Grab and GoTo are reportedly back in talks to merge

Plus: Paytm's future far from resolved, Alibaba in a tough spot and Chinese Bitcoin miners head to Africa

Welcome back,

Just when you thought it was safe to come out, Grab and Gojek (GoTo) are back in conversations about a merger deal, according to reports. With both companies public, and very much the antithesis of each other, it remains to be seen if a deal can be done. A deal probably needs to be done for the sake of both businesses, but we shall see.

Paytm, meanwhile, is in a tight spot with its wallet app likely to be rendered useless after February if it can’t figure out a solution after its sibling bank was hit by restrictions by the Reserve Bank of India due to persistent non-compliance.

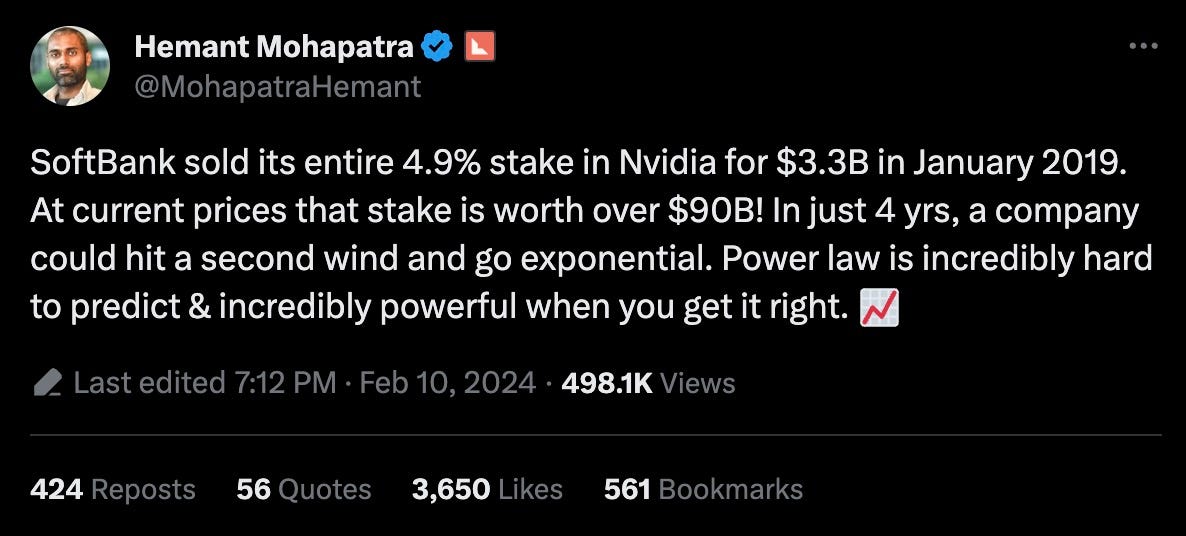

Elsewhere, SoftBank is hatching a plan to get over the tens of billions of dollars it ‘lost’ by selling its Nvidia stock early, Alibaba is going through a tough patch and much much more. And why are Chinese Bitcoin miners heading to Ethiopia?

That’s all for this week—have a great one,

Jon

Follow the Asia Tech Review LinkedIn page for updates on posts published here and interesting things that come our way. If you’re a news junkie, the ATR Telegram news feed has you covered with news as-it-happens.

News in focus

Grab and GoTo reportedly restart merger talks

Is the inevitable about to happen? Bloomberg reported that Grab and GoTo have resumed talks over a merger deal that could help each business—both of which have claimed flaky profitability milestones—become sustainable.

The timing makes sense, with TikTok and GoTo completing their unique merger in Indonesia last week, and both companies continue to struggle to be profitable which has cost them significantly with stagnant share prices.

Ride-hailing executives have long argued that the model can work at scale. Uber, for instance, just announced its first annual profit after a sustained period of working on balancing its numbers and a Southeast Asia merger could accelerate Grab and GoTo’s efforts to do the same. It will, of course, be a complicated conversation to get over the line. Not only is there a rivalry spanning nearly a decade, but the companies are polar opposites—Grab is regional, GoTo is strong is one single-market—and listed in different countries.

Watch this space!

(No such luck for India’s Ola, which just had one investor slash its valuation to below $2B.)

