Inside North Korea's silent infiltration of the crypto industry

Plus, Peak XV plays it safe, a leading Korean crypto exchange eyes IPO, and more

Welcome back,

This week, we have a lot on Korea—both Koreas, in fact. There’s insight into how North Korea infiltrated the crypto industry, while in South Korea, we explore the impact of deepfakes on women—a cautionary tale for the rest of the world—and how a crypto giant may follow in Coinbase’s footsteps and go public.

In case you missed it, we also had a story on the takeover of on-demand service Robinhood in Thailand, which is giving Grab even more competition in the region’s fiercest market.

Grab faces fresh competition in Thailand, Southeast Asia's most fiercely contested on-demand market

Be sure to share with friends and subscribe—there’s plenty more original content coming to Asia Tech Review, and you won’t want to miss out!

We’ll see you later this week—have a great Monday,

Jon

Follow the Asia Tech Review LinkedIn page for updates on posts published here and interesting things that come our way. If you’re a news junkie, the ATR Telegram news feed has you covered with news as-it-happens or join the community chat here.

News in Focus

How North Korea infiltrated the crypto industry

I’ve written before about why North Korea is so interested in crypto—plenty of money and weak security—but a new report from CoinDesk sheds light on the trend and provides concrete numbers.

The article pins a number of cryptocurrency startup hacks on North Korean developers who had deceptively joined companies using false names and IDs. In various cases there were red flags, but the attacks were not sophisticated and instead involved social engineering or inside access.

In one case, one founder who Coindesk had been talking to for comment was actually hacked during the reporting of the story, giving them a live example and a clear reminder as to how rife the threat is.

CoinDesk identified more than two dozen companies that employed possible DPRK IT workers by analyzing blockchain payment records to OFAC-sanctioned entities. Twelve companies presented with the records confirmed to CoinDesk that they had previously discovered suspected DPRK IT workers on their payrolls.

Some declined to comment further for fear of legal repercussions, but others agreed to share their stories with the hope that others could learn from their experiences.

In many cases, DPRK employees proved easier to identify after they'd been hired.

Interestingly, a number of firms admitted to hiring employees who were subsequently found to be North Korean but they didn’t last long, either due to red flags being raised or sub-quality work.

The idea that North Korea is some kind of expert at crypto hacking is largely debunked. The takeaway from the article is that a number of North Koreans are knowledgeable of the industry but they rely on its unique factors, like a globally-spread workforce and accepted levels of anonymity, to gain positions that can be abused.

Peak XV cautiously trims fund as valuations soar

Peak XV, the fund formerly known as Sequoia India and Southeast Asia, is reducing the size of the fund it closed in 2022. It raised $2.85B in commitments from its limited partners (LPs), but now it is releasing $465M in obligations, according to Manish Singh at TechCrunch who got access to a letter sent to LPs.

That’s not quite all:

The venture group, which remains the largest in the region, isn’t just scaling back its growth and multi-stage funds, but it’s also trimming how much it charges its backers, lowering its management fees to 2% and the percentage of carried interest it collects on profits to 20%, down from 2.5% and 30% respectively.

The figures move back in Sequoia’s favour if/when it achieves a 3X or more for LPs, but essentially it has made terms more favourable for its investors. That begs the question why?

Manish writes that the change is in line with “a perceived dearth of venture-scale opportunities” in India, as well as rising valuations. News emerged last month that the firm has cashed $1.2B from exits over the last year since it split from Sequoia. Combined with this reduction in fund and more favourable terms for LPs, that would suggest Sequoia sees this as a frothy time that’s more a seller’s market than a buyer’s market, for VCs.

There’s still some $2B in dry powder for Peak XV so it will still be active, albeit perhaps more cautiously than before. The fund had been fairly selective in its deals, with a penchant for bigger cheques at the later stage—we shall see how that changes as it continues to operate independently and with this more prudent outlook.

Will other investors in India and Southeast Asia follow suit?

