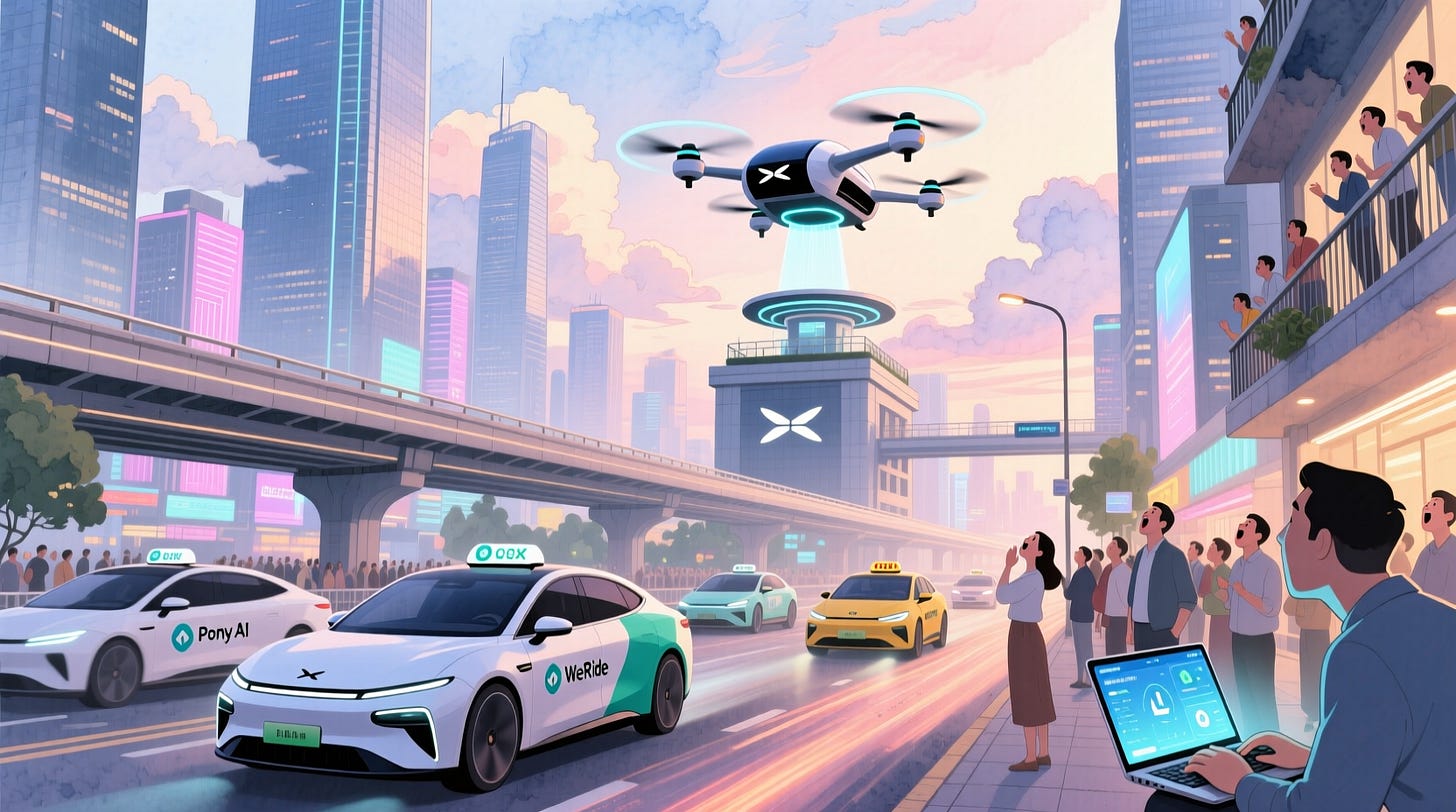

Chinese self-driving firms WeRide and Pony AI raise another $1B

Despite the vast sums, both firms saw their share prices fall

WeRide and Pony.ai had a homecoming last week as the two self-driving tech companies raised over $1 billion from IPOs in Hong Kong, listings which took the exchange beyond NYSE and Nasdaq as this year’s top listing venue.

