Ant Group reforms, Tokojek emerges and India's funding train rolls on

Asia Tech Review: 11 January 2021

Hello folks and Happy New Year,

We’re more than 10 days in 2020, but I think it’s still ok to wish people you like a Happy New Year, especially if you’re speaking to them for the first time on this side of New Year’s Eve. And, ATR did enjoy an extended break over the festive period.

Much happened in those weeks, including:

Ant Group is retying itself with new Chinese government-appropriate fastening after its massive IPO came undone at the last minute.

In Southeast Asia, Grabjek has become Tokojek as two Indonesian unicorns seek to team up, and potentially usher in a period of consolidation (and public market exits) among the region’s big players.

In India, the funding train continues to run with Udaan and (reportedly) Sharechat among those to raise big money in recent weeks. And then there’s the tantalising prospect of the Apple Car being developed alongside Hyundai.

I could have written reams for the first ATR of the year, but I’ve stuck to the most important developments of recent weeks. I hope to be back to normal service next Monday.

All the best,

Jon

PS: You should also check out The Ken, we’ve published some incredible work these recent weeks—too much for me to call out individually. That would be its own newsletter… we have one and you should sign up for it!

China

Ant Group’s record IPO fell apart, as is well documented, and now the tricky task of reform to appease the government is top of the list. Ant is now said to be restructuring its business using a holding company structure that it hopes will win the approval of Chinese authorities.

The Alibaba Group's loan intermediary business and sales of mutual funds and insurance would be become subsidiaries of the holding company, with Ant as the parent. The restructuring would also cover MYbank, an online lender to small and midsize companies, and likely Tianhong Asset Management, operator of the Yu'ebao money market fund.

Authorities have requested that "all businesses requiring a financial license go under the holding company," the source said. Whether this includes Alipay -- the mobile payments platform with more than 1 billion users -- remains up in the air.

Ant maintains the holding company structure "is not necessary under current regulations" but has said it would follow any such request from authorities.

