for keeping up with the tech industry across Asia.

If someone sent this to you, you can sign up for free at Asiatechreview.com