Both listed on the Nasdaq last year, so these were secondary listings but considerable as they give China/Hong Kong-based retail investors a buying option.

WeRide raised 2.39 billion HKD, $306 million—it raised $440.5 million from its US IPO in October 2024

Pony.ai raised $859 million, having raised $413.4 million from its US IPO in November 2024

Despite raising significant sums of money—that’s more than $1 billion—their share prices fell by as much as 15% after the Hong Kong listings.

The duo has landed significant deals across the world, including partnerships Southeast Asia and elsewhere with Uber, which has backed both businesses. Despite similarities, a common investor and similar IPO timing, the pair are fierce rivals.

Reuters reported that Hong Kong listing “oversupply” coupled with the two companies’ struggles to grow overseas were key reasons for the share price declines.

Hong Kong’s equity capital markets have become the world’s most active this year, with $31.25 billion raised in initial public offerings and secondary listings, LSEG data showed.

The rush of deals means Hong Kong has overtaken the New York Stock Exchange and Nasdaq as the top listing venue this year, excluding special purpose acquisitions companies.

In related news, Baidu said its weekly robotaxi ride volume has reached 250,000, equalling the number for Alphabet’s Waymo. Baidu’s Apollo Go operates robotaxis in Wuhan and parts of Beijing, Shanghai and Shenzhen, while Waymo is present in California and Arizona. More competition is imminent with automaker XPeng ready to jump into robotaxis next year.

Taking things further still, Chinese startup EHang said it plans to bring $30 flying taxi services to major airports within the next three years. It currently operates limited ‘sightseeing’ services in Guangzhou and Hefei. It expects broader deployment soon as Beijing pushes its low-altitude economy initiative.

Have a great week,

Jon

Follow the Asia Tech Review LinkedIn page for updates on posts published here and interesting things that come our way. If you’re a news junkie, the ATR Telegram news feed has you covered with news as-it-happens or join the community chat here.

China pushes local chips and energy saving for data centres

China’s AI strategy is evolving to cover new areas of infrastructure after subsidies were expanded to slash major data centre bills by as much as 50%.

Local governments in provinces that include Gansu, Guizhou and Inner Mongolia are offering the incentives to major domestic tech companies which include ByteDance, Alibaba and Tencent. The major concern is that a ban on Nvidia AI chips will lead to higher electricity bills.

That ban is very clear. Authorities in China have also ordered new data centre projects that are state-funded to remove or scrap any plans to use foreign chips. They are mandated to use domestically made AI chips, instead.

Like all politics of this day, there’s a lot of shuffling on the US side.

The White House has ruled out any possibility of Nvidia being allowed to sell chips in China again. That’s despite previous suggestions from President Trump. Even last week, Treasury Secretary Scott Bessent said there’s a future scenario in which Nvidia’s advanced Blackwell chips are sold in China and other markets as technology advances.

Nvidia CEO Jensen Huang has, once again, warned that the ban is forcing China to develop sophisticated infrastructure that will see it “win” the AI race.

The race continued when China announced a one-year suspension on export controls for five critical minerals needed to manufacture certain semiconductors, as well as explosives, ammunition and more.

In related news: There’s concern that China’s push to advance AI is doubling as a tool for the state to expand surveillance and tighten control over its citizens.

Amazon has a go at rivalling Temu, Shein and others again

Amazon missed the social commerce trend that companies like Shein, Temu and TikTok created, and it struggled to serve international markets outside of its core country focus.

The US firm is trying to address both of those segments with a budget shopping app called Bazaar, which sells products for less than $10. Amazon Bazaar has now launched in more than a dozen selected markets in Asia, Africa and Latin America. Shipments will take up to 2 weeks.