Paytm’s future remains uncertain

The hobbling of Paytm’s bank, as covered in last week’s issue, took everyone by surprise and this week the inquest and analysis has flowed.

One of the big takeaways has been chaos, as Bloomberg wrote—the Reserve Bank (RBI) has given little information as to why it has cracked down. There was no official comment but a source told Bloomberg that “the confidentiality around its orders is to prevent public panic and offer the entity an opportunity to remedy its failures.”

“Persistent non-compliance” is the official reason, and there has been plenty of speculation around possible fraud, loose application of rules and more—Paytm Payments Bank has been hit with charges five times since it began operations in 2017. Interestingly, it emerged Paytm had made plans to remove founder Vijay Shekhar Sharma from the Paytm Payments Bank board and rebranding in response to past regulatory heat—neither happened. (Its e-commerce business has rebranded though.)

Sharma has been pressing the flesh and meeting government and regulatory figures as Paytm’s digital wallet product—which it is best known for—faces an uncertain future after the end of February, when its sibling Paytm Payments Bank is no longer able to handle basic banking services. Notably, Jio Finance has denied reports it is in talks to buy the wallet business.

The saga may spill over into other fintech startups, with concerns around KYC not likely to be limited to Paytm.

Alibaba’s struggles continue

Alibaba had a tumultuous earnings report which saw it miss revenue estimates but it did announce an increase of $25B to its share repurchase program which propped its share price up somewhat.

Cainiao, its logistics arm, has paused its IPO plans due to market conditions as sales figures have not hit expectations, according to co-founder Joe Tsai

Elsewhere, Ant Group saw its profits drop by more than 90% and Alibaba took a $1.2B write-down on video-streaming operation Youku. The firm also disclosed that it had let go of some 20,000 staff in 2023—it ended the year with 219,260 employees.

SoftBank’s mixed bag of swings—with a painful miss

SoftBank may have dodged the Paytm saga after selling most of its 18.5% share in the troubled firm over time, but its Nvidia cashout has caught attention, too.

This goes a long way to explaining why the Japanese telco/investor is refocusing its strategy around Arm, which it sees as having the potential to replicate Nvidia’s incredible run. Arm has already helped it record its first profit for five quarters, with $6B for the three months ending December 2023.

To be fair to SoftBank, not many people saw Nvidia’s tremendous rise coming. It has been a public stock since 1999 and the chart is quite something.

SoftBank’s investments in India are doing alright—up 9% at $14B thanks to full exits from Zomato and Policybazaar during the year along with PhonePe -- which was part of the dividend payout from the Flipkart investment.

China

The Biden administration is considering restrictions on imports of Chinese smart cars and related components that would go beyond tariffs to address growing US concerns about data security. link

The measures would apply to electric vehicles and parts originating from China, no matter where they’re finally assembled, to prevent Chinese makers from moving cars and components into American markets through third countries like Mexico. The measures could also apply to other countries about which the US has data concerns. Tariffs alone, they added, won’t fully address this issue.

VC firms Sequoia Capital China, Qualcomm Ventures, GGV Capital, GSR Ventures and Walden International are facing heat for plugging at estimated $3B into Chinese tech companies that support Beijing's military and its repression of minorities in Xinjiang, according to a US congressional report link

Shein is in a “delicate dance” with Beijing as it seeks tactic approval for a properose US IPO even though it has severed its Chinese roots link

Douyin CEO Kelly Zhang stepped down as head of TikTok’s Chinese version to focus on ByteDance video editor CapCut and AI link

SMIC and Huawei plan to make new, next-generation 5nm processor potentially as early next year, supporting Beijing’s goal for advanced semiconductors and defying US efforts to limit access to advanced technology link

US sanctions are having an impact, however, since SMIC reported a 55% fall in quarterly net profit link

But Huawei did reclaim top spot in China’s smartphone sales ranking, its first time back since company was added to US blacklist in May 2019—nearly 5 years ago link

That momentum might slow though as AI chip demand is reportedly forcing Huawei to lessen its focus on smartphone production link

Despite a global frenzy, investor enthusiasm in China’s AI startups is said to be waning link

In 2023, China recorded around 232 investments in the AI space, a 38% decline year-over-year, according to research firm CBInsight. The total amount raised by China’s AI firms amounted to roughly $2B, 70% less than the year before.

