China gets tougher on tech companies, Sea is raising $2B for potential acquisitions

Asia Tech Review: 15 December 2020

Welcome back,

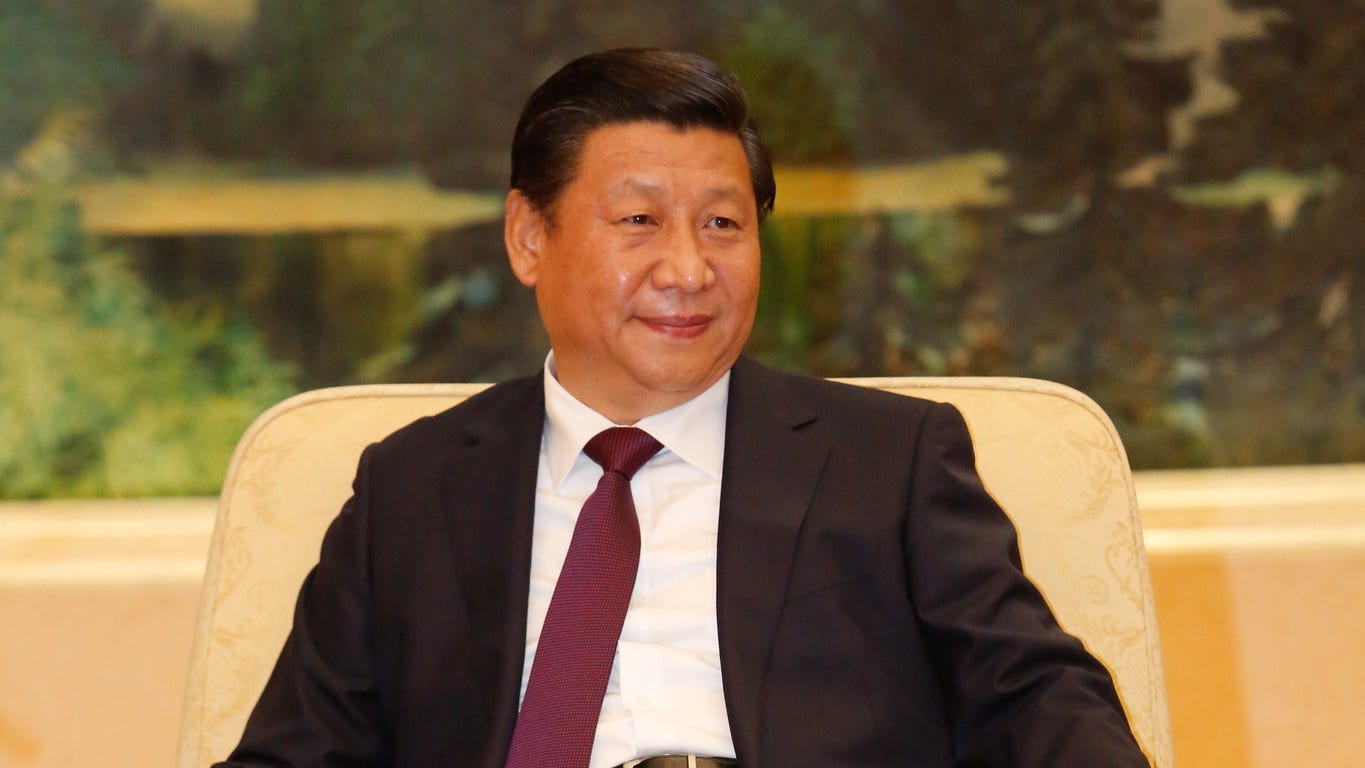

China is cracking down hard on tech companies, that’s a key theme in this week’s newsletter as the government dished out symbolic fines to Alibaba and a Tencent division. Premier Xi’s approach is two-sided, while he wants Chinese companies to be successful overseas, the desire to add government controls is clear.

Elsewhere, Southeast Asia is heating up for acquisitions as Sea announced plans to raise $2B to fund deals and rising startup Carsome pulled in $30M for growth, which could also include acquisitions and investments. Speaking of which, is Fave on the way to becoming a potential acquisition from an Indian fintech? Quite possibly, I think, that’s the subject of a story we ran on The Ken today. As ever, if you’re curious about going behind our paywall to read our stories, drop me a line for a 30-day trial code.

See you next time and take care,

Jon

China

Alibaba and Tencent’s e-publishing division were hit with paltry fines of 500,000 yuan ($76,000) after being found guilty of failing to report past acquisition and investment deals for clearance. The fines are, of course, not materially significant for either company but they are being taken as a symbolic warning shot to counter, or at least check on their growing power.

That’s very much a them this week as the Wall Street Journal wrote that President Xi is increasingly seeking to control private sector companies:

China’s most powerful leader in a generation wants even greater state control in the world’s second-largest economy, with private firms of all sizes expected to fall in line. The government is installing more Communist Party officials inside private firms, starving some of credit and demanding executives tailor their businesses to achieve state goals.

In some cases, it is taking charge entirely of companies it regards as undisciplined, absorbing them into state-owned enterprises.

The push is driven by a deepening conviction within the country’s leadership that markets and private entrepreneurs, while important to China’s rise, are unpredictable and not to be fully trusted.

