ByteDance is quietly becoming a force in VR (and more)

Asia Tech Review: 20 February 2023

Welcome back,

This week’s newsletter is packed with a range of different reads and news.

Did you know, for example, that ByteDance is pushing Meta (FKA Facebook) hard on VR despite not selling any products in the US?

There’s drama in the world of chipsets after Dutch firm ASML said a former Chinese staffer stole its IP—and that’s not its first theft from China.

Elsewhere, top Chinese bank China Renaissance says its head is unreachablee—sparking fears for his well being. India is seeing a slowdown in investing and problems within Apple factories, as Apple continues to diversify away from China with more plants in India and Southeast Asia.

Plus: can GoTo be profitable? Japan’s Netflix rivals team up. How did Flipkart rival Amazon? Korea goes all in on AI… all that and much below.

Thanks for subscribing and see you in your inbox next time,

Jon

Stories in focus

ByteDance is quietly becoming a force in Virtual Reality

We know ByteDance is making a big play for commerce with its efforts in Southeast Asia, but its VR movements have largely gone under-the-radar. A recent report from analyst firm IDC found that Pico, the startup acquired by ByteDance 2 years ago, is eating into Meta’s dominant market share:

Meta held 90% of the market share about a year ago, according to research firm International Data Corp. By the third quarter of 2022—the latest period for which data is available—its market share had dropped to about 75%. Market share for Pico more than tripled over the same period to about 15%. No other VR headset maker held more than 3% of the market.

That’s particularly impressive since Pico doesn’t yet sell in the US market—a geography that is huge but also challenging for ByteDance’s main business, TikTok. It isn’t hard to imagine Pico piggybacking TikTok’s popularity to mount an even stronger challenge

Meanwhile, Tencent has scrapped plans for VR hardware link

Dutch chip firm says ex-employee in China stole confidential information

Dutch chip equipment maker ASML says that an ex-employee in China stole proprietary tech data and may have violated export controls. This isn’t ASML’s first IP theft rodeo, the firm previously accused a Beijing-based firm of potentially stealing its trade secrets. The claims come as increased tension persists between China and the US around a tech arms race. The US has convinced other nations to put restrictions on Chinese chip firms, while governments across the world are looking to stimulate their own chip and component production, especially around AI and connected devices.

For more info: Reports suggest the ASML breach occurred in a repository that includes details of the lithography systems critical to producing some of the world’s most advanced chips link

