Indonesia's record IPO opens the gates for tech listings

Asia Tech Review: 9 August 2021

Welcome back,

The newsletter is back from a fairly lengthy hiatus. But there’s so much happening in Southeast Asia, China and India that I feel pangs of guilt that this newsletter hasn’t run for more than a month.

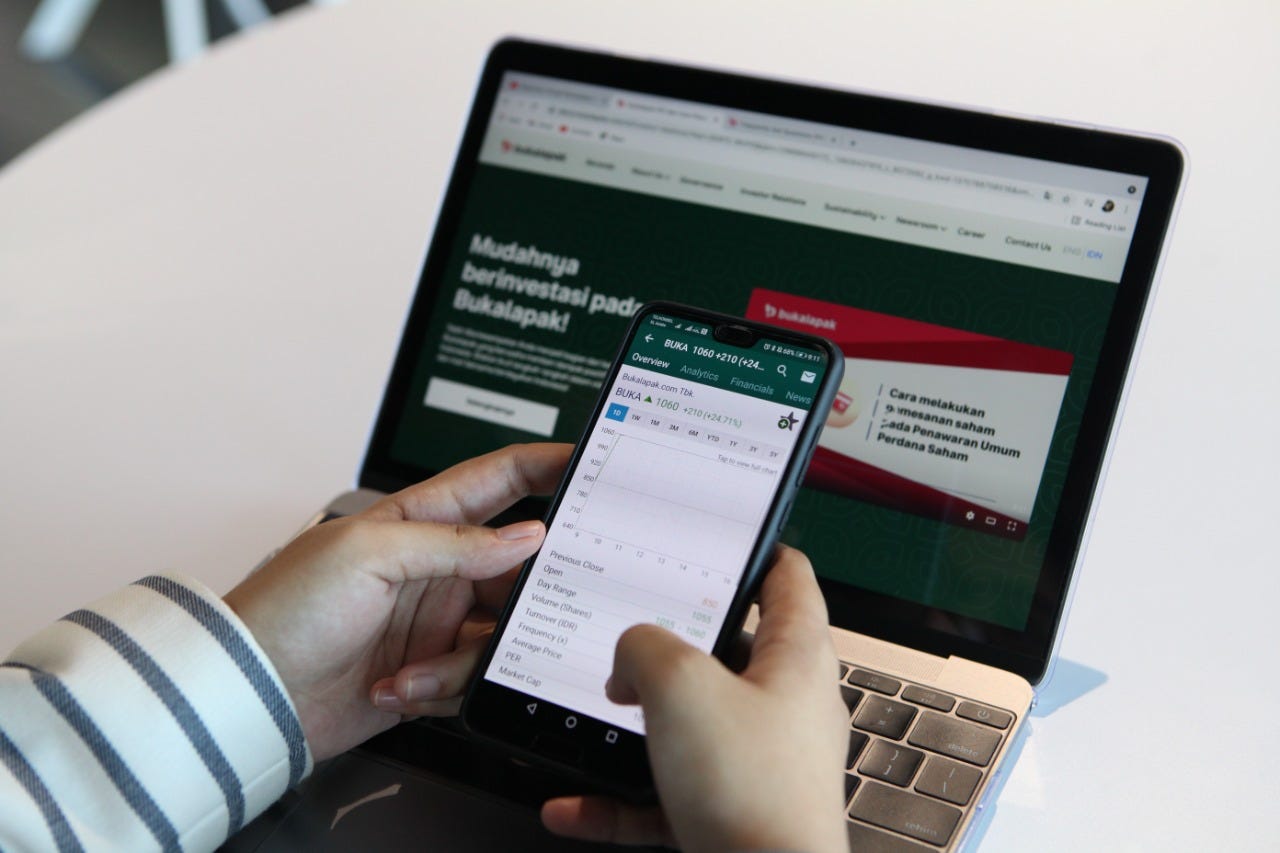

This week’s edition alone has a huge amount going on starting with Bukalapak, which celebrated a record $1.5B Indonesian IPO on Friday. Its stock price immediately hit the maximum price jump ceiling. It’s the first of wave of tech IPOs but Bukalapak has much work to do to grow into the huge valuation/expectations that this listing has set for its business.