Korea’s deepfake image crisis runs deep and could happen elsewhere

We wrote in September about issues around deepfake pornography in South Korea, where illicit images were circulating among groups on Telegram and other social spaces. The AP has a deeper look at the situation and how it is impacting the way that women in the country use social media.

Police say they’ve detained 387 people over alleged deepfake crimes this year, more than 80% of them teenagers. Separately, the Education Ministry says about 800 students have informed authorities about intimate deepfake content involving them this year.

That’s just those who have come forward.

Experts believe the situation has developed due to a few connected factors:

The prevalence of deepfake porn in South Korea reflects various factors including heavy use of smartphones; an absence of comprehensive sex and human rights education in schools and inadequate social media regulations for minors as well as a “misogynic culture” and social norms that “sexually objectify women,” according to Hong Nam-hee, a research professor at the Institute for Urban Humanities at the University of Seoul.

Overall, there’s concern that not enough has been done to combat deepfake images. The stories from Korea are bad enough, but what is particularly troubling is that this could happen in plenty of other countries as AI products become more sophisticated and easier to access.

Top Korean crypto exchange may list in the US

Listing a crypto business is a big deal. Trading on the NASDAQ is one element that makes Coinbase the world’s most trusted crypto exchange, although it has also cost the company by forcing it to adopt a more conservative and cautious approach.

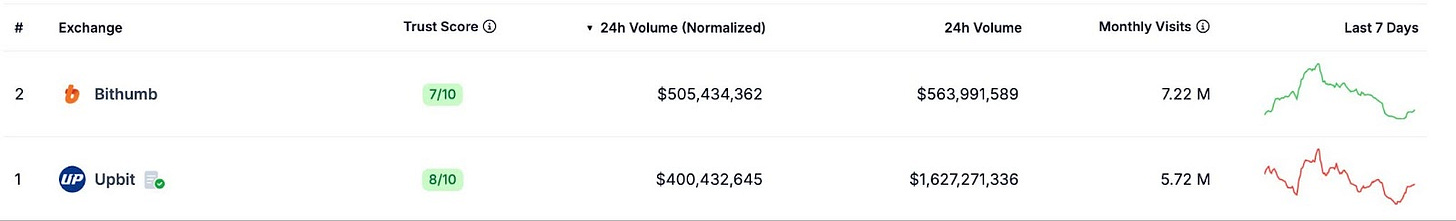

Bithumb, Korea’s largest exchange based on trading volume, is looking to follow in Coinbase’s steps according to a report that claims it is eying a NASDAQ listing.

The firm is said to be looking to go public in the second half of next year. Initially, a local listing in Korea was said to be favoured but new reports suggested that Bithumb is reviewing an opportunity to float in the US via NASDAQ. The Coinbase halo may play a part here, but there’s also some necessity since Korea’s regulators do not recognise cryptocurrency exchanges as legitimate businesses at this moment.

Bithumb and Upbit compete closely in Korea, according to data from Coingecko

That’s despite the crypto industry, and particularly trading, being comparatively mainstream in Korea compared to other markets. Last month, we published a story looking at how the country’s Web3 industry is rising from the ashes of the Terra-Luna collapse two years ago.

If and when Bithumb does list, its financials will be a fascinating look.

China

Beixiazhu, once a thriving center for live-streaming e-commerce, has fallen silent, mirroring the industry's decline, China's economic slowdown, and shifts in the e-commerce landscape link

ByteDance is said to be planning to develop an AI model using chips primarily from China's Huawei, that’s after US restrictions pushed it to seek domestic alternatives link

Huawei’s Meng Wanzhou, the daughter of founder Ren Zhengfei who was formerly detained in Canada for 3 years, has became the latest rotating CEO of the firm ahead of next flagship smartphone launch—she last held the position last year link

Semiconductor startup Numemory has launched the mainland’s largest-capacity memory chip which it claims could challenge the long-standing dominance of international players link

AI firm SenseTime has a new majority owner after Yang Qiumei, an executive at Hong Kong Exchanges & Clearing, inherited a 20% stake worth $1.5B from her late husband, SenseTime co-founder Tang Xiao'ou, who passed away last year aged just 55 link