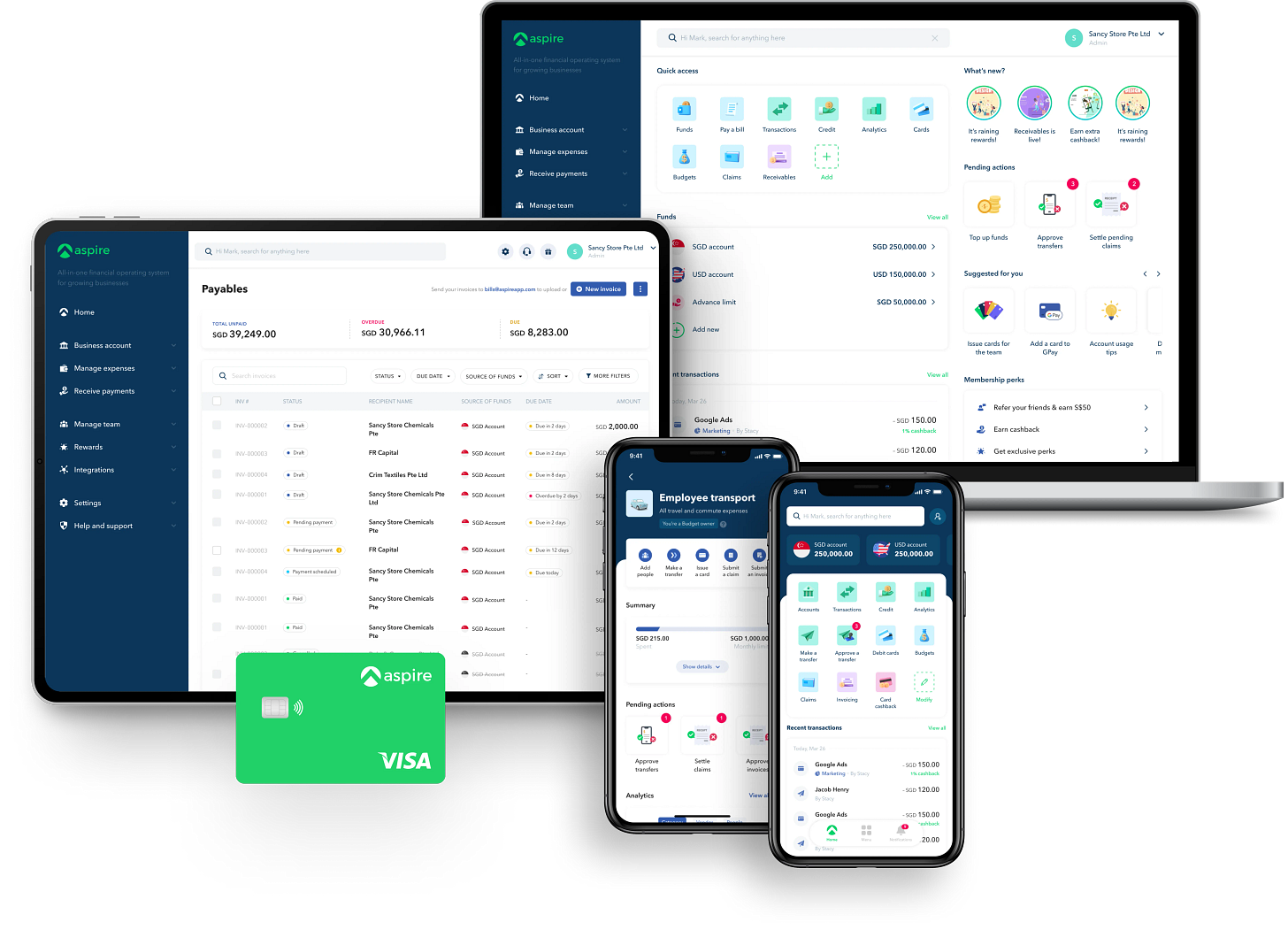

Singapore fintech startup Aspire raised $100M

Despite a challenging market, Singapore-based lender and neo-bank Aspire closed a $100M Series C from a raft of top investors including Lightspeed, Sequoia, PayPal, Tencent and others. The valuation is unknown but this is likely to be one of Southeast Asia’s next unicorns (if it isn’t already) in what’s likely to be a tough year to raise big funding rounds. (Aspire previously raised over $150M in a mix of equity and debt financing in late 2021.)

The company was set up by former Lazada executives, and saw rapid growth during the pandemic and beyond. It started out providing financing such as working capital loans for SMEs, but expanded to offer a suite of banking services for SMEs. The idea is to become a one-stop-shop or ‘financial operating system’ with services that include bank accounts for cross-border businesses, corporate cards, payable and receivable management and automated invoice processing connected to financial management software.

China

Auto giant Geely’s EV brand Zeekr raised $750M at a $13B valuation link

Shein reportedly projects its revenue will more than double to nearly $60B by 2025, according to a leaked presentation, as it seeks to convince investors that it is on course for a blockbuster IPO link

Binance has had a tough time lately, with its stablecoin product forced to shutdown after US regulators called it a security. Broadly, though, the company expects that it will pay penalties to resolve US investigations into other parts of its business, which could include potential violations of US anti-money-laundering law—with Binance saying it was unaware of doing so link

Chinese officials have reportedly given ByteDance unofficial assistance in its negotiations with the US government—China is thought to favour the current data-focused proposition over a forced sale link

The development of China’s ChatGPT rivals may be complicated after Beijing pledged to provide support to “key firms”—that’s likely to mean a lot of resources but, on the flip side, what compromises will the Chinese government demand from AI makers? Alibaba, Tencent and Baidu are all in various stages of working on their own answers to Open AI and Google’s efforts Link

Case in point, China’s top video gaming firms are now focused on promoting the nation’s culture and social values as part of an easing in regulations that had been strict around the release of new titles link

Chip design company Unisoc is reportedly aiming to raise $1.5B at a valuation of over $10B link

China plans to implement new overseas listing rules for mainland firms which it hopes will clear the way for more IPOs link

But that feeds into ongoing trends that have seen Chinese firms listing and raising locally link

US Dollar investments in the country’s new companies fell by nearly three-quarters last year, declining to 19 per cent of the total capital put into startups from 39 per cent in 2021, according to new data from research group ITJuzi

Savvy Games Group, which is backed by Saudi Arabia’s sovereign wealth fund, invested $265M into Chinese esports company VSPO link

China Renaissance shares tumbled after its founder, Bao Fan, became ‘uncontactable’—sending a cloud over the bank behind Didi, Meituan, Kuaishou and other successful tech firms link

Hong Kong

The US crackdown on crypto is making overseas markets like Hong Kong, which is actively trying to develop a friendly regulatory environment, appealing for startups link

Taiwan

Taiwan’s TSMC will invest $3.5B into its upcoming Arizona semiconductor factory link

India

Apple continues to diversify its production away from China, but concerning reports out of India suggest that only 50% of iPhone casings made in the country meet Apple's quality standards link

A slowdown in venture exits, particularly IPOs, is causing concern in India where startup funding dropped 40% over the last year. Major names and backers like Tiger Global, SoftBank and Sequoia have reportedly halved their investment with a lack of exits said to be a key reason as a number of funds approach the end of their life cycles with a need to extract returns for LPs link