US lawmakers asked Intel and Nvidia about their role in providing technology that enables China to monitor and surveil Uighurs following a New York Times report

Huawei, meanwhile, has been revealed to have worked on several surveillance systems, one of which could send alerts to the police when it identified the muslim minorities

The push to spy continues after a Chinese state-sponsored hacking group was suspected of having breached a Mongolian software company and compromised a chat app used by hundreds of Mongolian government agencies

China is pushing its local companies to help it close the gap on semiconductors: semiconductor software design startup X-Epic just raised a new $30M investment, that’s $60M raised this year

Huge news that I’m putting here under China Inc update: Sequoia Capital and KKR are reportedly leading a new $2B funding round for ByteDance that could value the company at $180 billion. Its last funding round in 2018 valued it at $78B, but secondary market trades are said to have been made with a value of $140B

Robinhood has a Chinese rival called WeBull which is apparently growing like a weed and providing stiff competition

OnePlus co-founder Carl Pei has raised $7M for his new venture—exact details are not clear but it will reportedly focus on “audio-related hardware”

India

Facebook has doubled its annual profit in India—revenue grew by 43% to reach $1.73B according to filings. Facebook also said live video and messaging grew exponentially during the pandemic, something that I think we all know but the admission is still interesting:

Speaking at the India Mobile Congress 2020, said digital engagement has shot through the roof as people around the world practice social distancing.

"We saw more people use our apps than ever before. Messaging grew almost 50 per cent, live video grew almost 60 per cent (globally), especially on Instagram, which saw video views really scaling up. Video posts became almost one-third of all the content posts that were created on Instagram in India," [said Facebook India Director and Head of Partnerships Manish Chopra.]

India is among the biggest markets for Facebook, which also operates photo-sharing platform Instagram and messaging app WhatsApp. Around 2.5 billion people globally use Facebook's family of apps daily, while there are over 10 million active advertisers across its services.

Meanwhile, Facebook added shopping carts to WhatsApp across the world not just in India. Related: Facebook investee Meesho, a social commerce service that uses WhatsApp to enabled buying and selling, is reportedly in talks to raise $150M at a valuation of up to $1.5B, double its previous valuation

A dispute over salaries prompted as many as 2,000 workers with Apple supplier Wistron Corporation to go on “a rampage destroying the company’s furniture, assembly units.” Apple is said to be looking into whether worker rights were violated

Hotstar now has 26M subscribers that’s 30% of the Disney+ user base—new growth has come via the latest India Premier League cricket season

Ola says it will set up the world’s largest electric scooter factory after pledging to invest nearly $330M into a facility in Tamil Nadu

Elsewhere, Samsung will set up a $656M display factory in northern state Uttar Pradesh, which is providing financial incentives for the investment

Cuemath raised $40M led by LGT Lightstone Aspada, Alpha Wave Incubation

Walmart’s CEO says there’s scope for other investors to buy into Flipkart and its payment business PhonePe both via private deals and potential public listings—Flipkart will reportedly look to raise $10B through a US IPO

India’s cabinet approved a proposal to create a national network of public Wi-Fi hotspots to increase connectivity

Southeast Asia

Right after nabbing a digital banking license in Singapore, Sea is tapping retail investors to raise $2B in fresh capital—it says the money could go towards acquisitions:

Used car marketplace Carsome raised $30M led by Asia Partners for growth, which might also include strategic M&A

Stripe says it is making a big push into Southeast Asia as well as Japan, China and India—we at The Ken recently wrote about its slow approach to this part of the world

Singapore launched a blockchain innovation program backed with $8.9M

Fave, which started out offering fitness subscriptions and raised over $30M, is struggling to convince investors of its pivot to offline deals and could end up an acquisition target for Pine Labs, the Indian fintech firm that recently made a strategic investment in Fave. Pine Labs, which is valued at over $1B, recently expanded to Southeast Asia and it is hunting overseas opportunities.

Indonesia is already wooing Tesla in the hopes of becoming a supplier of nickel for EV batteries, now it is encouraging Elon Musk to consider the country as a launch site for SpaceX with the remote province of Papua proposed

My colleague Jum at The Ken looked at the rise of Kickstart, the first corporate venture capital fund in the Philippines which has grown from a small $2M accelerator to a new $180M fund

Here’s an interesting concept: a mini app ecosystem for developers—it’s being built in Singapore and just raised $1.1M

Australia-based e-commerce logistics platform Shippit raised $22.2M led by Tiger Global to expand to Southeast Asia

Finally, I looked deep into Ula—an ambitious B2B e-commerce startup in India that raised unprecedented capital ($10.5M) within months of long and has ambitious goals

Japan

Hyundai bought a controlling ownership of Boston Dynamics from SoftBank in a $1.2B deal—SoftBank had acquired it from Google in 2017

Speaking of SoftBank, reports claim it may go private using a “slow burn” strategy:

SoftBank Group is debating a new strategy to go private by gradually buying back outstanding shares until founder Masayoshi Son has a big enough stake he can squeeze out the remaining investors, according to people familiar with the matter.

The approach would likely take more than a year and would mean the Japanese company continues to sell assets to fund successive buybacks, the people said, asking not to be identified because the plan is private. Son wouldn’t buy more shares himself, but his ownership stake, now about 27%, would increase as other investors sell stock. Under Japanese regulations, Son could compel other shareholders to sell when he gets to 66% ownership, perhaps without paying a premium, the people said.

SoftBank has, however, made a lot from the DoorDash IPO: to the tune of over $11B. Singapore’s GIC is another winner.

The Japanese government is cracking down on fake and faulty goods that are sold online

Sony is buying anime streaming service Crunchyroll from AT&T for $1.2B

South Korea

LG is finally revamping its phone business after the mobile division’s 22 consecutive quarters of losses (something I wrote about a lot at TechCrunch)—now it plans to outsource more of its low to mid-end smartphones which will cut costs

Chai, a payment aggregator and enabler for merchants, raised $60M

You just finished reading Asia Tech Review, the weekly newsletter for keeping up with the tech industry across Asia.

If someone sent this to you, you can sign up for free at Asiatechreview.com