Tencent has taken control of the Chinese gaming studio behind Swords of Legends franchise in its latest diversification move link

Tencent’s gaming division is also reportedly working on a mobile version of hit console game 'Elden Ring' link

Enterprising car sellers in China are selling Chinese EVs overseas markets like Russia, Kazakhstan, and Saudi Arabia as second-hand, despite being brand new, and with significant markup link

Dutch intelligence finds Chinese hackers spying on secret Defence Ministry network link

For years, Western companies complained about Chinese copycats—now, the copycats are coming for Chinese companies link

CISA and the FBI warn of China-linked hackers pre-positioning for ‘destructive cyberattacks against US critical infrastructure’ link

Abu Dhabi AI group G42 has sold its stakes in Chinese companies, including ByteDance, to appease US government concerns about ties to China link

Chinese bitcoin miners are flocking to Ethiopia, attracted by cheap energy and an ideal climate link

India

Byju’s asset sale hangs fire amid investor flare-ups link

Byju’s plan to sell assets, including Great Learning, has stalled amid mounting financial challenges stemming from term loan B (TLB) investor demands and discord with stakeholders, said potential buyers who have been approached. They are waiting in expectation of a lowering of the purchase price.

Unlike Epic — which is also on the block — the sale of Great Learning is being overseen directly by its founder Mohan Lakhamraju, along with the TLB investors. Byju’s is seeking around $600M from sale of the higher education asset but is yet to find a buyer with a binding term sheet.

Xiaomi says that India's scrutiny of Chinese firms unnerves suppliers link

Binance has been in discussions with the Indian government to restore access to its mobile app and website in the country—while it is ready to pay the taxes and the penalties levied, it is not yet ready to comply with the PMLA (Prevention of Money Laundering Act) guidelines, according to sources link

River, an Indian startup manufacturing electric two-wheelers, raised $40M in a funding round led by Yamaha Moto—other investors include Futtaim Automotive, Lowercarbon Capital, Toyota Ventures, Trucks VC and Maniv Mobility; it has raised $68M to date link

The founder of crypto exchange WazirX and the ex-CEO of payment form Zebpay have jointly launched a rupee-denominated futures exchange for crypto traders link

Social commerce firm Meesho is using micro-entrepreneurs to plug gaps in India’s supply chain network link

CRED is acquiring mutual fund startup Kuvera in wealth management push link

Microsoft partners with India's Sarvam AI for voice-based genAI tools link

Indian parliamentary panel red-flags PhonePe and Google Pay cornering 83% of India's UPI payments amid Paytm clampdown link

Attentive.ai, US-Indian startup that uses AI for landscaping and construction services, raised $7M led by Vertex Ventures Southeast Asia and India with participation from Peak XV’s Surge and InfoEdge Ventures link

Southeast Asia

Singapore-based crypto payment app Oobit raised $25M from investors including Tether, the issuer of the world’s largest stablecoin link

TikTok has begun a battleground for Indonesia’s presidential election, tapping its 125M users in the country (Indonesia is TikTok’s second-largest market) and taking over Instagram which was seen as the key platform for the previous election in 2019—notably, millennials and Gen Z voters making up 56.5% of the electorate campaigning is often done on social media link

How Generative AI is transforming Indonesia's election link

Google has begun blocking Singapore-based users from sideloading certain apps that abuse Android permissions in order to reduce financial scams link

South Korea

Samsung chief Lee cleared of charges in 2015 merger case link

Terraform Labs former CFO Han Chang-joon has been extradited to South Korea—Do Kwon is still appealing a decision to extradite him to either the US or Korea link

South Korea has proposed a vetting process for crypto executives to strengthen oversight link

South Korea has arrested Haru Invest executives over allegations of a $826M embezzlement link

Japan

Taiwanese chipmaker TSMC said it will build a second Japanese plant to begin operation by the end of 2027, bringing total investment in its Japan venture to more than $20B with the support of the Tokyo government link

Japan will spend up to $300M on chip research to catch up on semiconductors link

The rest of Asia

UN sanctions monitors are investigating dozens of suspected cyberattacks by North Korea that raked in $3B to develop its nuclear weapons program link

Hong Kong among first to propose crypto reserve requirements for banks aligned with new international standards link