That’s all for this edition—see you next time,

Jon

Southeast Asia

A momentous moment in Indonesian history saw Bukalapak go public through an IPO that raised $1.5B—the highest listing that Indonesia has ever seen. Demand was such that the stock rocketed 25%, the maximum price growth ceiling, within just minutes of trading opening. This is the first of wave of public listings likely to include GoTo (Gojek-Tokopedia), Traveloka and others.

The IPO is a huge deal but there are questions over whether the Bukalapak business—which lags leaders like Shopee and Tokopedia but is working on its B2B business—can live up to the hype. My colleague Dita explored this in a story on The Ken today, it’s a free read so you just need an account with The Ken to access it.

A smaller scale but nonetheless important deal saw Kredivo, a buy now, pay later platform, announce its plan to go public in the US via a SPAC deal that will see it valued around $2.5B. Kredivo could raise around $430M which it plans to use for regional expansion. This deal is important not because of the size, we know Grab and co are larger, but because this is an exit path that’s relatable for other startups rather than just the 1%—as I wrote for subscribers of The Ken Southeast Asia last week.

The next Indonesian public market exit could be Traveloka which is reportedly in talks for a SPAC that aims to raise $400M

At least five major telecommunication providers from Southeast Asia have been hacked over the past years by different Chinese cyber-espionage groups, according to a report

Singapore granted its first-ever crypto exchange license

Nikkei Asia looks at how Vietnam has emerged as Southeast Asia’s next fintech battleground

Speaking of Vietnam, on-demand e-commerce platform Loship raised $12M

Matrixport, a Singapore-based spinout of mining giant Bitmain which offers crypto services, raised $100M at a valuation of $1B led by DST Global, C Ventures and K3 Ventures

Sequoia led a $4M investment in Thailand-based accounting software startup FlowAccount in what is the firm’s first investment in a Thai startup, excluding crypto (which tends to be globally focused companies so less of a bet on Thailand)

Eduardo Saverin’s B Capital led a $6M round for Singapore-based Nektar.ai, which helps sales team communication and organise their leads

The outbreak has caused chaos with Southeast Asia’s factories

Singapore wants to be a world leader in e-sports through infrastructure including its first experiential center

China

Alibaba is in crisis mode after a female employee accused her manager of raping her after a night out entertaining clients in July. The employee wrote about the alleged incident on the company’s internal website after she said that she had reported it within the company but no action was taken. Now Alibaba has fired her manager and two senior managers who failed to respond appropriately.

Didi is reportedly in talks with state-owned information security firm Westone to handle its data management and monitoring activities, to placate domestic regulators

Alibaba missed its revenue estimates and warned investors that years of government tax breaks for the internet industry will start to dwindle, adding billions of dollars in costs

Tencent saw its share plummet after a state-backed media outlet criticised online gaming as “opium for the mind”—the article was pulled but it reappeared with less harsh language. Tencent said it would introduce stricter curbs on younger users.

Meanwhile, Meituan is in line to cop a $1B fine from China’s antitrust regular for allegedly abusing its dominant market position to the detriment of merchants and rivals

Now Beijing is suing Tencent alleging that WeChat’s ‘youth mode’ doesn’t protect minors—Tencent said it is looking into the complaint

Signs suggest that the Chinese Communist party is just getting started as it bids to align tech company goals with its own

However, Alibaba and Tencent are looking to get ahead of Beijing’s sweeping internet reforms. China's biggest tech rivals are moving to make their platforms interoperable. It's a calculated gamble that might just pay off.

Online retailer Shein is grabbing attention for fast growth, especially in the US, but Reuters found it lacks required legal disclosures and made false statements about factories:

Shein, the fast-growing Chinese online retailer, has not made public disclosures about working conditions along its supply chain that are required by law in the United Kingdom, and the company until recently falsely stated on its website that conditions in the factories it uses were certified by international labor standards bodies, Reuters has found.

Under fire crypto exchange Binance lost its new US CEO after he resigned following “differences over strategic direction”—he’d been in the role just 3 months

Robotruck startup Inceptio raised $270M from investors that include strategic backers like JD Logistics and Meituan

TikTok rival Kuaishou saw its Hong Kong shares drop 25% in a week after it killed off its US app Zynn—once heralded as a unique rival to TikTok because it paid users—and the six month lock-up for investors came to an end. All told, the stock is down 75% since its IPO.