Last year, Amazon tried its hand at rivalling Shein et al with a product called Amazon Haul. That looks like it will remain in Amazon’s core markets, such as the US, UK, Germany and France.

It’s hard to see Bazaar making any significant dent on the Chinese social commerce companies. Amazon is just throwing a little more spaghetti against the wall.

China

Shein expects to earn about $2B in net income in 2025, nearly doubling last year’s $1.1B profit with mid-teens sales growth—the company has used price hikes and cost-cutting to offset the impact of US tariffs link

But Shein was in the headlights in France, where it was briefly threatened by a suspension for selling sex dolls and weapons, which the Chinese firm quickly delisted link

French prosecutors did, however, open an investigation into TikTok for failing to filter content promoting suicide link

Nexperia resumed exports of key chips from China following an internal rift that saw supplies to its Chinese factories paused last week link

Dutch authorities previously said they’d consider dropping control of Nexperia if exports were to resume, so stayed tuned on what happens next link

In a rare public appearance, a DeepSeek researcher told a government-organised internet conference that he was pessimistic about AI’s future impact on humanity link

China is racing to defy aging, pouring resources into longevity labs, “immortality islands,” and supplements like grapeseed pills—an ambitious national quest that blends science, hype, and hope link

The country unveiled a new program to boost imports from other countries to mitigate trading partners’ concerns over China’s goods flooding their market link

Xiaomi’s swift expansion into electric vehicles is reportedly straining employees, reflecting a broader trend among Chinese tech giants pushing longer hours to break into new markets and rival US companies link

Alibaba’s mapping unit Amap is expanding overseas alongside Chinese carmakers, launching an international version of its AutoSDK to help develop in-car navigation and cockpit systems abroad link

A 2022 dinner in San Diego revealed how a Chinese investor allegedly leveraged proprietary technology from TuSimple, a $8B US self-driving truck startup, to develop a Beijing-backed competitor link

Crypto mining hardware company Canaan raised $72M from investors including Brevan Howard and Galaxy Digital link

Zhipu AI said it has seen a tenfold surge in foreign users as another Chinese AI gains traction internationally link

Meanwhile, Moonshot—an AI startup backed by Alibaba—says its new “Kimi K2 Thinking” AI model outperforms OpenAI’s ChatGPT link

Evotrex raised $16M from investors including Anker for its off-grid energy products which use power-generating RV trailers—they’re pretty wild looking link

India

Talk about delivering earlier than expected: Quick commerce pioneer Zepto may file draft IPO papers as soon as this month with a target to raise up to $500M link

Bankers are proposing a valuation of as much as $170B Jio Platforms ahead of a likely record IPO from Reliance’s wireless carrier business link

Zynk, a stablecoin-based cross-border payments startup, raised $5M in a round that included Coinbase Ventures link

NVIDIA and Qualcomm Ventures are part of a US-India investor coalition to deep tech startups with over $1B in commitments—this comes after criticism that Indian funding has mostly gone to quick commerce and food delivery ventures link

Pine Labs plans to raise $440M from its IPO at a $2.86B valuation, that’s downsized from an earlier target of $1B at $6B link

Sequoia Capital US is likely to back investment platform Groww, marking its first investment on India soil since it split from its India and Southeast Asian fund two years ago link

Data labelling startups are using workers in India to carry out mundane activities, such as folding towels repetitively, to train AI robots for physical tasks link

Investment firm Lighthouse Canton raised $40M led by Peak XV link

Customer engagement platform MoEngage raised a $100M Series F at a $700M valuation led by Goldman Sachs Alternatives link

Accel invested in ride-sharing startup Rapido and existing investor Prosus increased its stake after Indian two-wheeler firm TVS Motor sold its entire stake for $32M, realising a return of over 150% in 3 years, according to a stock exchange filing link

Online autosales platform Spinny is reportedly set to acquire GoMechanic to complete the once-troubled car servicing startup’s turnaround link