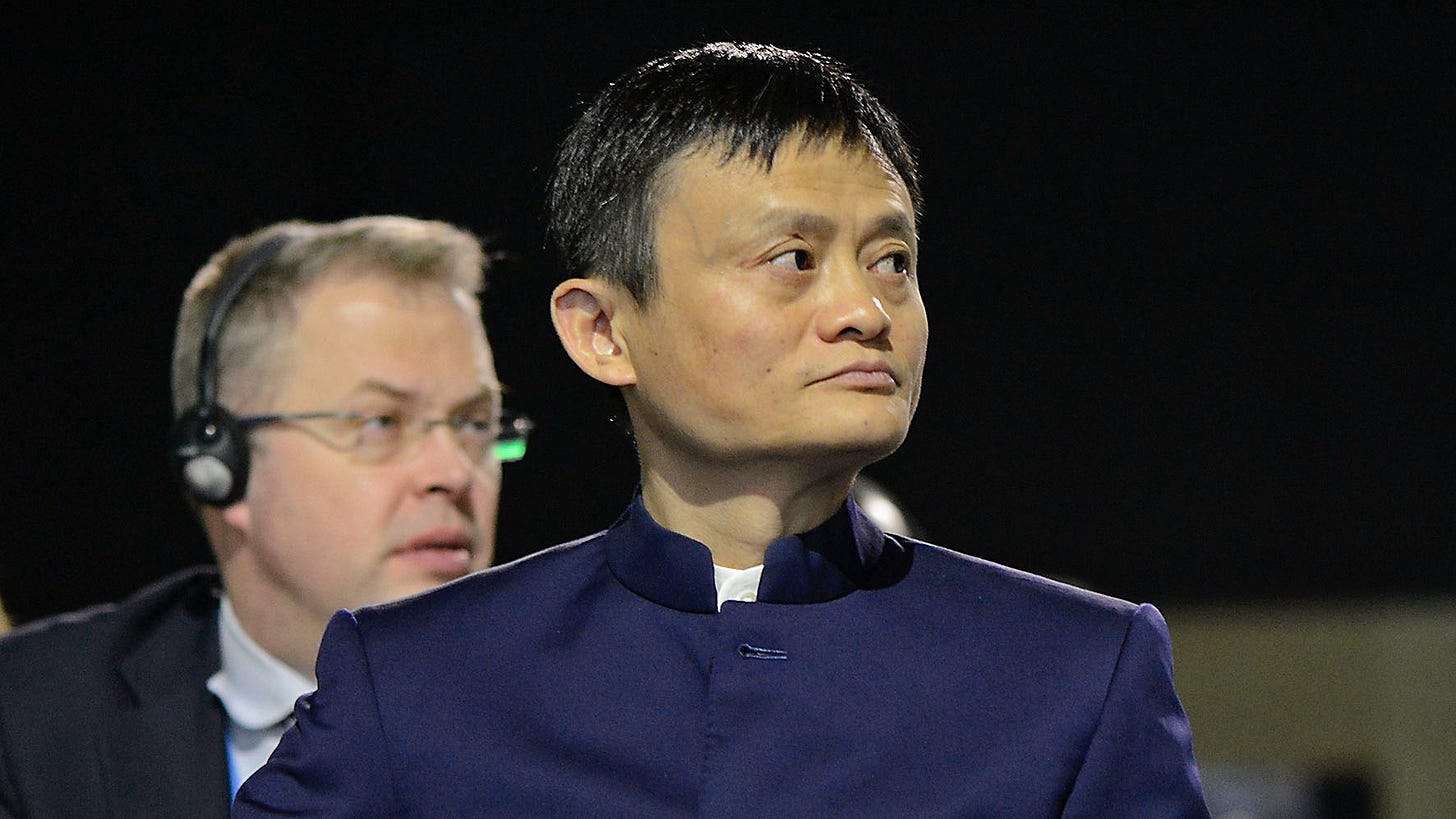

There’s also pressure to share data, which is deemed to be an unfair advantage. And Jack Ma is laying off…

Alipay and WeChat are among the newest Chinese apps to be targeted by outgoing US President Donald Trump, who wants to ban them on American soil.

That app ban may not happen, but the NYSE will delist China Mobile, China Telecom and China Unicom. There’s been plenty of confusion. After an initial announcement, the exchange u-turned but then it clarified that it will, indeed, drop the stocks. Messy.

SoftBank led a $360M round for Beijing Calories Technology, the company behind China’s most popular workout app Keep.

Tesla is said to be searching for a design director in China as part of an effort to develop local cars for the Chinese market. Its effort in China has been about producing for the global market so far, and its operations have come under criticism. A December story from PingWest suggested Tesla is knowingly using subpar parts in its Shanghai manufacturing plant in order to meet aggressive production targets.

India

Udaan, a B2B e-commerce service that helps equip retailers with stock to sell, raised $280M. Its valuation has now jumped to over $3B, and it means Udaan has raised over $1B from investors. It’s even taking a punt on Southeast Asia, after its co-founders led a seed investment in Indonesia-based Ula alongside Udaan investor Lightspeed, which I wrote about in December.

Not to be outdone, rival JumboTail closed a $14.2M round.

Beer company Bira 91, which is backed by Sequoia, landed $30M from Japan’s Kirin Holdings, which focuses on beer, white, spirits and food. Covid has been pretty disruptive to the company so it remains to be seen how much of an emergency investment this was.

Speaking of deals, Sharechat had been linked with a sale to Google but now TechCrunch reports that Google and Snap are poised to invest in the business in a round that could top $200M, half of which will come from the Big G.

At least 10 Indian lending apps on Google’s Play Store, which have been downloaded millions of times, breached Google rules on loan repayment lengths aimed at protecting vulnerable borrowers, according to Reuters.

There’s lots more India funding deals: CRED raised $81M and gave employees a chance to sell shares; hardware startup Boat raised $100M; La Renon Healthcare raised $30M at a $500M valuation.