Shein is reportedly ready to begin a IPO roadshow as it prepares for a listing in London soon link

To press the point home, Shein’s reclusive founder, Sky Xu, travelled to the UK to meet investors—the company’s key goal is to secure regulatory approval in both China and the UK to proceed with the IPO link

Ubisoft could be sold after reports suggested that key shareholder Tencent and the Guillemot family, which co-founded the business, are exploring options which could include a buyout or going private—the share price has halved this year link

A Chinese government-linked cyberattack infiltrated multiple US broadband providers, potentially accessing systems used for court-authorised wiretaps link

A state-funded semiconductor lab in China said it has achieved a milestone in the development of silicon photonics, which could help the country overcome current technical barriers in chip design and achieve self-sufficiency amid US sanctions link

India

Apple plans to open four new retail stores in India and has begun manufacturing iPhone 16 Pro models locally link

Apple may need to turn to China for critical parts after a fire forced Tata Group’s iPhone component plant to halt production—the Tamil Nadu-based facility is the only Indian supplier of iPhone back panels and other parts for Foxconn link

The Financial Times looks at how Byju’s, once India’s highest-valued startup at $22B, has tumbled and is now caught up in legal proceedings in India and the US due to poor corporate governance link

Uber partnered with logistics firm Shadowfax to integrate its two-wheeler fleet into UberMoto’s bike-taxi service link

Swiggy filed for its IPO at the end of last month and now it has started to deliver meals in 10 minutes across parts of major cities, expanding its quick commerce focus link

Google is deploying its AI model, Gemini, to enhance search, visual recognition, and language processing on its services in India link

Southeast Asia

The big spending on cloud continues after Google pledged to invest $1B into data centres and cloud infrastructure in Thailand—Microsoft announced a commitment to Thailand back in May link

Oracle plans to invest over $6.5B to establish its first public cloud region in Malaysia link

Malaysia is set to introduce a national cloud policy and AI regulations to drive ethical AI use—the announcement coincided with Google’s $2B investment in a data center, which is expected to create 26,500 jobs by 2030 link

AI is fuelling an Asia grid investment boom—with analysts believing that energy storage solutions will become increasingly lucrative as renewable capacity continues to grow link

Meta will expand AI innovation investment in Vietnam, including producing its latest virtual reality devices from 2025 link

Philippine President Ferdinand Marcos Jr. has pulled out a classic Southeast Asia after he signed a law imposing a 12% VAT on non-resident digital service providers like Netflix, HBO, and Disney link

‘Pig Butchering’ style scamming operations that originated in Southeast Asia are now proliferating around the world, likely raking in hundreds of millions of dollars—if not billions—in the process link

South Korea

Samsung is cutting up to 10% of jobs in Southeast Asia, Australia, and New Zealand as part of a plan to reduce its global workforce by thousands link

Japan

Saudi Arabia’s sovereign wealth fund is considering increasing its investments in Nintendo and other Japanese gaming firms to boost its entertainment sector and reduce reliance on oil link

Masayoshi Son outlined an ambitious timeline for AI adoption, predicting it will soon manage households, monitor health, make investments, and tutor children link

Japan is set to begin a review of the nation’s cryptocurrency rules, opening up the possibility of lower taxes on digital assets and potentially paving the way for the roll out of domestic funds investing in tokens link

Taiwan

Foxconn beats estimates with record third-quarter revenue on AI demand link

North Korea

Believe it or not, North Koreans are reportedly getting into online and QR-based payments—apparently as many as 6 in 10 link

An anonymous source in North Korea told Daily NK that around 60% of people in Pyongyang use mobile phones for purchases, with 40% doing so in the provinces. Electronic payments, including mobile apps and QR codes, are gaining popularity due to convenience, with home delivery being a key advantage. Some women even joke that it's more reliable than their husbands.

The country’s government hackers have targeted several Southeast Asian countries with a malware campaign over the last year designed to create backdoors into systems at important organisations link

Hey Jon, your newsletter is awesome! I love reading about tech and Asia. You’re a great writer. Keep it up!