Tiger Global exited Ather Energy entirely after it sold its remaining 5% stake in the electric two-wheeler maker through open market transactions link

Speaking of exits: Edtech startup Unacademy is said to be in advanced talks to be acquired by Upgrad in an all-stock deal valuing it at $300–320M, some 90% below its 2021 peak of $3.4 billion link

Uber invested another $20M in Everest, one of its largest taxi fleet providers—this third investment takes it to nearly 16% ownership having invested more than $50M link

Southeast Asia

Grab raised its full-year earnings forecast after it recorded a profit of $17M in Q3 2025 with revenue rising 22% to $873M link

China is cracking down on crime syndicates running pig-butchering scams in Southeast Asia, sentencing ringleaders to death, a sharp turn from its earlier indifference link

Myanmar’s military last month attacked a major scam hub on the Thai border, claiming to target criminal syndicates—but analysts say the strikes were more about appeasing foreign pressure than real reform and the warlords behind the operations remain untouched link

Liu Wei, who led development of Tencent’s flagship AI model, raised $50M for his startup Video Rebirth, which is based in Singapore and aiming to rival OpenAI’s Sora link

Thailand is planning new incentives and simplified listing rules to attract tech IPOs and boost its stock market—Thailand has a strong public market but investors are concerned over the scarcity of high-tech firms link

Singapore’s parliament passed a law giving authorities more powers to block harmful content on social media platforms link

South Korea

Coupang posted third-quarter profits well below Wall Street expectations, even as revenue beat forecasts link

Naver topped 3 trillion won ($2.2B) in quarterly revenue for the first time as its commerce and fintech businesses flourished link

SK Telecom told shareholders that recovery costs and other losses tied to a data breach earlier this year led to a 90 percent drop in operating profit for the third quarter link

President Lee Jae Myung pledged to transform the country’s industries, public services and defense through aggressive AI investment and policy support link

South Korea has launched an investigation into LG Energy Solution after one of its former researchers allegedly leaked “national core technology” on battery manufacturing to India’s Ola Electric link

Ola Electric refuted the claim, however link

Samsung opened its annual Science & Technology Forum to the public for the first time, offering a rare look at its privately funded research program, which has received 1.14 trillion won ($782M) from the South Korean conglomerate since 2013 link

Japan

Japan’s Finance Ministry plans to scrap a personal-use import tax exemption as local retailers struggle to compete with cheap shipments from Chinese e-commerce platforms like Shein and Temu link

Studio Ghibli and other Japanese publishers want OpenAI to stop training on their work link

SoftBank considered acquiring US chipmaker Marvell earlier this year, in what would have been the semiconductor industry’s biggest-ever deal link

SoftBank and OpenAI plan to launch AI services for Japanese businesses next year, featuring voice recognition tools to cut down on manual typing link

Japan’s ruling party plans to allocate about $6.5B annually to bolster its semiconductor and AI industries. link

Media giant Nikkei said hackers gained unauthorized access to its internal Slack communication system, potentially exposing data linked to more than 17,000 people link

Hong Kong

Animoca Brands, the Hong Kong-based crypto investor and blockchain developer, plans to go public on the Nasdaq stock exchange through a reverse merger with Currenc Group Inc that’s targeting a $1B valuation link

Uzum, Uzbekistan’s first unicorn just raised $70M from Tencent at a $1.5B valuation, is looking to raise another round of funding ahead of a planned IPO in Hong Kong or other locations in 2027 link

Rest of Asia

A look at the Asian billionaires who are at the front and centre of the AI infrastructure development in Asia, including SoftBank’s Masayoshi Son and Reliance’s Mukesh Ambani link

The US has sanctioned eight individuals and two companies for laundering money for North Korea through cybercrime and an IT worker fraud scheme link

Wired has a long read on the Gen Z-fuelled revolution that saw social media activity lead to the replacement of Nepal’s leader link

Kazakhstan plans to launch a $1B crypto reserve fund using seized assets link