And finally, India is showing us all how it’s gone when it comes to responding to Facebook’s new data sharing policy for WhatsApp—it also happens to be WhatsApp’s largest market 🍿

Southeast Asia

We ended the year wondering whether Grab and Gojek would consummate more than a year of merger rumours, but it turns out there are other options. Tokojek! Tokopedia and Gojek are reportedly in advanced conversations to merge their businesses—jointly valued $18-$20B—and then take the new entity public in Indonesia and the US.

A few observations come to mind:

The deal has universal buy-in from the top of both companies and their investors—Grab-Gojek never did, given the fractious relationship between the two companies and their execs

Gojek and Tokopedia appear complementary—there’s little overlap and in theory on-demand, payments and e-commerce should blend well if the deal is closed smoothly. (It may help that the execs know each other well, Tokopedia’s Patrick Cao was at VC Formation 8 when it invested in Gojek, for example)

As two homegrown companies, the union is likely to have the blessing of Indonesia’s government which is keen to encourage local digital companies

Where does this leave Grab? Fairly marooned. Needing cash to continue to fight the Indonesia battle, the costliest market in SEA. I’ve heard the deal with Gojek was agreed until Grab CEO Anthony Tan demanded control that was deemed to be excessive. (Gojek is then said to have spoken to a bunch of potential investors/merger partners beyond Tokopedia, including Tencent and Sea.)

The forming of a digital conglomerate like this could trigger other tie-ups. My colleague Nadine and I riffed on the prospect of Grab-Lazada, it sounds fanciful but would make plenty of sense. Who knows what is possible or even under-discussion right now?

All the while, Grab is said to have raised $300M for its financial arm (Grab Financial)—talk to funding has been rumoured since last summer. It’s not clear why it has taken so long.

Elsewhere, mobile wallet service Mynt is on track to be the first unicorn in the Philippines after it raised $175M, at a valuation that is apparently close to $1B. Mynt previously raised money from Alibaba’s Ant Group and it is also backed by telco Globe and conglomerate Ayala.

Indonesia is preparing new rules on payment systems around ownership following a jump in investments:

Non-bank payment services will now need to have at least 15% Indonesian owners, while at least 51% of shares with voting rights must be owned by Indonesians, individuals or entities.

Non-bank payment infrastructure companies must be at least 80% Indonesian-owned, it said.

Related: Gojek bought into a bank and it emerged that Sea owns one, too

Meanwhile in other hit sector: Zenius, one of Indonesia’s top edtech companies, just raised undisclosed pre-Series B funding.

Despite offering most of its services for free during the first half of 2020, Zenius saw its revenues increase over 70% in the second half of the year compared to the same period in 2019. Its live-class segment grew its user numbers tenfold since its launch in March 2020, with a retention rate of over 90%. Live classes now represent nearly 50% of Zenius’ revenue. The platform also claimed to have the largest education content library in Indonesia with over 90,000 videos for elementary to high-school students. Zenius is facing competition from Ruangguru, which offers similar services.

Indonesia-based robo advisor Bibit raised $30M led by Sequoia

A fascinating story on providing telecom in Papua New Guinea

The FT has an overview of Facebook’s recent mishaps in Southeast Asia where it is pushing hard, including censoring anti-government voices in Thailand and Vietnam. Nothing new but a useful read, if you have access to an FT subscription.

Japan

US-based Doordash is poised to enter Japan as its first international expansion after it posted a country manager job. This reminds me of Lyft, which earmarked Japan for its first expansion near three years ago but still hasn’t made the move.

South Korea

Will it or won’t it? Apple and Hyundai have been linked with a deal over electric cars.

Don’t expect to see any immediate fireworks. The concept of “The Apple Car” has been a mystical figure of fantasy and that’ll continue for some time.

The latest report claims the two companies will sign a deal in March that will see production begin in 2024. Hyundai had, however, said last week in a statement that it was in talks with Apple. The sent its shares shooting up 20%—its highest jump since 1988—but the Korean firm later walked that statement back.

No smoke without fire, right?

You just finished reading Asia Tech Review, the weekly newsletter for keeping up with the tech industry across Asia.

If someone sent this to you, you can sign up for free at Asiatechreview.com