Huawei reacts to US pressure and Grab-Gojek merger is back on the menu

Asia Tech Review: 19 October 2020

Welcome back,

It’s been a hectic past couple of weeks, including the breakdown of my trusty MacBook—I’ll spare you the full details—but ATR is back and there’s plenty to digest this week.

The story I’m keeping my eye on is Grab and Gojek’s much-mooted merger deal which, according to reports, now has the backing of SoftBank’s Masayoshi Son. Curious, it appears that he’d siding with Gojek’s demands. But a deal isn’t straight forward by any means. We rounded up our team at The Ken to explain why it’ll be tough even if both sides can (somehow) find common ground and hash out an agreement. (This one is our free read for the week so do check it out even if you’re not a subscriber.)

Until next time,

Jon

PS: if you haven’t heard of The Ken, you can sample our work as part of our four-year anniversary campaign happening—just click this link

China

The US drew blood from Huawei, which is reportedly in talks to sell chunks of its Honor smartphone brand—which has been successful in generating sales of mid-range devices among young people and other budget-conscious buyers. The reason is likely that blacklisting from the US made it tough to buy components and other pieces for the phones, new ownership could change that.

Image via Kārlis Dambrāns/Flickr

America looks like it’ll try a similar trick for Ant Group with the Trump administration reportedly planning to add Ant to a trade blacklist which could make it harder to work with US companies. (Ant barely has any US business, and an effort to buy MoneyGram fell through in 2018 after the US government canceled the deal.)

Remarkably we can talk about US government intervention without an update on TikTok USA or WeChat. Not sure how long that’ll last though.

But nothing—even domestic regulation going against it—seems to be derailing the Ant IPO. Indeed, it looks like early estimates for Ant’s IPO were too low. The firm is now reportedly shooting for a valuation of “at least” $280B, that’s up from $250B.

Elsewhere in Babaland, Alibaba is spending $3.6B to take majority ownership of grocery retailer Sun Art as it continues its offline commerce strategy

Nasdaq-listed Chinese video platform Bilibili is planning a secondary listing in Hong Kong that could raise up to $1.5B

Two games streaming giants are teaming up after Huya agreed to DouYu—both are backed by Tencent, which is of course a world leader in gaming

China Creation Ventures closed a new $300M fund

Carl Pei, a co-founder of OnePlus, has left to start his own project

How China has businesses doing its censorship work for it—Chinese internet companies have had their own content self-policing divisions for years

China is set to pass a new law that would restrict sensitive exports vital to national security, expanding its toolkit of policy options as competition grows with the U.S. over access to technologies that will drive the modern economy

Taiwan

Foxconn now plans to make electric vehicles

Meanwhile, Foxconn’s great American dream is struggling. The firm was just denied tax subsidies in Wisconsin because it isn’t building what it promised and has failed to hire enough people

India

Lee Fixel is reportedly raising his second $1B fund in a year—he is, of course, the executive who brought Tiger Global (and its billions) to India

Zomato snagged $52M from Kora Investments are part of an ongoing $600M round—it is said to have around $220M confirmed so far

Young startups are now actively avoiding capital from Chinese investors

150 of India’s startups have come together to build their own version of an app store… but it’s harder than it looks and isn’t the ultimate solution

RazorPay is set to become India’s latest $1B startup

Flipkart and Walmart invested $30M into Ninjacart

Uber let thousands of workers worldwide go as part of Covid-19-related cuts, now it is rehiring over 200 positions based out of India

India is working on reform that will make it easier for companies to go public. Apparently now it has decided that it won’t force those who opt to IPO overseas to also list domestically, too.

Tata said before it is going to build a super app—part of that appears to be adding its own payments network... for some reason. Tata is also looking to tie-up with grocery firm BigBasket.

Southeast Asia

SoftBank supremo Masa Son is reportedly pushing Grab and Gojek to agree to a merger deal. Interestingly, Son is said to favour a regional deal versus Grab’s desire to own Gojek Indonesia outright and ignore Gojek’s (small) presence outside of Indonesia. (Despite its efforts to double down in Thailand and Vietnam, where it has rebranded as Gojek.)

There’s lots of coverage of talks between Grab-Gojek, which have been ongoing for close to a year but little is said of the challenge of putting a deal together. We—my colleagues at The Ken and I—wrote in detail about the practical challenges of the merger: splitting Indonesia/SEA, figuring out how to handle financial services and regulators.

On ride-hailing: Singapore’s ComfortDelGro was supposed to be disrupted by Grab, Uber and co but instead it is sitting relatively pretty during Covid-19

Logistics firm Flash Express raised $200M to venture outside of Thailand and across Southeast Asia

AC Ventures—a merger between two VC funds in Indonesia—announced its debut (post-merger) $80M fund

iSeed is a new seed stage fund in Southeast Asia and it is run by former AngeList staff

I wrote about how Singapore-based Mdaq raised investment from Ant, but ended up needing to diversify its business after Ant began to build its own version of its tech and a proposed acquisition agreement fell through

AirAsia is developing a super app strategy to deal with the impact of Covid-19—still hard to see it branching out as successfully as Grab and others, who are still a work in progress when it comes to being financially sustainable. What chance does AirAsia have?

Luxury e-commerce startup Reboonz was one of the first in Southeast Asia to go public via a SPAC, it didn’t work out

The Philippines is registering millions of people with ID cards

Tencent has opened an office in Singapore and it is… at a JustCo co-working space

Malaysian on-demand work platform GoGet raised a $2 million Series A

Thailand’s program to provide financial aid for citizens using cash cards is raising privacy concerns for the data it is generating for the government

Japan

How do you know SPACs have become a mainstream investment phenomenon? SoftBank plans to do one

South Korea

Uber has opted for yet another overseas joint venture after it paired up with SK Telecom in Korea, where it has struggled to make inroads

Good timing, too, since food delivery is booming in Korea

And also...

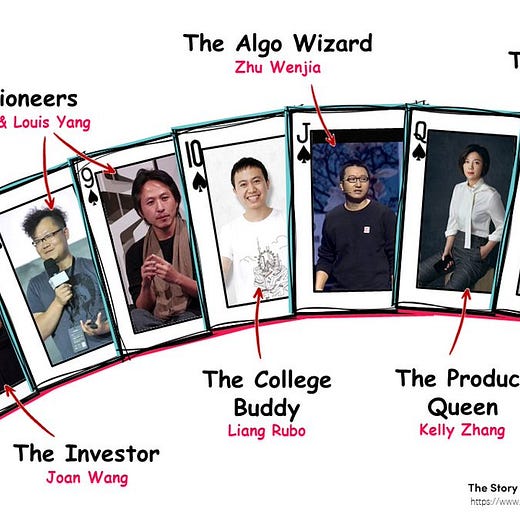

Excited to read this upcoming book on ByteDance from Matthew Brennan, a true China digital expert, and my former colleague Rita Liao:

Auditor EY is taking heat for its role in a string of companies that have been hit with controversy, including WireCard, WeWork and Luckin Coffee

A look at the flipside of China’s digital currency

America launched a program that looks much like China’s Belt and Road strategy—it’ll give loans to developing countries to help wean them away from Chinese telecom and infrastructure gear

And a wild story on Chinese diplomats behaving badly

You just finished reading Asia Tech Review, the weekly newsletter for keeping up with the tech industry across Asia

Did someone send this to you? Sign up for free at Asiatechreview.com

If you read this far you might have enjoyed ATR, why not tell others about it? Click here to tweet