There’s renewed concern that India’s Government is successfully pushing big tech to give it greater control of the internet and digital services link

India’s competition regulator is close to completing its investigation into the app store and billing policies of Apple link

Meanwhile, Epic Games has claimed that Google is not complying with an Indian antitrust order requiring it to alter its Android business model to stop forcing phone-makers to pre-install its apps and services link

India’s Central Bank has put Google and Amazon on a list of 32 companies that are permitted to be online payment aggregators in the country link

Byju’s is said to be in negotiations with investors to raise more than $500M (at a $22B valuation) with investors like TPG and Middle Eastern sovereign funds doing diligence on a potential deal link

The secret to Flipkart’s success, and acquisition by Walmart? Kalyan Krishnamurthy, the chief who was “parachuted” into the top job ahead of a critical sale season in 2016. Beating Amazon during that online shopping festival 5 years ago paved the way for Walmart’s move and much more, as former employees tell Rest Of World link

Now entering its 9th year, it is being asked whether Xiaomi India—Xiaomi’s star overseas business—is losing its shine amid increased competition and regulatory crackdowns. Xiaomi has lost key personnel in India—including its original head, Manu Kumar Jain, who left in January—and closed down some of its newer businesses link

Foxconn is not the only Apple supplier gunning for India. Finland's Salcomp plans to double its workforce in India to 25,000 over the next three years, targeting annual revenue of $2B-$3B from India. It currently has a Chennai plan that makes chargers and smartphone parts with 12,000 staff link

Tiger Global and Ribbit will invest another $100M in PhonePe—the fintech firm’s pre-money valuation is reportedly $12B for an ongoing funding round that could reach $1B link

InsuranceDekho, a venture spun out of 13-year-old CarDekho, raised $150M from Goldman Sachs Asset Management and TVS Capital Fund at a valuation of around $500M link

Pakistan

Online lender AdalFi raised $7.5M link

Southeast Asia

Singapore-based startup Transcelestial, which makes wireless laser communications equipment, landed $10M led by Airbus Ventures link

GoTo believes it can be profitable before the end of the year, as opposed to its target of next year, thanks to a cutting of costs and increased efficiency link

Singapore is looking to double down on chip investments as it seeks to boost its impressive position in the global tech space. For a country of limited size, Singapore punches above its weight to attract startups and investment, now the country’s Economic Development Board (EDB) is pushing to capitalise on the chip war between China and the US. Singapore currently accounts for 5% of the global wafer fab output, it plans to focus on mature nodes, wafer fabs and design-related work after a blockbuster 2022 brought in $17B in fixed asset commitments link

Meanwhile, state fund GIC has scaled back commitments to China-focused private equity and VC funds over the past year—it has also reportedly significantly slowed the pace of its direct investments in private Chinese companies link

More confirmation that Vietnam is the up-and-coming startup market in Southeast Asia. The country saw $2.6B in startup investments in 2021, with the number of startups reportedly doubling during the pandemic. The government has ambitious goals to develop Vietnam into a tech funding hub, with a target of 40% of Ho Chi Minh City’s GDP coming from its digital economy by 2030 link

Foxconn is expanding its presence in Vietnam to meet “operational needs and expand production capacity” as Apple continues to diversify its production away from China link

Huawei, Tencent and Alibaba are among the Chinese cloud providers giving Microsoft, Google and Amazon competition in Southeast Asia—while Chinese players see Southeast Asia as a strategic market, it is far smaller in terms of value than Western markets that US firms focus on link

Japan

Japan’s top streaming services—U-Next and Premium Platform Japan—will merge as they seek to work together to survive financial challenges and wealthier rivals like Netflix. The joint company claims to have 3.7M viewers and over 350,000 videos and shows link

Fresh from investing in China’s VSPO via its Savvy Games Group, Saudi Arabia’s Public Investment Fund became the largest outside shareholder of Nintendo, too link

Japan says it will launch a pilot for issuing a Digital Yen in April, following more than two years of proof-of-concept experiments link

South Korea

The SEC has charged Terraform Labs and founder Do Kwon with defrauding investors link

South Korea’s Ministry of Science and ICT said it plans to invest $642.5M (826.2 billion won) into companies working on advanced AI chips by 2030 in a bid to capture the potential of AI link

South Korea is making a play for AI after startup Rebellions launched a dedicated chip that it claims can out-perform market leader Nvidia—the Korean government is helping it land local business as it bids to get off the ground link

Grocery delivery app Oasis has shelved a Seoul IPO that could have raised around $160M—reportedly due to not finding its desired valuation link

You just finished reading Asia Tech Review, the weekly newsletter for keeping up with the tech industry across Asia.

If someone sent this to you, you can sign up for free at Asiatechreview.com