Coincidently, reports suggest ByteDance is not phased by any such negative market sentiment since it is now aiming for a Hong Kong IPO by early next year

Meanwhile, ByteDance let go of “hundreds” of staff within 3 of its edtech companies following the government’s crackdown on tutoring apps

One blockbuster HK IPO happening with certainty is China Telecom’s planned listing to raise $7.3B—that’s in response to the carrier being delisted from the US in May. China Mobile—the country’s top carrier which was also yanked from US markets—is tipped to follow suit with an even larger IPO.

Those US government bans on Huawei are really beginning to bite after the company saw revenue drop by 47%—its largest ever decrease. That’s a reflection of falling sales:

The sanctions hobbled Huawei's handset business, with Huawei dropping out of the top five vendors in China for the first time in more than seven years in the second quarter, shipping 6.4 million units, according to consultancy Canalys.

That compares with 27.4 million handsets shipped in China in Q2 2020, excluding shipments of Honor budget handsets. Huawei sold the brand in November.

Language learning app Duolingo went public in the US but now its apps are no longer available in China

Taiwan

Foxconn bought a chip plant from Taiwan chipmaker Macronix International for T$2.52B ($90.8M), as it looks to make auto chips amid its foray into the EV market.

India

India’s IPO streak continues with PolicyBazaar which just filed to take its online insurance business public and raise $800M in the process

Unacademy is one of the few edtechs in India not to be gobbled up by Byu’s—now it has raised $344M at a valuation of $3.44B:

Temasek led the Bangalore-based startup’s new financing round — Series H — while Mirae Asset and existing investors including SoftBank Vision Fund 2, General Atlantic, Tiger Global as well as Deepinder Goyal of Zomato and Oyo’s Ritesh Agarwal participated in it, said the startup.

The new round values the six-year-old startup at $3.44 billion, up from $2 billion in November last year. The investment brings Unacademy’s to-date raise to about $860 million.

Here’s a fascinating deal: Brazilian digital bank Nubank, itself valued at $30B, co-led a $45M investment in neobank Jupiter which launches in a month. What is Nubank’s strategy in India and the rest of Asia: we’ll likely find out soon. There’s a lot of chatter about overlap between India/SE Asia and Latam, this is one of the first major links to be forged.

Another less-than-average deal saw Automattic, the company behind Wordpress, invested $30M in email startup Titan—that is its only external funding

Infra.market, which helps construction and real estate companies, became a unicorn in February and now its worth $2.5B thanks to a $125M round led by existing backer Tiger Global

In another Tiger led round, BharatPe is now valued at $2.85B after raising $370M

Zeni, a bookkeeping and accounting startup which uses basic tools to offer financial services, closed a $34M Series B (the twins who founded it previously sold a streaming company)

Amazon scored a win as a court ruled in favour of stalling the sale of Future Group—which Amazon is an investor in—to Reliance Industries, a saga that has rumbled for over a year

India's financial-crime division reportedly asked Flipkart and its founders to explain why they shouldn't face a penalty of $1.35 billion for alleged violating of foreign investment laws,—

Chiratae Ventures closed its fourth fund at $337M, higher than its target of $275M

Yellow.ai raised $78M for its chat platform powered by AI

B2B manufacturing marketplace Fashinza raised $20M from investors including Accel, Elevation Capital and actress Sonam Kapoor Ahuja

Mindtickle, a Saas business that helps companies make sales, is the latest SoftBank investment—it just raised a $100M Series E at a $1.2B valuation

After a two month delay, Twitter said it has appointed three executives as required by Indian IT rules—a chief compliance officer, resident grievance officer, and nodal contact person

South Korea

Kakao Bank, the neobank arm of messaging and entertainment company Kakao, saw its share price rocket some 80% on its first day of trading following a $2.3B IPO

Netmarble acquired Hong Kong social casino game company SpinX Games for $2.19B to diversify its gaming portfolio

You just finished reading Asia Tech Review, the weekly newsletter for keeping up with the tech industry across Asia.

If someone sent this to you, you can sign up for free at Asiatechreview.com

You should also check out The Ken—we’re an independent media outlet that publishes deeply-reported and analytical business stories from India and Southeast Asia